Netflix Adds More Older Viewers As Younger Audiences Head to the Movies

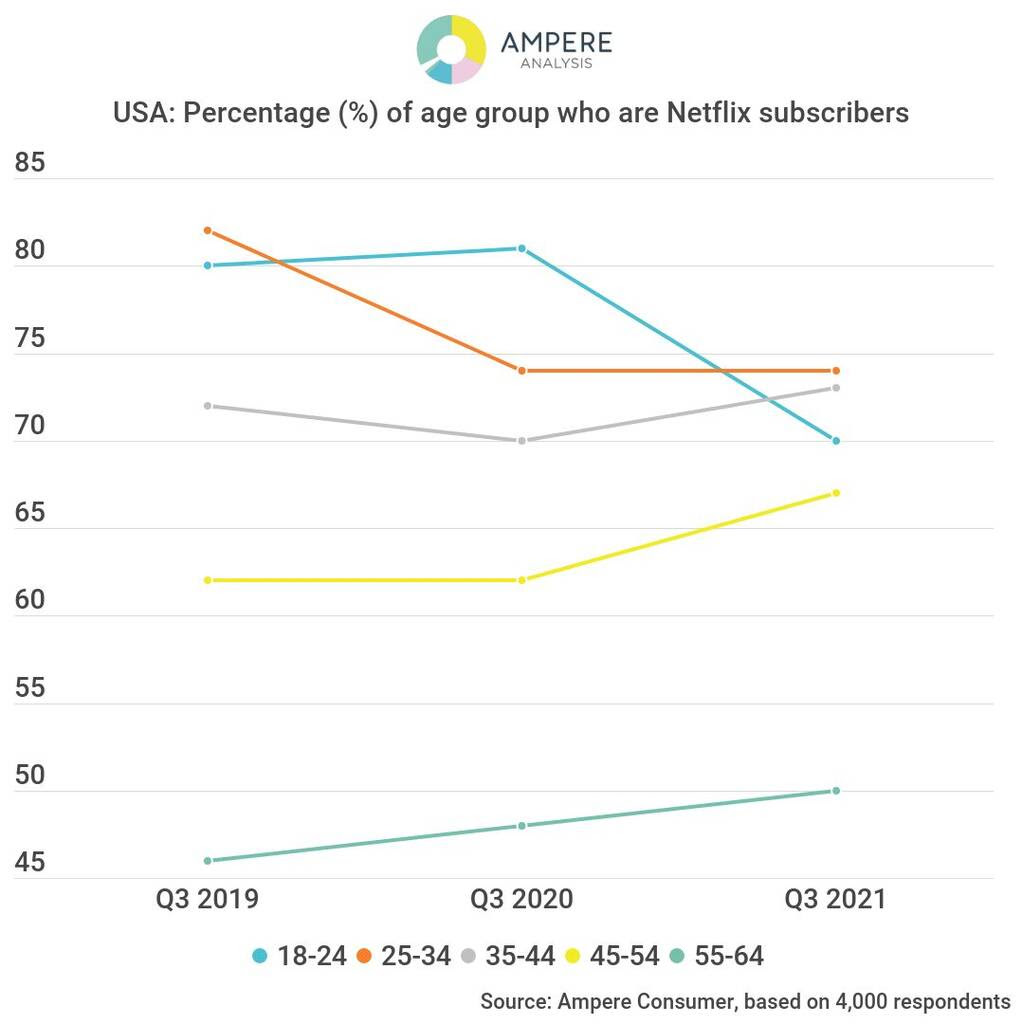

For the first time, 24–44-year-olds are now more likely to be Netflix subscribers than those aged 18-24 according to a new survey from Ampere

LONDON—New data from Ampere shows that Netflix is beginning to lose its youth-skewing customer base as people of all ages are embracing streaming and on-demand entertainment.

In some mature markets, for the first time, 24–44-year-olds are now more likely to be Netflix subscribers than their 18-24 year-old peers and even among even older groups, Netflix usage is growing rapidly, Ampere reported.

Among those aged 45 and older, global monthly usage of Netflix increased by over 22% in the past two years, while the same time period saw a growth of just 5% among younger consumers.

The numbers, which are based on Ampere's Consumer data for Q3 2021 involving interviews of 48,000 Internet users across 25 markets, also illustrate rapid demographic changes in media consumption as the world emerges from lockdown.

As the streaming service skews older, Ampere reported that younger consumers have been flocking back to cinemas to see new major releases like “Cruella” and Marvel’s “Shang Chi and the Legend of the Ten Rings.”

Nearly half of returned cinemagoers this quarter were aged under 35. Pre-pandemic, they represented just over a third of theatrical attendees, Ampere said.

“We can see the pandemic’s impact as older audiences turned to Netflix for entertainment during the numerous lockdowns,” explained Ampere Analysis principal analyst and consumer research lead, Minal Modha. “As we emerge from the pandemic, it’s the younger demographics who are spearheading the return to the cinema in search of a more social viewing experience.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The survey also found that the 2020 Tokyo Olympic Games led to new fan engagement with a growth in younger consumers self-identifying as fans of the games. While viewing is still driven by those aged over 45, a higher proportion of fans are now younger. Prior to the Summer Olympics earlier this year, 24% of self-professed Olympics fans were under 35. By Q3 2021, this had grown to 28%, Ampere reported.

The data also highlighted a number of ongoing trends, as ownership of streaming boxes and sticks has increased by 18% since Q3 2019, before the pandemic began, Ampere said.

Devices such as Roku, Amazon Fire TV or Google Chromecast are now in nearly two thirds of US Internet homes and half of UK Internet homes.

In addition, these devices are driving adoption of a wider range of streaming products, particularly among advertising-supported Video on Demand (AVOD) platforms in the U.S.

The Ampere survey found that 34% of Internet users in the US have used an AVOD service such as Pluto TV, Tubi and The Roku Channel in the past month, compared to 17% in Q3 2020.

Usage is growing particularly quickly among younger consumers. In Q3 2020, only 9% of 18- to 24-year-olds had watched AVOD services, compared to 30% in Q3 2021, Ampere said.

“The growth in AVOD usage partly reflects how expensive the streaming market is becoming,” Modha noted. “The fact that younger audiences are now engaging with AVoD will be welcome news for platform owners and will make the services even more attractive to brands.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.