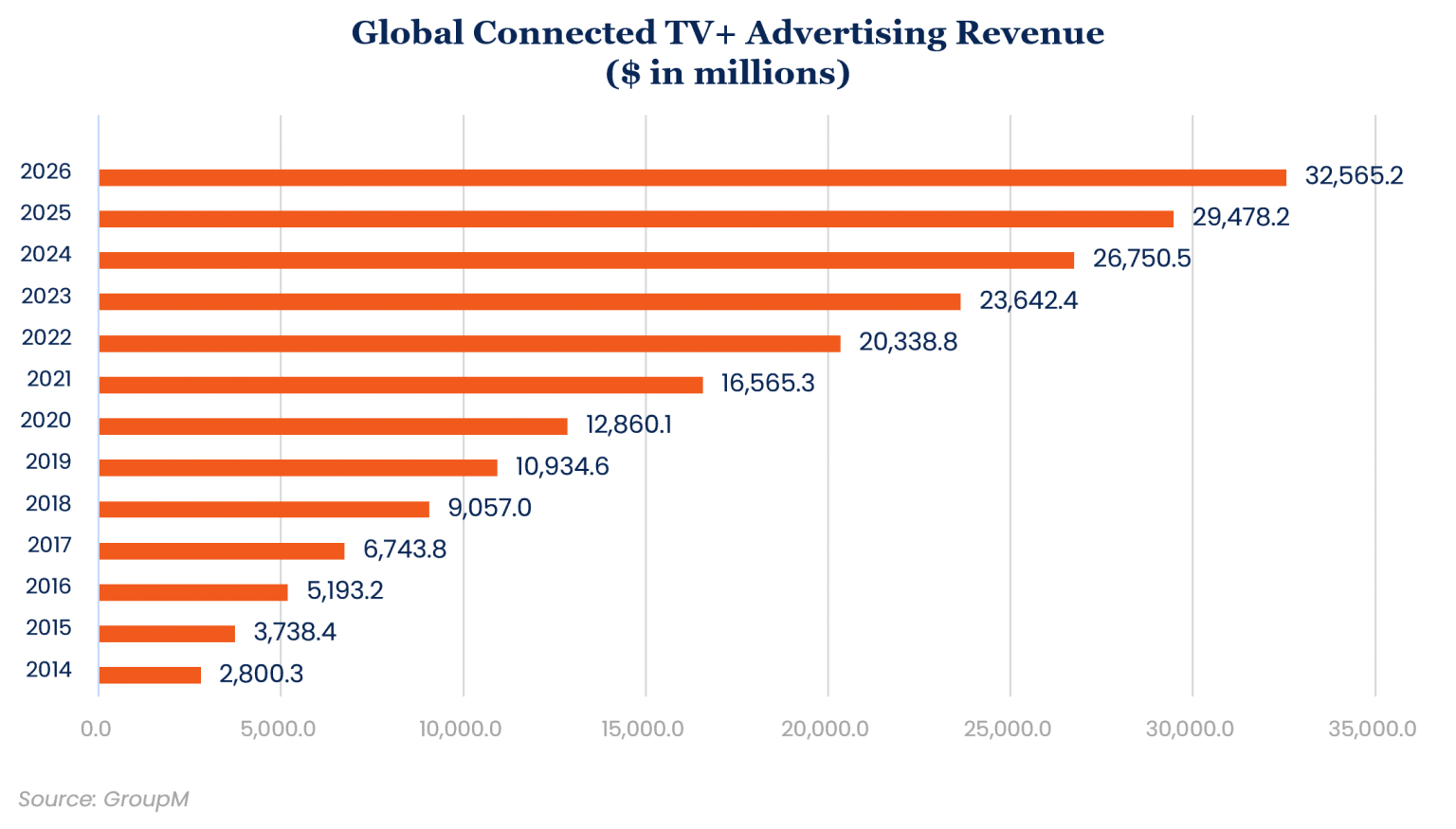

GroupM: Global Connected TV Ad Revenue to Hit $32.6B by 2026

U.S. TV advertising will not return to 2019 levels until 2023, and the declines in traditional TV viewership will `generally make TV less attractive to many marketers,’ according to GroupM

NEW YORK—In a new forecast for the 2022 ad market and media landscape, GroupM is forecasting rapid growth for connected TV advertising in 2022 and beyond. But it is also predicting that the U.S. TV advertising won’t return to 2019 levels until 2023 if political advertising is excluded and that the ongoing shift of viewing towards streaming media will make traditional TV less important for marketers.

Worldwide, total TV advertising will hit $171 billion in 2021, of which $16.6 billion will go to connected TV+, which covers the digital extensions of professional produced content, the new GroupM “This Year Next Year: Global 2021 End-Of-Year Forecast" report noted.

While traditional TV is expected to be relatively flat in years ahead, the connected TV+ ad spend is set to see rapid growth, GroupM predicted. After growing from $12.9 billion in 2020 to $16.6 billion in 2021, it will hit $20.3 billion in 2022 and $32,6 billion in 2026, tripling the $10.9 billion spent in 2019.

“The primary reason for all of the growth we expect in Connected TV+ advertising is that these environments are simply where a large and growing share of viewing is shifting,” the report noted. “We recognize that much of this space is, and will remain, ad-free, largely because the dominant players, such as Netflix, Amazon Prime and Disney+, are ad-free and plan to remain so in most of the world for the foreseeable future. While there are other service providers that intend to sell ads, they are investing less than these three in original programming, which will likely result in lower viewing shares. Consequently, the emerging world of television will simply offer fewer opportunities to advertise.”

“Falling viewership of ad-supported TV in traditional environments will lead to reduced reach potential for campaigns that rely on the medium, which will generally make TV less attractive to many marketers,” the report explained. “To deal with this challenge, some will look to better integrate the management of campaigns on YouTube and traditional TV rather than manage them separately, as typically occurs today. To the extent that YouTube and traditional TV converge, this will help sustain the role of a broadly defined notion of television in the media mixes for many, while further blurring the lines between TV, digital and search advertising for others.”

The report also predicts that digital advertising will likely end 2021 spiking by 30.5%, excluding U.S. political advertising and growing to $491 billion if revenues from digital extensions of traditional media are excluded or $537 billion in its broader form. That means, digital advertising should account for 64.4% of total advertising in 2021, up from 60.5% in 2020 and 52.1% in 2019.

The full report can be found here.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.