The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

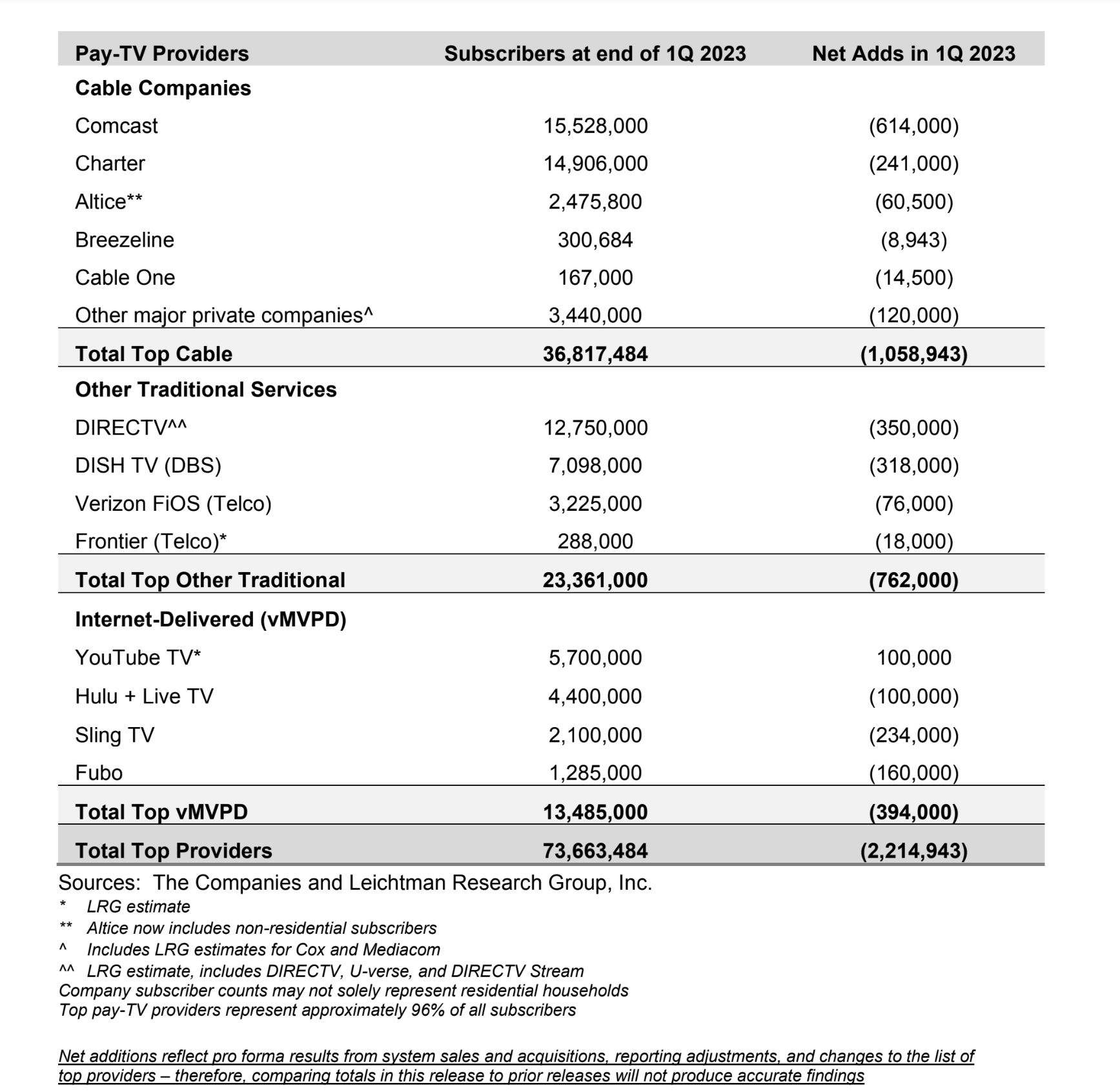

DURHAM, NH—Cord-cutting hit an all time high in the first quarter of 2023, with the largest pay TV providers in the U.S.—representing about 96% of the market—losing about 2,215,000 net video subscribers, compared to a pro forma net loss of about 1,850,000 in the same period a year ago, a decline of more than 16%, according to Leichtman Research Group.

But the loss wasn’t restricted to just traditional pay-TV; virtual multichannel program distributors such as Hulu Plus Live TV and Sling TV also lost subscribers as well. As a whole, vMVPDs lost 394,000 subscribers in Q1; the only service to gain subscribers was YouTube TV, which added approximately 100,000 during a quarter when it announced an $8 rate increase that went into effect in April.

The top pay-TV providers account for about 73.7 million subscribers—with the top seven cable companies having about 36.8 million video subscribers, other traditional pay-TV services having 23.4 million subscribers, and the top Internet-delivered (vMVPD) pay-TV services (now including an estimate for YouTube TV) having about 13.5 million subscribers.

Key findings for the quarter include:

- Top cable providers had a net loss of about 1,060,000 video subscribers in 1Q 2023 – compared to a loss of about 825,000 subscribers in 1Q 2022;

- Other traditional pay-TV services had a net loss of about 760,000 subscribers in 1Q 2023 – compared to a loss of about 625,000 subscribers in 1Q 2022, and

- Top vMVPDs had a net loss of about 395,000 subscribers in 1Q 2023 – compared to a loss of about 400,000 subscribers in 1Q 2022

“Pay-TV net losses of about 2.2 million in 1Q 2023 were more than in any previous quarter,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Similar to recent quarters, the record net losses appear to be as much a function of a slowdown in new connects as an increase in disconnects.”

The numbers match a similar report from MoffetNathanson released last week that noted total pay-TV penetration of U.S. households (including vMVPDs) has dropped to 58.5%, its lowest in 31 years.

The report comes a day after LRG reported that broadband providers added about 960,000 subscribers in Q1, however that comes as little comfort to the pay-TV providers whose broadband business is taking up the slack from the loss of video customers. Most of the additional broadband subscribers during the quarter were for the fast-growing fixed wireless 5G market dominated by T-Mobile.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.