S&P: `The Apple Effect’ to Boost AR/VR Market

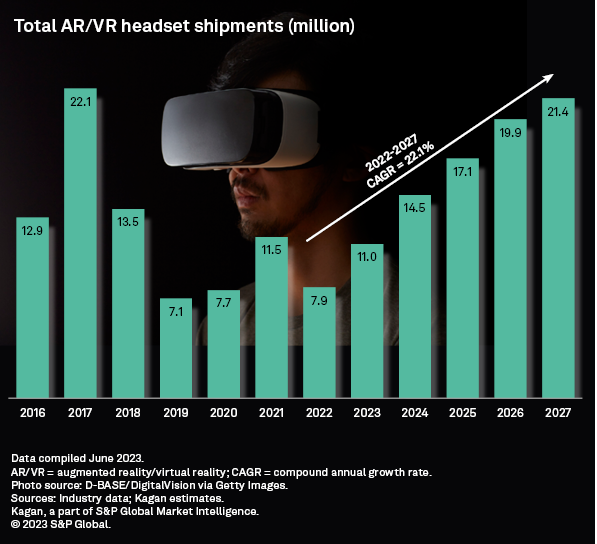

Augmented reality/virtual reality (AR/VR) headset shipments are expected to increase from 7.9M in 2022 to 21.4M in 2027, according to S&P Global Market Intelligence

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

NEW YORK—While the augmented reality/virtual reality headset market has struggled in recent years to gain traction with consumers, a new analysis by S&P Global Market Intelligence argues that Apple’s entry into the business should help the sector see strong growth in upcoming years.

S&P Global Market Intelligence is predicting that augmented reality/virtual reality (AR/VR) headset shipments are expected to increase from 7.9 million in 2022 to 21.4 million in 2027, a 22.1% compound annual growth rate (CAGR).

“The AR/VR hardware segment found a relatively low ceiling as an extension of the video game market after an initial surge in 2016 and 2017,” said Neil Barbour, associate research analyst at S&P Global Market Intelligence. “But a wave of new headsets hopes to find a broader market by emphasizing other popular computing tasks, such as video conferencing, web browsing and media playback. The core value proposition is that AR/VR headsets can merge the portability of a smartphone with the expansive workspace of a multimonitor setup. This marketing message is being championed by Apple, which has a solid track record in emerging hardware segments.”

The analysis also argues that AR/VR headsets will start to develop into a relatively approachable computing platform over the next five years as advanced pass-through cameras and a focus on productivity and communication software opens the technology to a wider array of consumer personas.

The AR/VR market's next push into the mainstream will be spearheaded by Apple, which said it will start selling the Vision Pro in early 2024, the report said in a key finding. However, Apple itself is not expected to drive a substantial number of headset sales in 2024 as both demand and supply will be limited due to its high entry pricing of $3,500 and high-end components, such as OLED screens.

Instead, Apple is likely to drive substantive buzz around the market that will benefit other entrenched vendors, the report said.

Meta Platforms is most likely to benefit as it builds on its market-leading position with a new headset Quest 3 later in 2023 and a price reset on its existing hardware.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The S&P Market Intelligence report also is predicting that AR/VR will also be an important tool in accessing and building content for the metaverse.

More AR/VR use cases are expected to fuel the need for more shared virtual spaces, avatars, and the convergence of digital and physical data, the report said. This will be true in the consumer space (gaming, social) as well as the commercial space (digital twins, training, industrial design). As more headsets are installed, shared virtual experiences are expected to make a more concerted effort to serve those users and vice versa.

The S&P researchers report that there were an estimated 39.7 million AR and VR headsets installed in consumer and commercial settings as of the end of 2022, down 1.2% from 34.2 million in 2021 as user churn outpaced slowing sales. But installed base growth base is expected to pick up in 2023, and over the forecast, the installed base is forecast to grow to 71.4 million.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.