S&P: Inflation Cools Smart TV Demand

Shipments fell but the average selling price for smart TVs increased to nearly $500 according to S&P’s Kagan

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

NEW YORK—The pandemic fueled surge in demand for smart TVs cooled in Q1 2022, as the overall demand for smart TVs fell to down to pre-pandemic levels, producing a 9.2% year-over-year decline in total smart TV shipments in Q1 2022, according to Kagan, a media research group within S&P Global Market Intelligence.

At the same time, a shift in product mix—with most vendors increasing the proportion of high-margin premium products in response to component shortages—raised the average selling price, or ASP, by 21% year over year to an estimated $496.

While the price jump contributed to the shipment decline, Kagan is still reporting a 10% growth in smart TV revenues in Q1 2022 to $16.63 billion.

Other key highlights of the new Kagan report include:

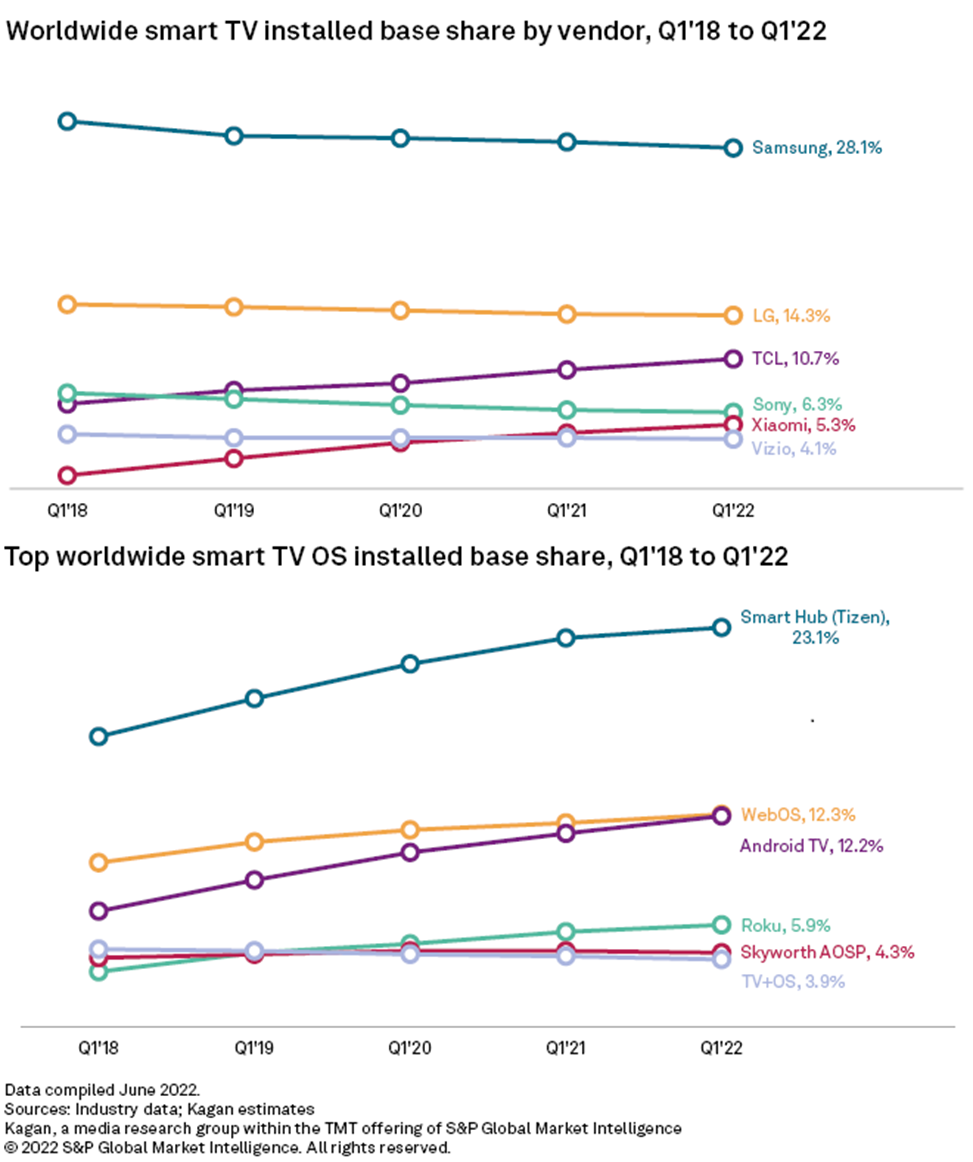

- Despite declining smart TV shipments, pockets of growth remained among emerging markets, fueling growth for young brands like Xiaomi and TCL. Both Chinese companies are growing at least twice as fast as the more well-known Korean and Japanese brands with 19% and 27% respective y/y installed base growth in Q1 2022.

- With its head start in smart TV shipments and solid shipment volumes for the past seven years, Samsung's Tizen-based Smart Hub maintains the largest OS installed base worldwide with an estimated 23.1% share. Alphabet's Android TV is close to overtake LG's WebOS to be the second-largest smart TV platform by footprint.

- Smart TV revenue continued to rise in recent quarters driven by component cost increases that were passed on to unit ASPs, offsetting shipment volume declines.

- While demand in the premium space is relatively stable regardless of price, the same cannot be said about the low-end and mid-range markets where competition on price remains stiff, keeping overall ASPs from going completely out of control.

- While temporary boom-and-bust cycles in demand can have significant impact on near-term results, gradual smart TV adoption in emerging markets will have a greater impact on overall shipment volumes and revenue in the long run, Kagan reported.

“Competitively priced models from the Chinese TV makers have become attractive options compared to more traditional brands, as smart TV adoption gradually grows among emerging markets like India, Latin America and the Asia Pacific,” explained Milan Ringol, research associate at Kagan, part of S&P Global Market Intelligence

Kagan's quarterly global smart TV estimates of unit shipments, revenue, average selling prices, and installed base with vendor and OS breakouts are built upon analysis of publicly available industry reports and proprietary data models.

The analysis only includes TV sets used for home entertainment, excluding commercial sets used, for instance, in the hospitality industry and in public spaces and offices. Revenue estimates include only unit sales and not revenue generated from smart TV usage through ads, platform fees, or the like.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.