The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

ENGLEWOOD, CO--DISH has announced that AT&T has pulled HBO and Cinemax from its satellite pay TV and Sling TV services due to what DISH calls “untenable demands designed specifically to harm customers, particularly those in rural areas, as well as damage competing pay-tv providers.”

DISH is using the dispute to further its claims that when AT&T acquired HBO/Cinemax parent company Time Warner earlier this year after winning an antitrust suit filed by the DOJ, there were no guidelines set in place to ensure that AT&T would treat subscribers to its channels fairly.

"Plain and simple, the merger created for AT&T immense power over consumers," said Andy LeCuyer, DISH senior vice president of Programming. "It seems AT&T is implementing a new strategy to shut off its recently acquired content from other distributors. This may be the first of many HBO blackouts for consumers across the country. AT&T no longer has incentive to come to an agreement on behalf of consumer choice; instead, it's been given the power to grab more money or steal away customers.

The move constitutes the first time in its 40+ year history that HBO is going black on a major pay-TV provider. For its part, AT&T defended itself, decrying DISH’s past negotiation tactics.

“During our 40 plus years of operation, HBO has always been able to reach agreement with our valued distributors and our services have never been taken down or made unavailable to subscribers due to an inability to conclude a deal,” HBO said in a statement. “Unfortunately, DISH is making it extremely difficult, responding to our good faith attempts with unreasonable terms. Past behavior shows that removing services from their customers is becoming all too common a negotiating tactic for them. We hope the situation with DISH changes soon but, in the meantime, our valued customers should take advantage of the other ways to access an HBO subscription so they can continue to enjoy our acclaimed programming.

DISH says the majority of its HBO subscribers are based in rural areas where they are less likely to have access to high speed broadband, which would allow them to substitute AT&T’s “HBO Now” streaming service.

"AT&T's actions are a deliberate slap in the face to rural Americans," said LeCuyer. "And furthermore, they are anticompetitive. AT&T, a company worth more than $200 billion, is intentionally punishing those who don't have big-city broadband access, in an attempt to push customers to the only other satellite provider, its own DirecTV."

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

DISH says the market for HBO has changed since DISH last signed a carriage deal in 2015: HBO set the market price at $15 per month with its launch of the direct-to-consumer HBO Now service; and AT&T has announced plans to launch a new direct-to-consumer HBO service next year.

"Usually when there is a programming dispute, we don't see eye to eye on rates; but HBO has already set the going rate, so now they're seeking to extract money a different way," said LeCuyer.

DISH says AT&T is demanding it pay for a guaranteed number of subscribers, regardless of how many consumers actually want to subscribe to HBO.

"AT&T is stacking the deck with free-for-life offerings to wireless customers and slashed prices on streaming services, effectively trying to force DISH to subsidize HBO on AT&T's platforms," said LeCuyer. "This is the exact anticompetitive behavior that critics of the AT&T-Time Warner merger warned us about. Every pay-TV company should be concerned."

DISH said it would welcome “binding, baseball-style arbitration” to determine the fair market value of HBO and Cinemax but that during the arbitration process, AT&T would be required to restore its channels to DISH customers.

"Rather than trying to force consumers onto their platforms, we suggest that AT&T try to achieve its financial goals through simple economics: if consumers want your product, they'll pay for it. We hope AT&T will reconsider its demands and help us reach a swift, fair resolution," added LeCuyer.

DISH said it would credit eligible Sling TV customers for time they do not receive HBO or Cinemax.

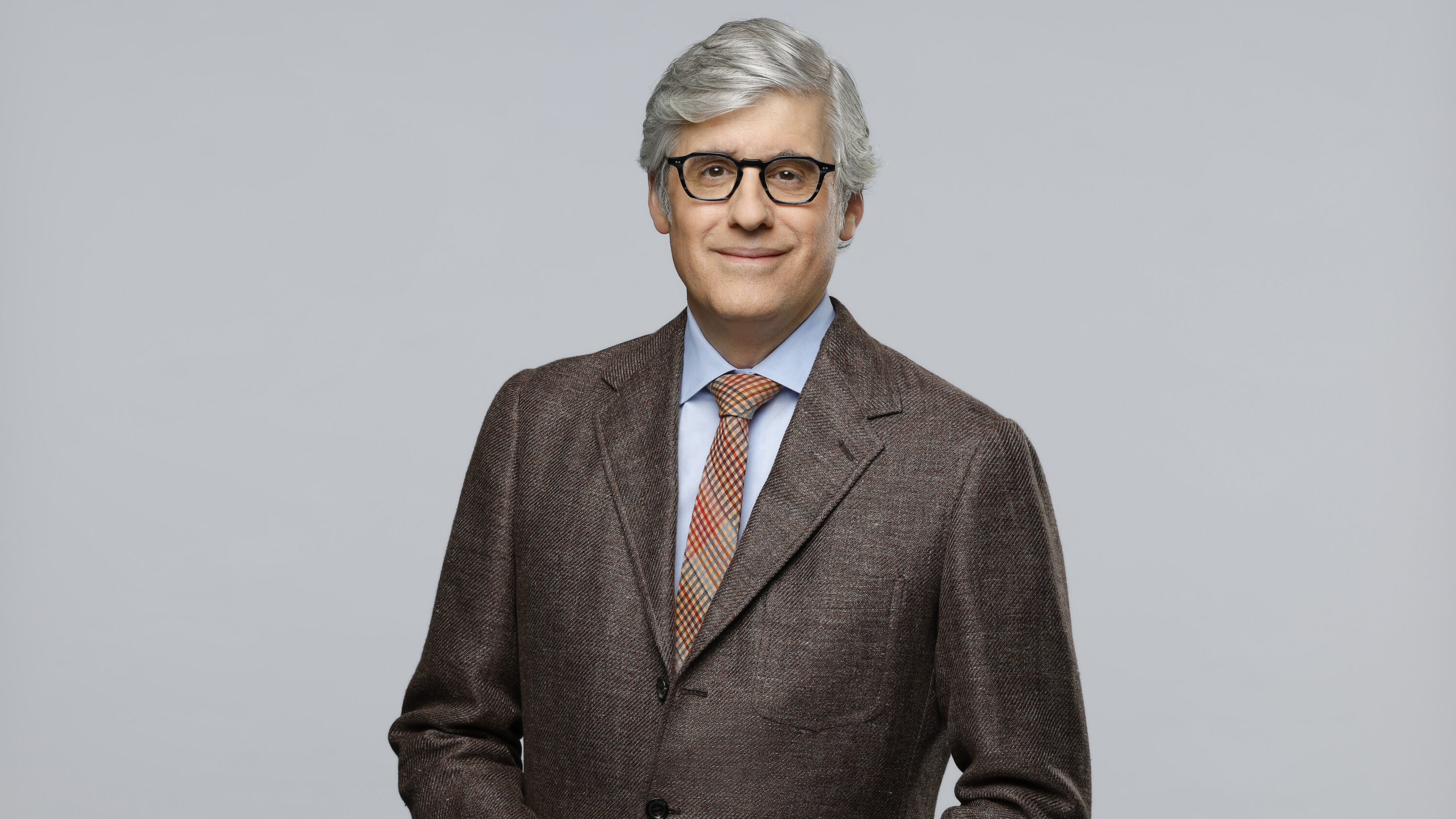

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.