Spectrum Demand Highest in Mid-Sized Markets

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

WASHINGTON—Demand for spectrum remained highest in small and mid-sized markets after three rounds of bidding in Stage 4 of the TV spectrum incentive auction—in cities such as Corpus Christi, Texas; Evansville, Ind.; Hannibal, Mo.; South Bend, Ind.; Valentine, Neb.; and Red Oak, Iowa, to name a few. Demand exceeded supply in 184 wireless licensing areas, referred to as “partial economic areas” or PEAs, after Round 3 concluded Thursday afternoon.*

Demand was highest for unreserved spectrum—spectrum not set aside for bidders with little or no low-band wireless spectrum, who in turn have exclusive access to 30 MHz of reserved spectrum in each PEA. Demand for unreserved spectrum exceeded supply in 146 PEAs and for reserved spectrum in 38 PEAs.

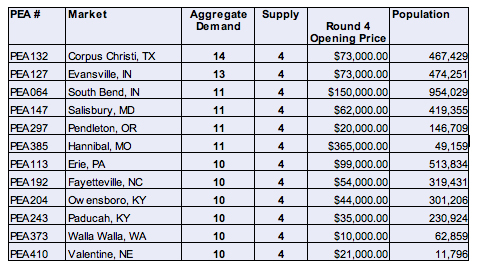

Fig. 1, The top 12 of non-top 40 PEAs ranked by demand for unreserved spectrum after Round 3 bidding.

Among the top 40 PEAs in terms of population, supply met demand in all but one after Round 3. Demand for spectrum in Milwaukee (No. 38) exceeded supply five-to-four for unreserved paired spectrum blocks, called “products.” The opening price for those products will be $19.3 million each when Round 4 bidding begins on Monday.

Supply exceeded demand in two of the top 40 PEAs: Los Angeles (No. 2), where product will open at $407.9 million; and San Diego, (No. 18), at $55.6 million, in Round 4.

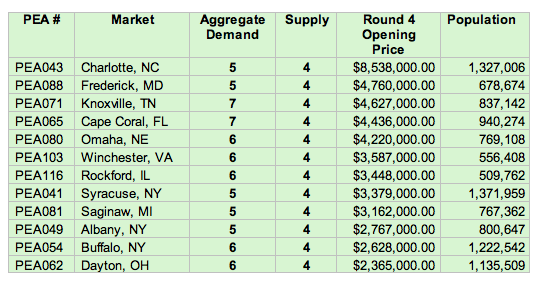

Fig. 2, The top 12 of non-top 40 PEAs after Round 3 bidding, ranked by Round 4 Opening Price.

Beyond the top 40, demand was greatest for unreserved spectrum in Corpus Christi, Texas, (No. 132) at 14-to-four, with a Round 4 opener of $73,000. Evansville, Ind., was next at 13-to-four, also at $73,000. South Bend, Ind., was 11-to-one and priced at $150,000 for Round 4, most likely because of its proximity to Chicago. (See Fig. 1.)

The highest Round 4 opening price for unreserved spectrum among non-top 40 PEAs was in Charlotte, N.C., (No. 43) at $8.5 million per product. Frederick, Md., (No. 88) a Washington, D.C.-adjacent community, was next at $4.76 million. Knoxville, Tenn., (No. 71) was next at $4.6 million. (See Fig. 2.)

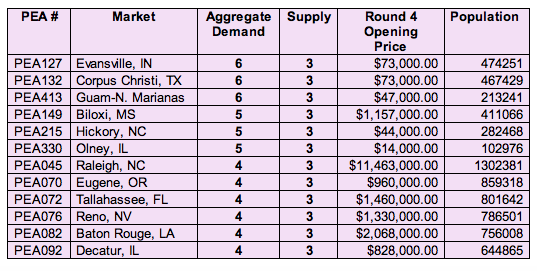

Fig. 3, The top 12 of non-top 40 PEAs ranked by demand for reserved spectrum after Round 3. Demand for reserved spectrum was met in all top 40 PEAs, but not in several mid-sized and smaller markets, including Evansville, Corpus Christi, Guam-North Marianas, Biloxi, Miss., and Hickory, N.C. (Fig. 3.) The highest Round 4 opening price for reserved product where demand remained was in Raleigh, N.C., at $11.5 million. (Fig. 4.) R4 opening product prices for both unreserved and reserved spectrum were the same in all but two of top 40 PEA, and was only slightly higher for unreserved spectrum in several non-top 40 PEAs.

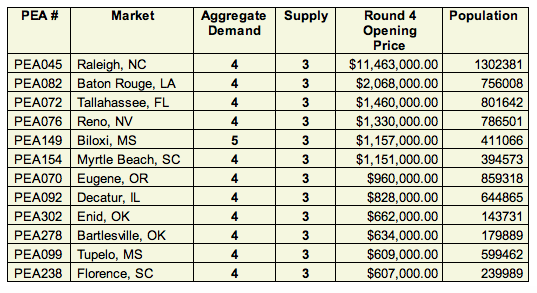

Fig. 4, The top 12 of non-top 40 PEAs after Round 3 bidding, ranked by Round 4 Opening Price. The two closing criteria of the auction were met on Wednesday, Jan. 18, after Round 2, when bids reached $18.2 billion and met a market reserve price. Bidding in Round 4 will begin Monday, Jan. 23, at 10 a.m. Eastern.

* The United States and its territories comprise 416 PEAs, each of which is divided into reserved and unreserved spectrum, creating 832 bidding areas.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.