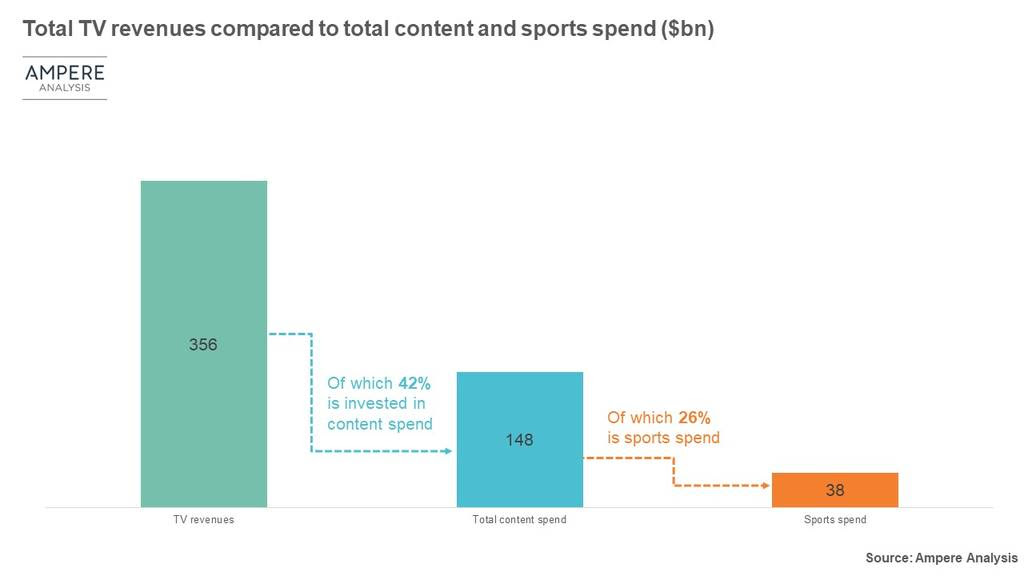

Sports Rights Made Up Quarter of 2018 Content Spending

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

LONDON—The bill to broadcast the NFL, NBA, MLB and other popular sports leagues around the world represented more than a quarter of the content spending in 2018, according to a new study from Ampere Analysis. Specifically, $38 billion was spent on sports rights acquisitions last year, making up 26% of all content spending and nearly doubling from the $20 billion spent in 2012.

Most of the spending on sports rights in the U.S. is made up of deals with the NFL, NBA and MLB. These deals have led to the U.S. spending more on sports rights than any other global market, despite a smaller portion of TV revenue (11%) devoted to sports rights than compared to the major Western European markets (17%). Ampere expects this to change over the next six years as rights deals for the three major leagues will expire and are estimated to generate another $4 billion per year.

While major sports leagues like Ligue 1, Bundesliga and La Liga also help drive the sports rights spending in Europe’s top markets, those countries also have invested more in secondary events and competitions, which are maintaining the same pace of growth as major leagues, according to Ampere.

Ampere also pointed out while OTT players are starting to break into sports rights, they are still considered minority players based on their overall spend.

Overall, Ampere believes that there is still room for growth in spending on sports rights in both emerging markets and established ones like Europe and the U.S.

“Even as major leagues turn their attention to international markets outside of Western Europe and the U.S., our analysis shows that there is still opportunity for many of the major competitions in their domestic markets,” said Alexios Dimitropoulos, senior analyst at Ampere Analysis. “Although there are significant competitive pressures on TV revenues due to the rise of new online competitors, the impending direct-to-consumer fragmentation of the market may also open up opportunities for sports rights bodies—who will increasingly hold some of the few premium rights that money can still buy.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.