Peacock, HBO Max Hitting With Different Age Groups, Ampere Reports

New streaming services are playing to their strengths as their build up subscribers

LONDON—As the streaming market continues to find its footing, what new streaming service you subscribe to may have something to do with what age group you fall under, according to a new report from Ampere Analysis, particularly when it comes to two of the newest platforms—Peacock and HBO Max.

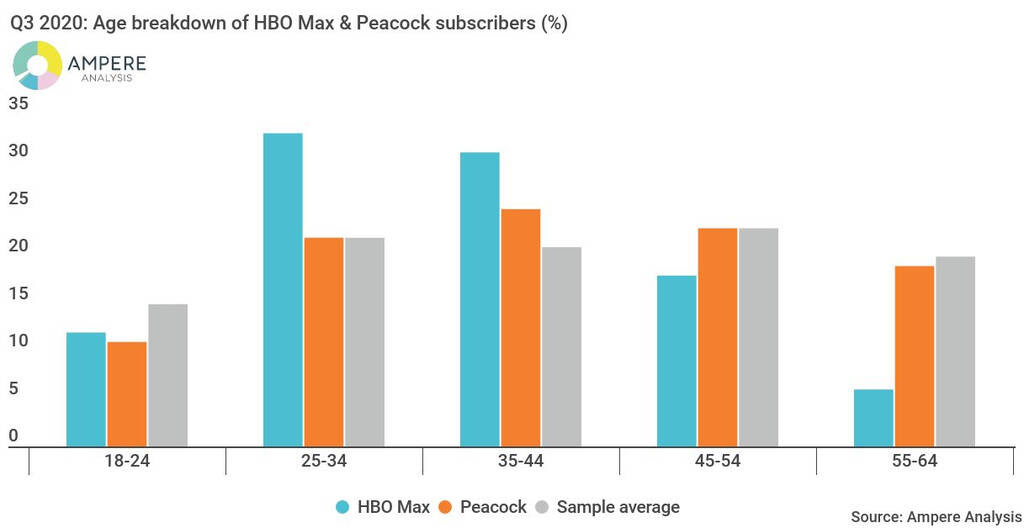

Ampere took a look at the two newest streaming platforms since their debuts—HBO Max launched in May, Peacock in July. Results showed that at the time of the report (August/September), 8% of U.S. internet households had subscribed to HBO Max and 7% were using Peacock. But an interesting part of the results was that the two services tend to be favored by different age groups.

HBO Max subscribers are 50% more likely to be in the 25-44 age bracket than the sample average, which mirrors the demographics of traditional HBO subscribers. For Peacock, their primary market is 35-44 year-olds, but 19% of their audience is over the age of 55, compared to just 6% for HBO Max.

The price of the services is also creating a divide between who subscribes to them. HBO Max, at $14.99 per month, is one of the more expensive streaming options available currently, resulting in 69% of its subscribers earning a household income of $51,000 or more. Peacock, meanwhile, offers multiple price options, including a free ad-supported tier, and two premium content subscriptions with ads ($4.99) and without ($9.99); 54% of Peacock subscribers earn more than $51,000 household income.

“Peacock’s early adopters show that it has been successful in converting broadcast channel audiences—who are an older demographic and typically more difficult to convert—into SVOD subscribers, allowing it to play in an arena that is generally less competitive,” said Annabel Yeomans, senior analyst. “HBO Max has yet to diversify its audience away from that of the HBO premium channel—whose mix of high-end drama, comedy and documentaries have a particular demographic appeal—but the array of new family and scripted series are aimed at doing precisely this.”

To Yeomans’ point on content, the Ampere report showed that comedy content was the big draw for both services—most important for Peacock subscribers and second for HBO Max’s audience. Planned content is focusing around comedy as a result (40% of upcoming content for Peacock, 31% for HBO Max). HBO Max does have plans to expand among families and younger adults with content from Looney Tunes, Sesame Street and DC Superheroes.

“Nonetheless this is an already crowded market with strong competitors like Netflix, Amazon, Disney+ and Apple TV+, so while increasing the diversity of catalogues and quality of original content will be key to driving scale, playing to each services’ brand and audience strengths should also not be forgotten.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

For more information, visit www.ampereanalysis.com.