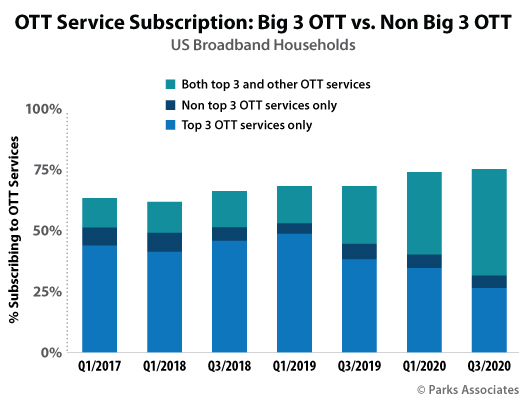

Over the past year the public has shown a willingness to subscribe to over-the-top services beyond Netflix, Amazon Prime and Hulu as new services like Disney+ attract customers who are spending more time at home since the COVID-19 pandemic began limiting entertainment options, new research from Parks Associates finds.

“It’s [2020 is] unlike any other year in streaming,” says Parks Associates Research Director Steve Nason. “There’s the launch of several high-profile subscription-based services that are attempting to challenge those big three.”

Disney+, Apple TV+, HBO Max and NBCUniversal’s Peacock, as well as the recently rebranded CBS All Access fortified with more content and renamed Paramount+, are giving the public more OTT choices, and they are responding, says Nason.

“What's happening with our latest data is that [it reveals] subscribers are tacking on a lot of these additional services instead of just having one or more of the big three,” he says. “They are tacking on an HBO Max, a Peacock, an Apple TV+ or, of course, Disney+, which continues to accelerate at such a high speed. Our new research is showing us the impact of these new challengers on the big three.”

The findings, part of Parks Associates’ new “The Next ‘Big 3 in OTT,” reveal 61% of U.S. broadband households subscribed to two or more OTT services as of Q3 2020, up from 48% in 2019.

Forty-five percent subscribe to three or more OTT services, an increase from 27% the previous year, and 31% pay for four or more services—up from 14%, the research reveals.

It also finds that 95% of U.S. OTT subscribers subscribe to one of the big three; 61% subscribe to Netflix, 47% to Amazon Prime Video, 36% to Hulu and 31% to Disney+.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Growth in OTT service uptake appears to be part of a larger trend that finds the public consuming more entertainment content—whether on DVD and Blu-ray Disc, via ad-supported OTT services like Pluto TV or through subscription services—as consumers limit possible exposure to COVID-19 outside the home, he says.

“… [B]ecause people are staying home, they're not going out as much, not going on vacations as much. When they’re not working, they are looking to be entertained. There are children doing school from home and more people working from home, so that has driven up consumption,” says Nason.

At least for the moment, the cost of an additional OTT service does not appear to be dissuading consumers nor is it driving consumers to replace one of the big three, he says.

“Amazon Prime, Hulu and Netflix have been in the market so long and have such brand affinity they are really ingrained as part of people’s entertainment activities,” he says. “We are seeing the cancellation rates for those services are really low.”

PLUS: Parks: Netflix Remains OTT King as New Services Make Inroads

For the moment, people are simply adding on another OTT service. “They are not using that money they could save—$14 on Netflix, for instance—to go to HBO Max or Disney+,” he says. “We’ll see if that continues and at what point that changes.”

Even if consumers reach that point it is unlikely they will drop the big three “unless something dramatic happens” with one of them, says Nason.

If any of the newcomers has a chance to make a real dent in the big three, it’s Disney+, he says. “They just accelerated—not only in the U.S., but globally—beyond what I think even Disney anticipated was going to happen. So there is the potential that it will become the big four down the line.”

More information about the new Parks Associates report is available online.

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.