Consumers Say They’re Paying too Much for TV, Per Hub

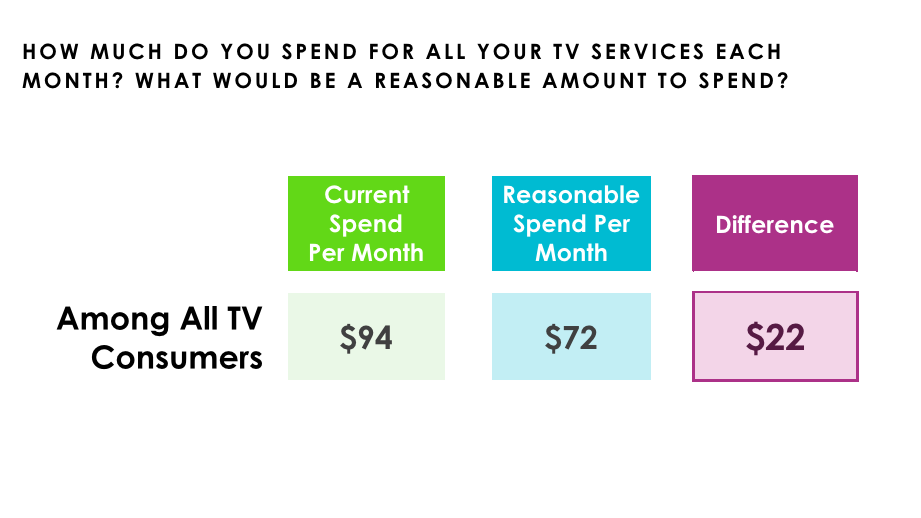

Hub found a difference of $22 between what average the consumer is paying and what they think they should be paying

BOSTON—Consumers would like to get a price check on their TV services. According to a recent survey by Hub Entertainment Research, the average consumer feels like they are paying too much every month for TV services.

The new findings come from Hub’s annual “Monetizing Video” study. As part of the study, Hub asked consumers to estimate how much they pay for all of their TV subscriptions combined and then what they would consider a reasonable price for those services. The average monthly cost for current services was $94, and the average reasonable price given by consumers was $72, a difference of $22.

Drilling down into more specifics on the types of services, consumers with a traditional TV service (cable, satellite or telco) without also subscribing to a streaming service have a gap between what they actually pay ($106/month) and what they think is reasonable ($69/month) of $37. That is more than for consumers who have traditional TV with or without streaming services ($29 gap) and those with streaming services but no traditional TV ($6 gap).

Not surprisingly, the services that provide the most value according to Hub’s respondents are all streaming services—Netflix, Hulu, Disney+, Amazon Prime Video and Apple TV+. Traditional TV services were the lowest, with 42% saying they found traditional TV to have excellent or good value.

PLUS: Netflix Tops 2020 'Must Keep TV' Rankings

An additional component of the Hub study showed that younger consumers also are willing to shell out more through streaming services for a chance to see first-run movies at home over the theater. Hub shared that 63% of consumers aged 18-34 would definitely or probably pay to stream a just-released movie; conversely, only 12% of consumers over the age 35 said they would (just 2% definitely would). More than half (57%) of 18-34 year olds would still prefer to stream first-run movies for up to $50.

“The strong preference for streaming, for TV and first-run movies, has the potential to fundamentally shift the entertainment distribution dynamic, assuming the industry is ready to accept the collateral damage—to the pay television and theater industries—such a move would leave in its wake,” said Peter Fondulas, principal at Hub and co-author of the study.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The full study is available at www.hubresearchllc.com.