Broadcast Deals Pick Up in Q3

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

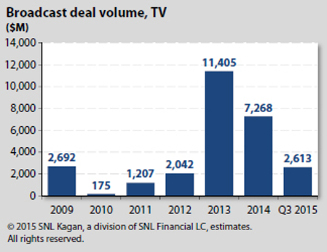

MONTEREY, CALIF.—After a lackluster start to the year, SNL Kagan has announced that broadcast station M&A volume saw a significant increase in the third quarter, reaching $3.04 billion. A series of large TV deals were registered at $2.61 billion by SNL Kagan, while radio reached $422.1 million. The total is more than twice the combined amount registered in the previous three quarters, and brings the 2015 total to $3.41 billion.

After not registering a single deal above $100 million between October 2014 and August 2015, five such transactions were registered during Q3 of 2015.The largest deal was Media General’s acquisition of Meredith Corp., which SNL Kagan valued at $1.81 billion. However, Nextstar Broadcasting announced on Sept. 28 an offer of $4.1 billion to buy all of Media General. The Nextstar offer was not included in SNL Kagan’s total deal volume numbers.

Other deals that took place during Q3 included Gray Television’s $100 million purchase of Gazette Company’s Cedar Rapids, Iowa station and $420.5 million deal for Schurz Communication’s 15 TV stations and two local marketing agreements in seven markets. Raycom Media also acquired Drewry Communications Group’s seven TV stations at a value of $160 million.

As a result of these and other deals, the TV broadcast cash flow multiple on two-year average forward cash flow rose from 8.0x at the end of Q2 to 8.3x at the end of Q3.

SNL Kagan, a division of SNL Financial LC, is a resource for financial intelligence in the media and communications sector. The company is based in Charlottesville, Va.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.