The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

NEW ROCHELLE, NY—A new report from Horowitz Research illustrates how popular free over the air TV is among multicultural audiences seeking to cut the cord.

As cord-cutters look for ways to stay connected to live and local programming, multicultural audiences are embracing over-the-air (OTA) antennas,

According to Horowitz Research’s “State of OTA 2021” study, two in 10 (21%) Black and 33% of Latinx and Asian cord-cutters (TV content viewers who do not subscribe to cable or satellite services, aka MVPDs), use an over-the-air antenna, which translates to 2.5 million Black, 5.7 million Latinx, and 2.3 million Asian adults using technology to access free over-the-air live, linear content.

Among Black, Latinx, and Asian cord-cutters, having access to local broadcast channels is the main driver for getting an antenna, with 8 in 10 consumers across these groups citing this as a reason to have one and almost 6 in 10 consumers in each of these groups citing local broadcast as the main reason they have an antenna. Local news, specifically, is important to most Black (76%), Latinx (68%), and Asian (82%) cord-cutters, and local and regional sports content is important to about 6 in 10 Black and Latinx cord-cutters.

Access to free, over-the-air culturally-relevant content is also important to Black, Latinx, and Asian audiences. Almost 6 in 10 (58%) Black antenna users say that having channels geared towards Black audiences is important to them, and 35% of Black antenna users say that they typically watch Black-geared content through their antenna.

The data are similar among Latinx antenna users: about 6 in 10 bilingual and Spanish-dominant Latinx say that having content in Spanish and/or for Latinx audiences is important to them, and among bilingual and Spanish-dominant Latinx antenna users, viewership of Spanish-language content from a variety of broadcasters, especially Univision and Telemundo, remains high, with about 3 in 4 Spanish-dominant and 2 in 3 bilingual Latinx antenna users watching content from those two broadcasters through their antennas on at least a weekly basis. The study also documented high importance for channels geared towards Asian audiences.

Cord-cutters are not the only ones leveraging antennas—the study finds that 10% of MVPD subscribers use an antenna. For MVPD subscribers, antennas serve three key purposes: as a backup in case of a cable/satellite outage (63%), to avoid having to pay for a cable/satellite box (47%), and for TV sets without an MVPD subscription (43%).

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

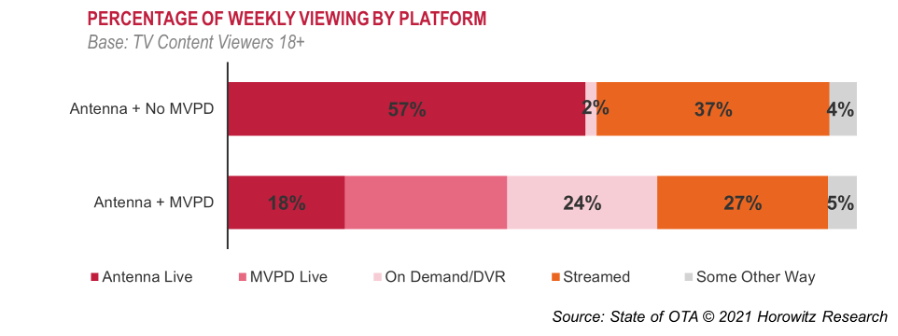

The study showed that, in fact, OTA viewers frequently combine their antenna usage with their MVPD and/or streaming services. Antenna users with no MVPD service spend about 6 in every 10 hours—(57%) of their viewing time—watching through their antenna and almost 4 in 10 hours—(37%)—streaming. Even for those with MVPD services, antenna usage consumes about 2 in every 10 hours (18% of time spent), as illustrated in the chart below.

In the survey, almost four in 10 (38%) of Black, 32% of Latinx, and 30% of Asian TV content viewers without an antenna say they would be very likely to get one in the near future. As more consumers decide to cut the cord, the study finds that new features of Next Gen TV (ATSC 3.0), such as stronger reception, enhanced video quality, on-demand content, Dolby sound, personalized advertising, and others, could draw more consumers to adopt antennas.

“The findings from this study underscore the continued value of free, local broadcast content to American TV content viewers, and in particular, to Black, Latinx, and Asian audiences,” said Adriana Waterston, Chief Revenue Officer and Insights & Strategy Lead for Horowitz.

The research firm added that new ATSC 3.0 technologies that will deliver OTA content with interactive, on-demand, and mobile capabilities could be another “game-changer,” helping ease some of the consumer pain points of the streaming ecosystem such as continued cost increases for subscription streaming services.”

The full State of OTA 2021 report provides analysis of U.S. TV content viewers and antenna users. The survey was conducted in October-November 2021 in English and Spanish among 1,600 TV content viewers (708 among antenna users). Data have been weighted to ensure results are representative of the overall TV universe. The report is available in total market, FOCUS Latinx, FOCUS Black, and FOCUS Asian editions.