The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Television broadcasters sit on a resource of immense, untapped value that ATSC 3.0 will unlock in the form of wireless data delivery, according to two NextGen TV authorities speaking at the virtual SMPTE2020 conference.

During “How ATSC 3.0 Wireless Spectrum Will Become Broadcasters’ Most Valuable Asset,” Mark Aitken, senior vice president at Sinclair Broadcast Group, and John Hane, president of BitPath, formerly Spectrum Co, reminded broadcasters that there’s more to NextGen TV than TV.

“If you… think of ATSC 3 as a wireless IP distribution platform, suddenly, it's not just about television,” said Aitken. “There are new opportunities that align themselves well with… the rest of the IP world.”

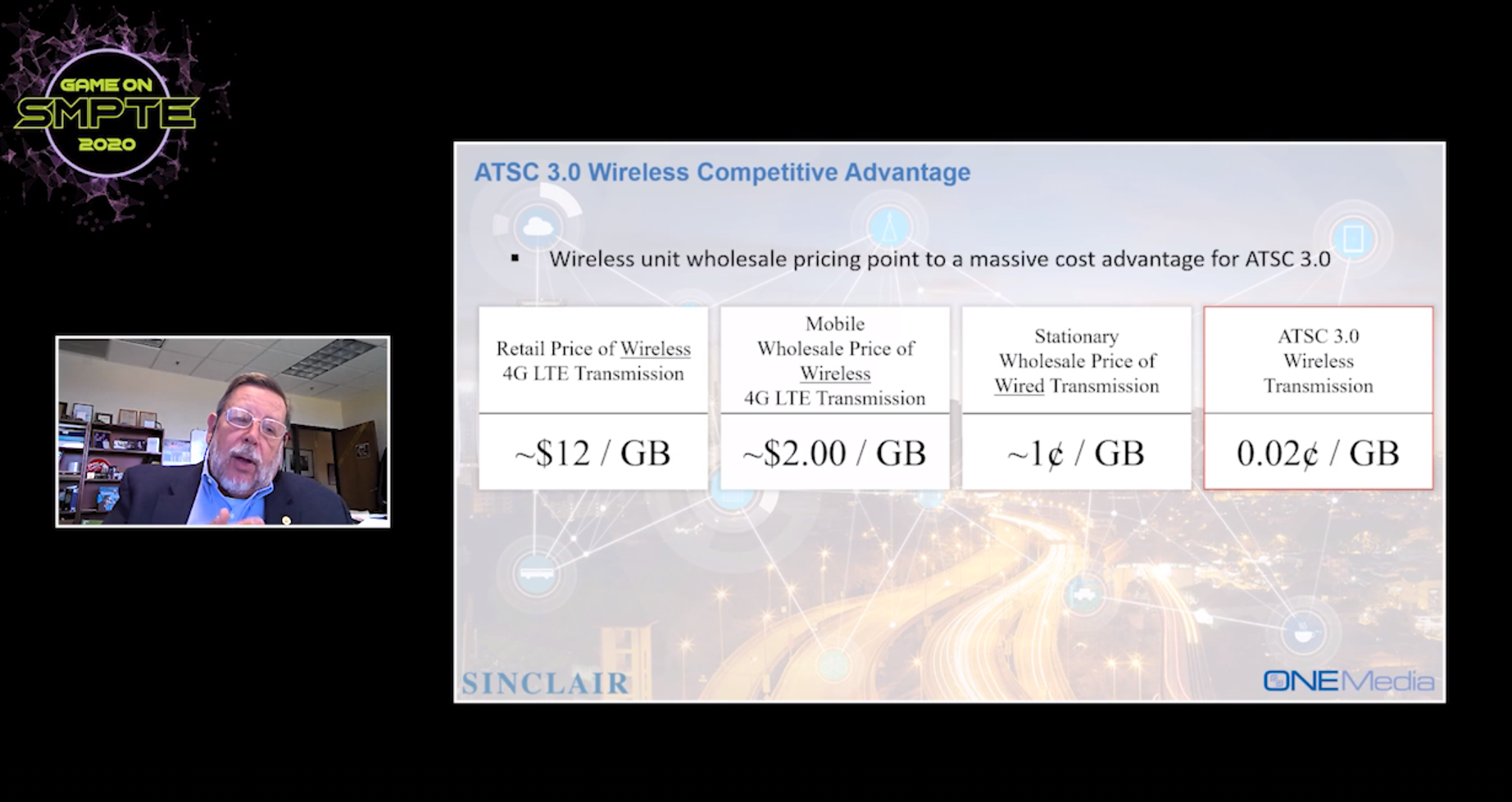

To illustrate his point, Aitken compared pricing of today’s wireless services to broadcasters’ cost of delivering wireless bits.

“When you look at the retail price of a gigabyte, you're looking at $12,” he said, referring to the average price charged by wireless companies.

“If you look at the wholesale price… the bulk discounting that's given to MVNOs, mobile virtual network operators, you're looking at a price valuation of about $2 per gigabyte.”

Consumers subscribing to an internet service provider pay about 1 cent per gigabyte monthly for wired delivery, he added.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“If you look at the valuation of… [broadcast] bits from the standpoint of the cash flow of a station, the valuation is like two one-hundredths of a cent per gigabyte. In other words, .02 cents per gigabyte based on… what we do today,” he said.

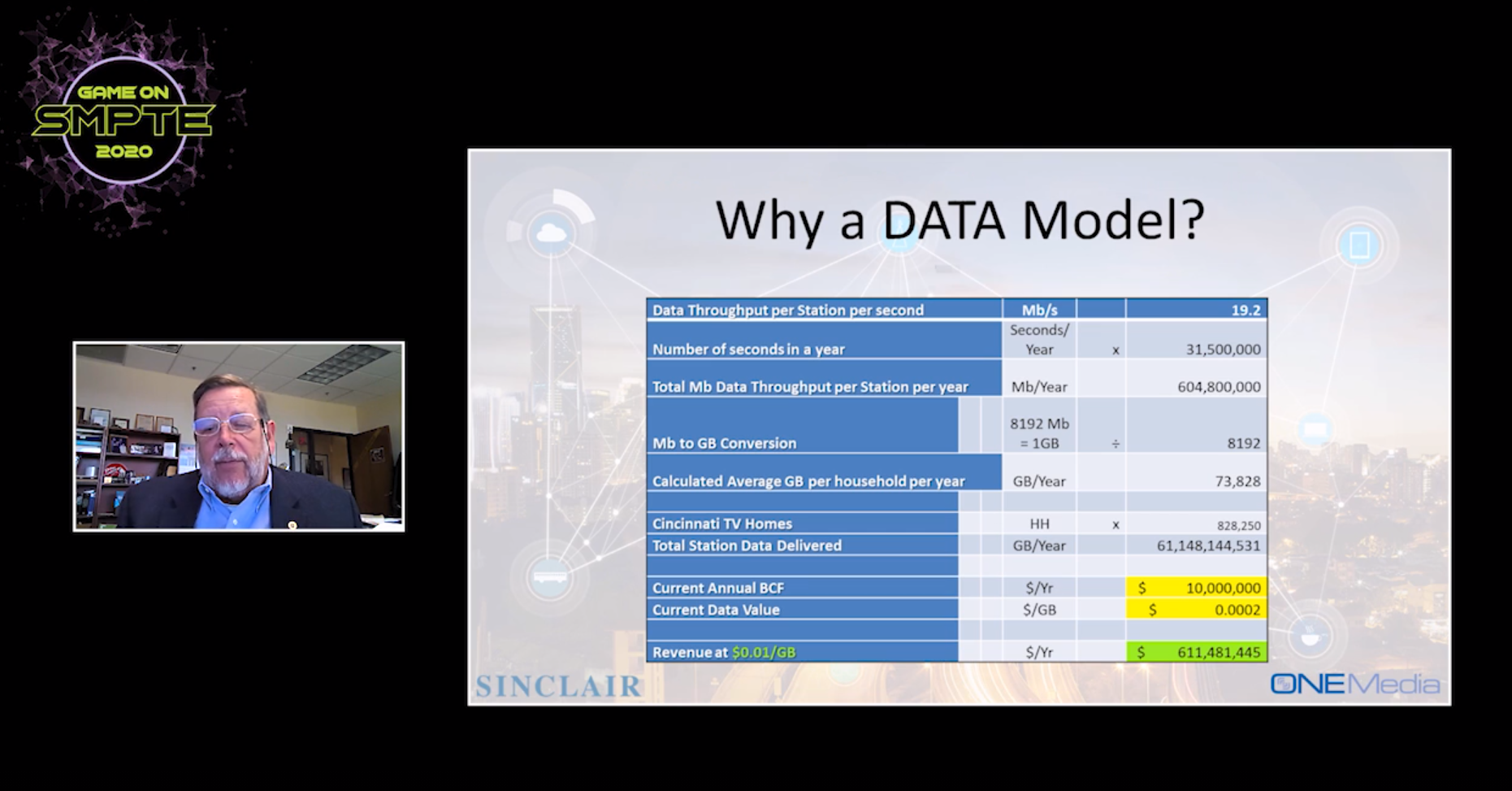

With ATSC 3.0’s far superior bandwidth efficiency, TV broadcasters can maintain their primary TV service while at the same time cashing in on 3.0 data delivery. To illustrate the point, Aitken laid out real-world numbers for Sinclair’s station in Cincinnati and how 3.0 data delivery could affect cash flow.

Based on gigabytes of wireless data delivered on an annual basis, the number of homes in the market and a price of 1 cent per gigabyte, the base cash flow valuation of the Cincinnati station, which today stands at $10 million a year, leaps to $600 million a year, said Aitken.

“Maybe that’s [1 cent per gigabyte] an unrealistic expectation, but I’ll ask you the question. ‘What is the realistic expectation of the value of a broadcast bit in the world today?’” Aitken mused.

The Sinclair senior vice president of Advanced Technology urged his virtual audience to think of ATSC 3.0 as 5G broadcasting—a supplement to 5G operator’s unicast service. Based on how wireless bits are distributed today, there exists an opportunity for an interplay between unicast and broadcast delivery. “Not one versus another, but one in conjunction with the other,” he said.

Wireless services deploying 5G face a host of issues depending on the bandwidth they are using that ATSC 3.0 broadcasting can address. While sub-1GHz spectrum provides 5G operators with good reach, it is limited in available bandwidth. “Some of this is down to 1.5 MHz bandwidth that are paired in the unicast uplink-downlink fashion,” said Aitken.

In the 2GHz range, there is higher available bandwidth for 5G, but also problems having “to do with macro base stations to provide for coverage-related issues,” he said. At the higher 5G frequencies, bandwidth increases, but coverage diminishes further.

LEGACY REUSE RESTRICTIONS

To realize the full value of its spectrum for data delivery, the TV industry will need to shed legacy regulatory restrictions on the reuse of spectrum put in place to protect TV stations from harmful co-channel interference.

In the days of analog TV, stations sharing the same channel assignment were prevented from interfering with each other by making sure the markets they served were spaced far apart. In essence, these fallow areas served as “geographical guard bands,” said Hane.

“This is a relic of a very old regulatory regime, which developed out of a specific technology [analog TV broadcasting]” he said. To which Aitken added there typically is a spectrum reuse factor of 4:1.

The pair then began discussing what this means in terms of potential revenue. Television broadcasters in the UHF band alone occupy nearly 45 billion megahertz pops, explained Hane. [A megahertz pop is a measurement that refers to 1MHz of bandwidth passing a single person in a licensed coverage area.]

“If you use the incentive auction valuation of 93 cents… call it $1 a megahertz pop, then the broadcasters are, not the exclusive, but the primary occupants of … $45 billion worth of megahertz pops,” said Hane.

Interference mitigation available in digital broadcasting, however, offers the opportunity to provide better reuse of spectrum and “approach a reuse factor of one, where all of that becomes available,” said Aitken. “Suddenly, that $45 billion… is $180 billion in a reuse one factor.”

Hane echoed Aitken’s observation. “There’s an awful lot [of spectrum] left on the table that is not being put to productive use,” he said.

“…[W]ith new technology, particularly ATSC 3.0 and OFDM and … DTS, distributed transmission facilities and other techniques, we can actually provide useful service … into all those areas, using those bands that are essentially just geographic preclusion zones now,” he said.

Calling the value of the bands used by broadcasters “very under appreciated,” Hanes spoke of extracting greater value in terms of public service. “The value of those bands—the intrinsic value—is so great, that we have to provide the public more service with the capacity that is allocated to broadcasters, but not all of it is used because of an old regulatory regime.”

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.