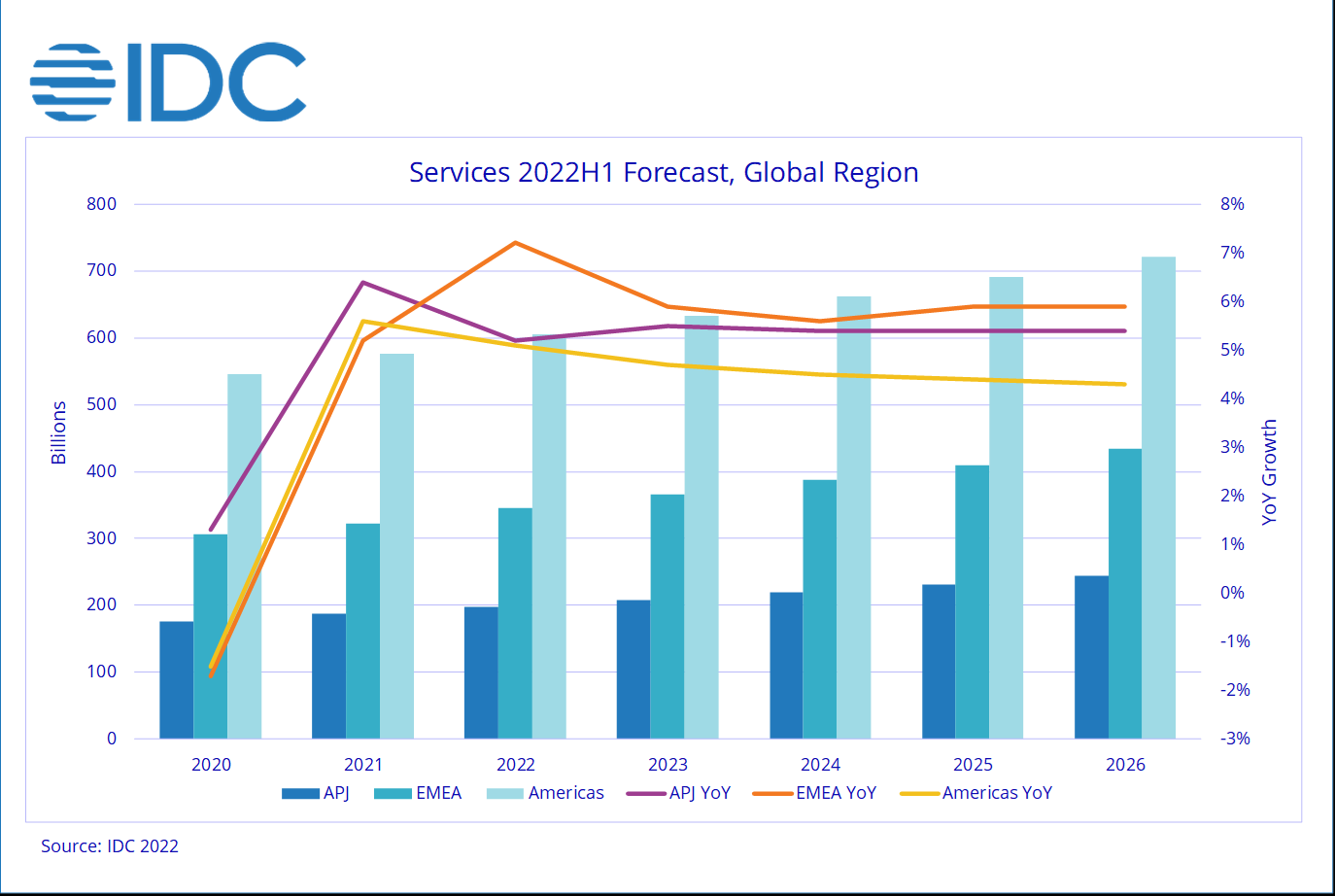

IDC: Worldwide IT, Business Services Market Will Continue to Grow Despite a Looming Recession

The IDC is predicting 5.7% growth this year and 5.2% growth in 2023 for the worldwide IT and business services market

NEEDHAM, Mass.—Despite growing fears of a worldwide recession, the International Data Corporation has issued new forecasts predicting that the worldwide IT and business services market will weather the storm with 5.7% growth this year and 5.2% growth in 2023.

Those figures are measured in constant currency, with lower growth rates of only 2% in 2022 in nominal dollar denominated revenue based on today's exchange rate.

Recently, a new forecast from Gartner also predicted growth in the IT sector in the face of a global slowdown.

The 2022 market growth represents a slight increase of 12 basis points from IDC's April 2022 forecast. The five-year compound annual growth rate (CAGR) is now projected to be 5.2%, compared to the previous forecast of 4.9%, the researchers reported.

The growth projection for growth in the worldwide services market is notable against the backdrop of a global recession.

Worldwide GDP growth has worsened since March/April and is now expected to grow by only 2.7% this year and 2.4% in 2023, based on August's figures, the IDC noted.

After adjusting certain geographic and market segments accordingly, IDC researchers said they remain cautiously optimistic based on stronger than expected reported results from vendors in the first two quarters of this year (including revenues, bookings, and pipelines) and larger residual effects from the pandemic on the IT industry (i.e., hybrid workplace, cloud adoption, etc.).

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

This was coupled with healthy bookings and pipelines and the fact that firms have not yet lowered their revenue guidance significantly, the IDC reported.

"While economic conditions for major economies around the world worsened in the last few months, given the services vendors' strong revenues, bookings, and other leading indicators, the worldwide services market will likely continue on its current growth trajectory," said Xiao-Fei Zhang, program director, IDC Worldwide Services Tracker program. "Also, the real threat to vendors may be from the supply side: with book-to-bill ratios above 1.1 or 1.15, attrition 25% plus, and utilization rate pushing close to 90%, something has to give. A cooler economy may actually help vendors to convert bookings to revenue faster by easing the labor market."

On a geographic basis, IDC has largely maintained its outlook for the Americas. Canada's long-term forecast remains intact, and the short-term growth rate was adjusted to reflect the speed of recovery among Canada's major vendors. Latin America's near-and-mid-term market outlook improved markedly this cycle: while still challenged by economic uncertainties and soaring inflation, major Latin American markets' economic conditions improved, thanks to rising commodity and energy prices.

This is offset by a slightly weaker outlook for the U.S. market, where a recession will primarily impact business consulting – its five-year CAGR was adjusted down by almost 110 basepoints (from 6.2% to 5.1%). Overall, the U.S. market is still expected to grow 4% to 5% year over year in the coming years.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.