Average U.S. Internet Home Uses a Record 6.8 OTT Services

But the March 2022 number was only slightly up from September 2021, according to new S&P Kagan survey results

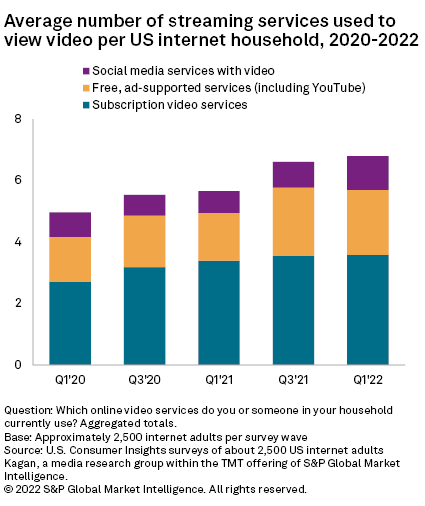

NEW YORK—New results from Kagan Consumer Insights surveys of U.S. internet adults reveal that U.S. internet households used an average of 6.8 streaming video services in March of 2022.

It was the highest level tracked to date but also up only marginally from an average of 6.6 services in September 2021, S&P Global Market Intelligence's Kagan found.

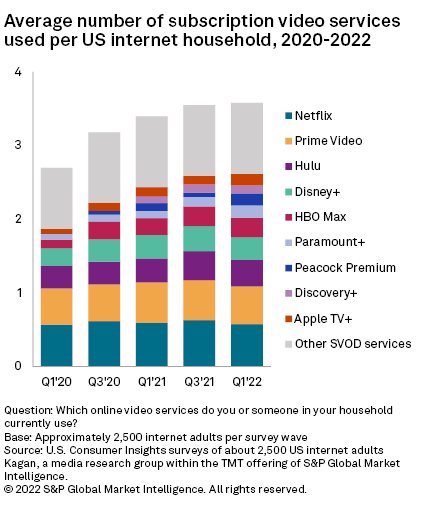

Mainstays such as Netflix, YouTube and Amazon's Prime Video continue to be widely used by many American households, but newcomers such as HBO Max, Apple TV+, Paramount+ and Peacock have driven growth in total streaming services used, the researchers said.

The survey also found that subscription video services accounted for the majority of services used while free, ad-supported services (including YouTube) stood at about 30% share and social video with about 15% share of total services.

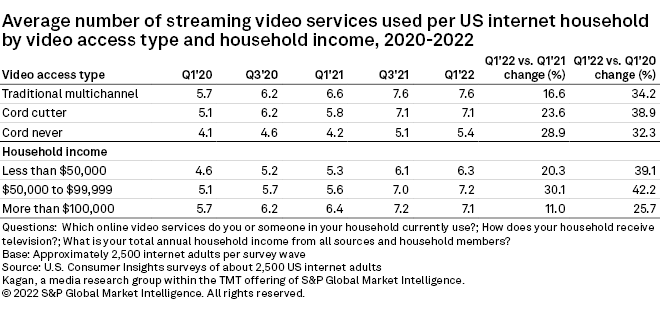

Interestingly, traditional multichannel households remain the most avid users of streaming services with an average of 7.6 services per home, Kagan reported.

While cord-cutter households saw the biggest annual gains in total services used in the first quarter of 2022 with year-over-year percentage jump in services used at nearly 30%, the cord-cutter households still significantly lag other video household types with an average of 5.4 service used.

Services used by household income showed a more equal distribution, ranging from 6.3 services for homes with less than $50,000 in annual income to 7.2 services in households making $50,000 to $99,999. Households with more than $100,000 in income had the smallest annual gain in services used and were the only group to see average services decline from third-quarter 2021 levels.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Netflix and Prime Video were each used by more than half of U.S. internet households, but their usage levels were flat versus the first quarter of 2020.

American consumers have also consistently turned to smaller niche services classified as "Other SVOD services" including ESPN+, BET+, Crunchyroll, AMC+, Fox Nation and OTT services from Starz and Showtime.

Multichannel homes used the highest average number of SVOD services at 4.2 services but also showed the smallest annual increase with a 1.6% gain from 4.1 services used in the first quarter of 2021. Especially those making more than $100,000 in annual household income — have historically been a key driver in SVOD usage gains.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.