Legacy TV Split Over Implications of Sports Streaming

How will broadcasters navigate the changing market?

Amid much commentary about the negative impact high-valued sports streaming initiatives could have on local TV stations and MVPDs there’s another much more optimistic view emerging from the ranks of several publicly traded station groups.In sharp contrast to those who feel threatened by sports rights owners’ surging embrace of streaming, these station owners contend they are making significant headway with opportunistic adjustments to the new reality.

Even in the case of “Spulu,”—the unofficial name of the mega sports streaming joint venture between ESPN, Fox and Warner Bros. Discovery scheduled to launch later this year—there’s a big split between those who are shrugging it off and the entities ringing alarm bells. According to a report in the Wall St. Journal, the service—which promises to offer feeds from ESPN, ESPN2, ESPNU, SECN, ACCN, ESPNEWS, ABC, FOX, FS1, FS2, BTN, TNT, TBS and truTV—could cost up to $50 per month.

A skeptic might see recent “what-me-worry?” sports-related stances taken by big station groups like Nexstar, Gray, Tegna, Sinclair and E.W. Scripps as posturing meant to allay Wall Street concerns. After all, there’s plenty of fuel for apprehension in the raw statistics surrounding the surge in sports streaming.

Unlevel Playing Field

In the U.S., 80% of sports fans, including 76% who watch NFL games and 89% of the soccer fan base, sometimes or regularly view the action online, according to Nielsen Fan Insights. As for sports rights revenues flowing to sports producers from streamers, research by Ampere Analysis found the global total jumped 64% to hit $8.5 billion in 2023, representing 21% of all sports rights revenues compared to 13% the year before.

Nonetheless, there’s a widening gap between station groups and Tier 1 multichannel video programming distributors (MVPDs) who can turn developments to their advantage and other station owners and smaller pay-TV systems who feel they’re trapped on an unlevel playing field. It makes for a cacophony of messages hitting regulators and investors at a moment when everyone is looking for a more coherent, predictable business environment to work and invest in.

“If you could figure out whether there’s one unified voice from either the broadcast side or the cable side, I’d love to read your article,” says Grant Spellmeyer, president of ACA Connects, the lobbying organization representing smaller cable companies. “It is fractured all over the place.”

Brian Lawlor, president of Scripps Sports, offers several reasons for his company’s upbeat perspective on the role sports will continue to play in drawing audiences not only to its stations but, in some respects, to most other local broadcasters as well. “Even though some stuff has moved to streaming, most premier sports remain on linear television,” Lawlor says.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Streaming may bring some additional revenue to rights owners, but discussions with teams and leagues reveal “they’re all concerned about reach and their ability to put games in front of fans,” Lawlor adds. “At the end of the day, local broadcast continues to reach 100% of households.”

Indeed, as Lawlor and other station group executives note, free over-the-air exposure has become even more important to sports producers in light of the reversal in regional sports network (RSN) fortunes, including most prominently those of Diamond Sports Group, which is pursuing a Chapter 11 restructuring deal that would give Amazon Prime streaming rights to its sports partners’ games. “A decade ago, a lot of us had partnerships with RSNs reaching 80 percent of their markets, and now it’s down to just 35 or 40 percent,” Lawlor says.

Scripps, like other station groups, is capitalizing on sports teams’ desires to maintain broad local coverage, in this case with new deals involving the NHL’s Las Vegas Golden Knights and Phoenix Coyotes. Other recent high-profile local station sports partnerships include Tegna’s with the NBA’s San Antonio Spurs, Dallas Mavericks and Milwaukee Bucks, and Gray Television’s with that league’s Phoenix Suns, Atlanta Hawks, and New Orleans Pelicans.

Market Overreaction?

Along with citing such deals to quell Wall Street anxieties, some station group executives have been addressing what Nexstar President/CEO Mike Biard recently referred to as “a significant misinterpretation in market overreaction” to the proposed JV streaming service.

During the company’s Q4 2023 report to investors in late February, Biard said, “We have confirmation that it will function in the same manner as other vMVPDs that distribute over Fox and ABC affiliated stations,” meaning he expects the new service to join other online providers of MVPD-like lineups in payment of what amounts to retransmission consent fees.

If this is all about attracting the sports fanatic, it’s hard to say it’s a slam dunk.”

Chris Ripley, Sinclair

Interestingly, the question of legally mandating retransmission payments from “virtual” MVPDs (i.e., YouTube TV, Hulu Live+, Sling TV), remains outstanding in an unresolved FCC notice of proposed rulemaking first issued in 2014, which the NAB has been pressing the commission to address since late last year. vMVPDs’ willingness to pay voluntarily while joining forces with the big four broadcast networks to oppose FCC action serves as another demonstration of market clout wielded by some station groups.

During their own Q4 conferences, Sinclair President/CEO Christopher Ripley and Scripps President/CEO Adam Symson agreed with Biard that the sports JV doesn’t look so bad, assuming it survives to generate payments to stations affiliated with broadcast networks carrying sports targeted by the JV. But as Ripley sees it, that’s a “big if.”

Citing missing Olympics and incomplete NFL and March Madness coverage, he said, “If this is all about attracting the sports fanatic, it’s hard to say it’s a slam dunk.” Instead, the JV “will be yet another virtual MVPD in an already crowded and somewhat established marketplace…competing with and likely cannibalizing other streaming products from the very same companies that make up the partnership.”

Such sanguinity is a far cry from the responses emanating from other sources. Along with crying foul over what they see as the JV’s antitrust implications, they assert high-profile exclusive pro sports deals like those cut by Amazon, Apple, and Comcast’s Peacock service are the tip of an unchecked spear coming right at them.

Initial Opposition

Opinions vary as to which business model constitutes the larger threat.

Unlike the big exclusive streaming deals, “Spulu’s” plans face court and Justice Department scrutiny. Coming to light in mid-February were the antitrust suit filed in New York by sports streamer FuboTV and an as-yet-unconfirmed investigation Bloomberg reported was getting underway at the DOJ.

ACA Connects’ Spellmeyer echoes widely held sentiments expressed by skeptics. Looking at what little is known about the partners’ plans as a “continuing deterioration of the linear programming model,” Spellmeyer says the JV is especially notable as a harbinger of what could be in store.

“This is a bigger deal than the movement of one baseball playoff game to Peacock or even moving Thursday Night NFL games to Amazon,” Spellmeyer says. The JV is doing this “to further exploit their market power and put it together collectively and leverage it.”

But a source voicing the concerns of a large station group owner says the amounts big streamers are willing to pay for sports rights represent an even bigger anticompetitive threat to broadcasters, MVPDs and even Silicon Valley vMVPDs.

“They are all in the same sinking boat with the great white Amazon shark circling,” the person said. “These big tech streamers are willing to spend stupid amounts of money to take rights away from the broadcast networks and broadcast stations—when it comes to sports—are at the mercy of the networks.”

In addition to the courts, observers are also keeping an eye on Congress, which has cast a skeptical eye on sports streaming, and in particular, garnering swift criticism from politicians when NBC broadcast an NFL playoff game exclusively on Peacock in January.

“I think our job here is to protect the American consumer to ensure that they’re able to easily access the content that they pay for,” said Rep. Anna Eshoo (D-Calif.), during a Congressional hearing on the subject in February. Referring to professional sports and media (with no pun intended), she said “I just think it’s a racket. It’s a racket.”

SIDEBAR:

NextGen TV Could Bring Sports Coverage ‘On Par’ With Streamers

Beyond the debate over the immediate impact of sports streaming there’s another story to be told that’s opening a new chapter on broadcast stations’ plays in sports programming. With ATSC 3.0 (aka NextGen TV), leaping to 75% market coverage over the past year on a trajectory to near blanket coverage by year’s end, NextGen TV will give stations an opportunity to greatly enhance sports viewing experiences as well as to bring more local sports coverage to their audiences.

As explained by Anne Schelle, managing director of the Pearl TV consortium of eight large station groups operating 820 TV stations nationwide, Pearl TV affiliated stations and others rolling out NextGen TV services are putting a lot of stock in the appeal of what they can do with sports programming. Indeed, she notes, sports broadcasting is a big focus of the ATSC 3.0 exhibit at this month’s NAB Show.

One big aspect to what can be done with NextGen TV has to do with enabling 4K UHD with HDR when games are broadcast in 4K along with HDR enhancements to HD when technology supporting upscaling to HDR from SDR is in play. With 20 million households in reach of HDR-enabled signals at the start of the year, the goal is to hit 50 million this spring, 80 million by the Summer Olympics, “and then it becomes pretty ubiquitous by year’s end,” Schelle says.

Another sports-related advancement involves setting up a “virtual TV station” to stream the contents of a sports-rich station not equipped for ATSC 3.0 broadcasts. Schelle notes this allows these stations to deliver sports programming to connected TVs and personal devices with the full benefits of NextGen TV sports viewing experiences.

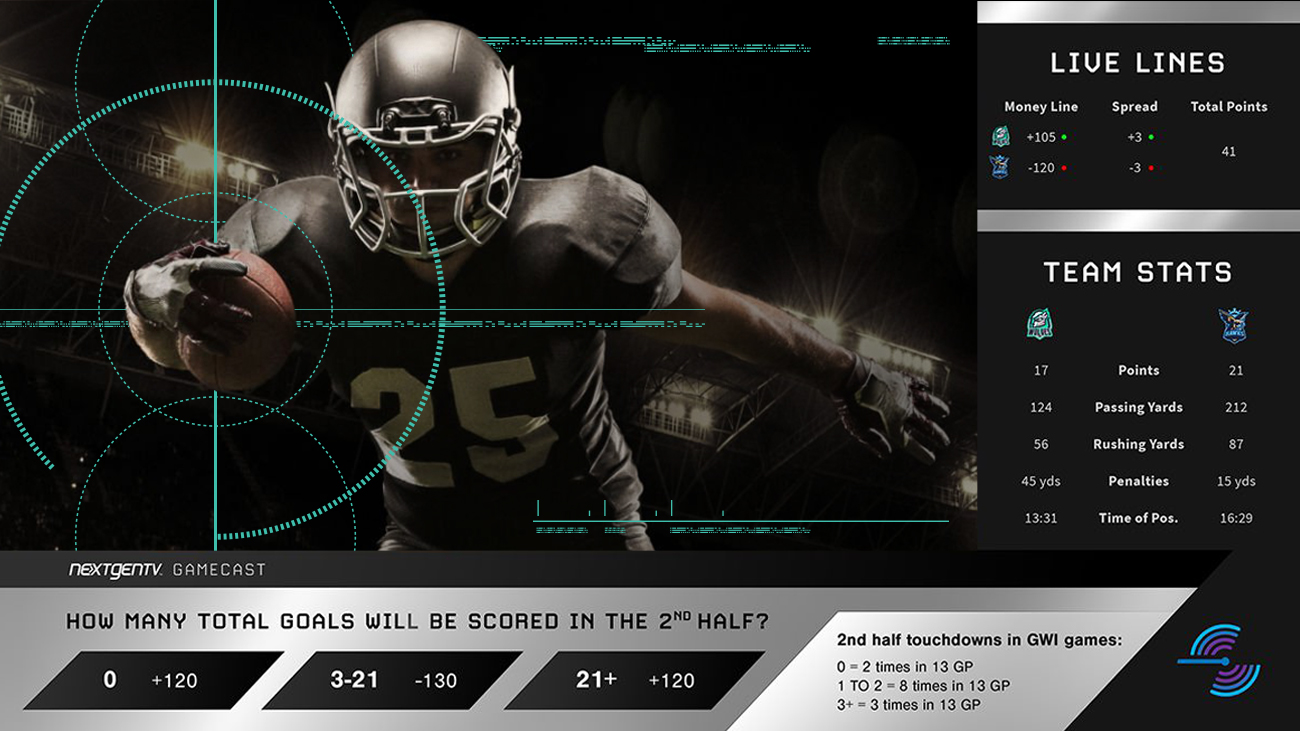

ATSC 3.0 support for HTML5 overlays that can be synched for display on OTA channels delivered to connected TVs adds still another dimension to sports viewing experience. Schelle says Pearl TV has partnered with Run3TV to use its platform as an abstraction layer that allows Pearl members’ HTML5 NextGen TV apps to run on all the operating systems used by their OEM partners.

“NextGen TV brings broadcasters on par with innovations we see on streaming services,” Schelle adds. She notes the ATSC 3.0 display at this month’s NAB Show includes demonstrations of joint efforts of Run3TV and Play Anywhere, a rights clearinghouse that facilitates interactive apps for advertising, betting, e-commerce and much else by ensuring all rights holders tied to a given app get the share due them from revenues generated by the app.

Critically, the HTML5 feed can also be used to bring complete coverage of sports events to CTV screens. “It allows broadcasters to do pop-up channels covering lots of things they couldn’t do on air in the past,” Schelle says. Pop-up tie-ins with stations’ EPGs can expose options to viewing local college and high school sports, enabling an unprecedented level of localized TV engagement. “There’s so much power in local sports coverage,” she notes.

Mentioning efforts along these lines by Pearl TV members’ Gray Television and Scripps, Schelle adds, “They’re recognizing it. Their ratings are super high with local audiences that have an affinity for these teams. This is helping them to pull in ‘Z-generation’ viewers.”

Fred Dawson, principal of the consulting firm Dawson Communications, has headed ventures tracking the technologies and trends shaping the evolution of electronic media and communications for over three decades. Prior to moving to full-time pursuit of his consulting business, Dawson served as CEO and editor of ScreenPlays Magazine, the trade publication he founded and ran from 2005 until it ceased publishing in 2021. At various points in his career he also served as vice president of editorial at Virgo Publishing, editorial director at Cahners, editor of Cablevision Magazine, and publisher of premium executive newsletters, including the Cable-Telco Report, the DBS Report, and Broadband Commerce & Technology.