This year will see the slowest growth in new TV content (excluding the Covid-driven slump of 2020) in more than a decade, according to Ampere Analysis, as the continuing global economic slump forces media companies and consumers to cut back on their spending.

Ampere expects global content expenditure to increase by just 2% year-on-year—in stark contrast to 2022 during which global content spend is projected to have grown by 6% to $238 billion, driven primarily by subscription video-on-demand (SVoD) platforms. Despite some degree of caution in the second half of last year, SVoD services collectively spent over $26bn on original content in 2022.

Economic headwinds across the globe will put pressure on household spending and advertising investment, leading companies to implement cost-saving measures and reduce content expenditure, Ampere said. For instance, following Netflix’s first global decline in subscribers, the service announced it would plateau its investment in content during 2023.

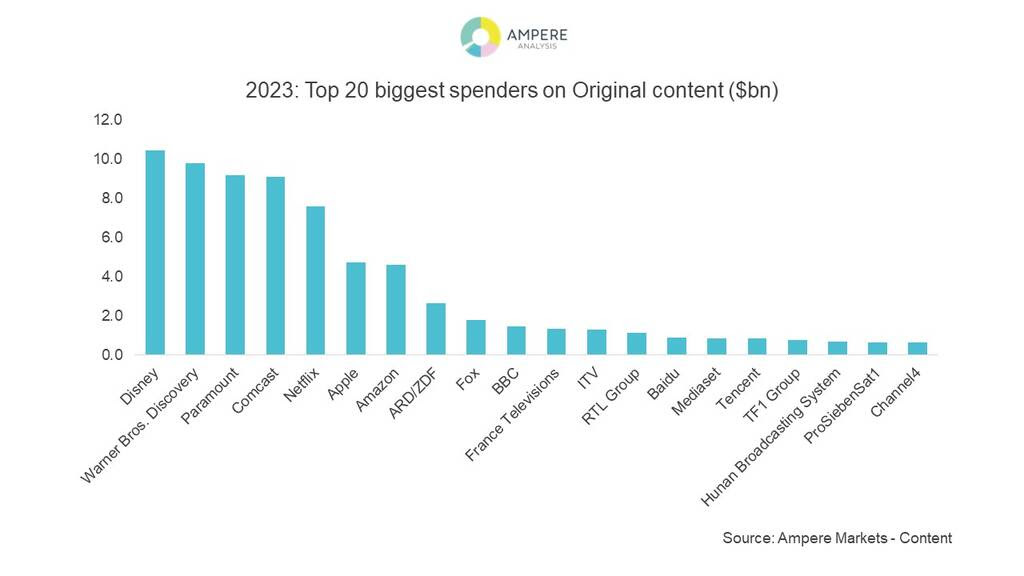

But the story isn’t uniform across media groups—some will continue to drive investment through 2023, while others will cut back. This year, Ampere says Disney and newly formed Warner Bros. Discovery will overtake Comcast and its subsidiaries to become the leading investors in original content—Disney reaching $10.5bn and Warner Bros. Discovery exceeding $9.5bn. Netflix will continue to lead dedicated SVoD spend, contributing over 25% of global SVoD original content investment.

Content investment by commercial and public broadcasters continues to linger below pre-pandemic levels, driven by declines in broadcast TV advertising revenue stemming from wider economic weakness and the ongoing shift of audiences to streaming platforms, the researcher said. In 2023, commercial broadcasters are expected to face a 3% decline in content investment.

“SVoD services will still see an increase in total content investment in 2023 but a lesser 8% year-on-year growth compared to 25% in 2022, said Hannah Walsh, research manager at Ampere Analysis. “Services will continue to focus on original content to compete in a crowded, cost-sensitive market, but we are already seeing a shift in content commissioning to incorporate a greater volume of cheaper unscripted formats.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.