Manufacturers adjust to slumping LCD demand

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With TV set sales slumping and more competition increasingly coming into the market from overseas countries, LCD TV panel manufacturers are planning less aggressive business strategies for 2013 as demand for LCD panels slows. That’s according to the latest NPD DisplaySearch Quarterly LCD TV Value Chain Report.

The makers of flat-screen displays, the survey said, are taking action to avoid an oversupply of LCD TV panels. This involves a drastic change in business models, which includes developing strategic alliances, making capacity allocation improvements and expanding product portfolios to include a larger variety of panel sizes, said the display industry analyst, which is based in Santa Clara, CA.

LCD TV panel manufacturers hope that by moving to larger screen sizes, they can decrease unit shipments while increasing the size of panels, thus boosting their bottom lines.

“Consumers are focused on TV prices, while brands have been focused on TV features. This disconnect has resulted in reduced demand and profits for TV supply chain participants in 2012,” said Deborah Yang, NPD DisplaySearch Research director. “A misalignment in panel size portfolios between buyers and sellers could result in supply constraints. Panel makers and TV brands are trying to strengthen their business portfolios and enhance their bargaining power with supply chain participants in order to improve profitability and gain a competitive edge.”

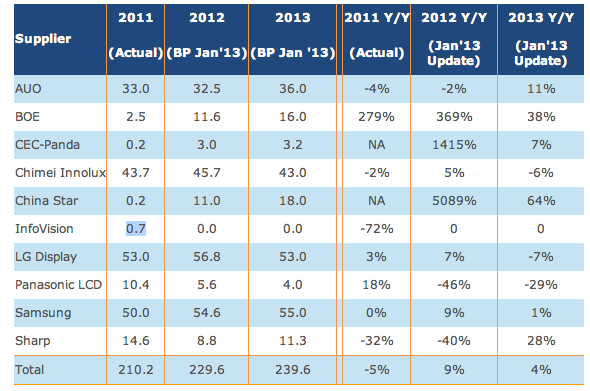

Taking these factors into account, along with the aggressive TV shipment plans of some TV brands (in particular the top two Korean TV brands and Chinese TV makers), NPD DisplaySearch forecasts four percent year-to-year growth in LCD TV panel shipments for 2013 and 11 percent year-to-year growth in TV shipments planned by surveyed TV brands.

Samsung and LG, for example, are working with Sharp to increase panel supply in 2013, mostly for 32inch panels.

“Some TV brands’ 2013 shipment plans reflect their strategy to set higher targets and secure sufficient panel supply, but they may also be too aggressive,” Yang said. “The TV supply chain is evolving, with Taiwanese panel makers leading the development of new panel sizes and ties with TV brands. Meanwhile, panel and set makers are adopting new business models around open cell and backlight-module-systems (BMS) assembly. Other TV manufacturers may be forced to follow suit — changing the TV value chain over the long term.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The DisplaySearch Quarterly LCD TV Value Chain Report maps the relationships between LCD TV brands, OEMs and panel suppliers with actual shipment information.