As the major streaming companies attempt to navigate the recent downturn in profits, they’ve turned to consolidation, subscription price increases and cutting programming budgets, with a more increased focus on unscripted (read “cheaper to produce”) programming such as game shows and reality TV.

This is according to Ampere Analysis which estimates that while the major global streaming platforms (Netflix, Amazon Prime Video, Disney+, Apple TV+, Paramount+ and Max/HBO Max) will raise their programming investment to $42 billion total this year, that represents only a 7% increase, compared to 24% growth in streaming spending in 2022. And although 90% of budgets go towards high-budget scripted originals, streamers are increasing their budgets for unscripted game shows and reality TV by 22% in 2023.

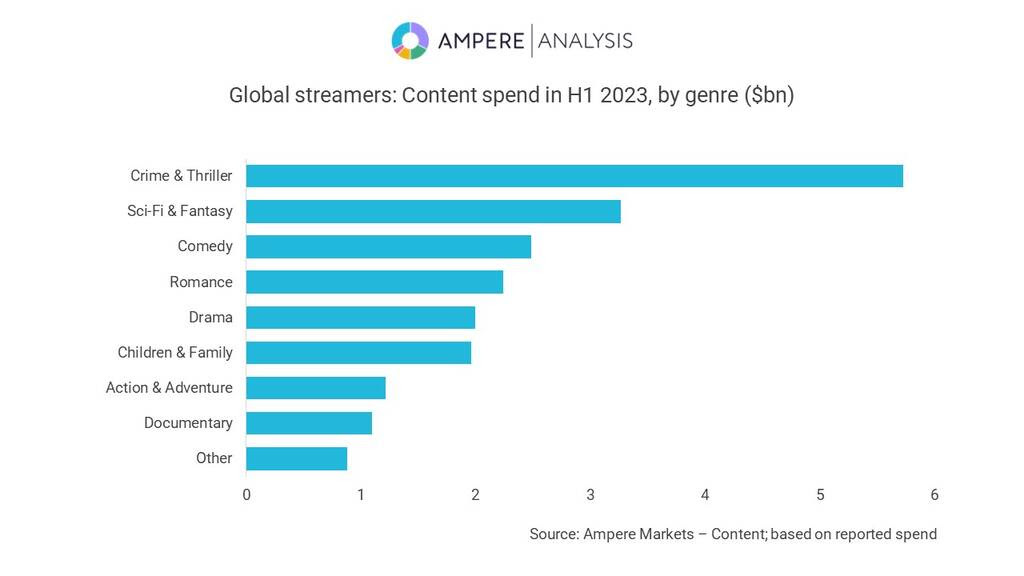

Scripted TV content remains the most powerful tool for attracting subscriptions and maintaining subscriber engagement, Ampere said, with Crime & Thriller topping SVoD spending at $12 billion this year. Sci-Fi & Fantasy and Comedy genres also command substantial funds, as well.

The unknown X factor in how all of this will impact production budgets is that although the writers' strike has been settled, production still is at a standstill with actors staying on the picket lines.

Perhaps that's why Ampere said that acquiring legacy content will also be an increased focus among streamers as well. Content acquisition spend for major SVoD platforms is projected to grow by 5% next year, reaching $14.8 billion. Crime, Romance, and Drama genres lead in acquired content spending, offering substantial potential for cross-border content licensing, Ampere said, citing recent successes with NBCUniveral's Suits and HBO shows Band of Brothers and Insecure on Netflix.

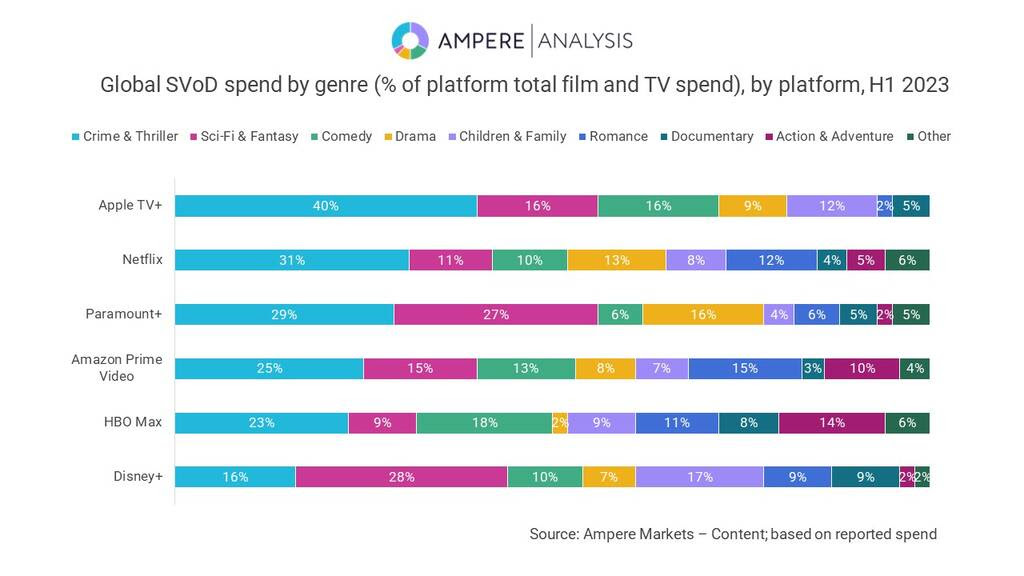

Ampere notes that at the platform level, Netflix and Amazon Prime Video adopt a balanced approach to genre allocation, leveraging their scale to cater to the preferences of diverse demographics, while other SVoD players are pursuing more targeted spending strategies, focusing on key genres and IP to cultivate loyal subscriber bases. Apple TV+, for example, dedicates 40% of its budget to Crime & Thriller titles, building on past successes such as Slow Horses and Severance. Disney+ has prioritized Sci-Fi & Fantasy and Children & Family genres, anchored by TV spin-offs from the Star Wars, MCU and Pixar franchises.

Ampere says that in light of intense competition and the influence of macroeconomic factors, SVoD platforms will prioritize cost management and effective content acquisitions to thrive in 2024 and beyond.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“The moderated spending growth rate in comparison to previous years underscores the maturity of the SVoD market and the importance of strategic spending across genres,” said Neil Anderson, Senior Analyst at Ampere Analysis. “At $15 billion, Netflix will retain its position as the top investor in global streaming content, albeit with a modest 2% increase. Meanwhile, rivals such as Disney+, Paramount+, and Apple TV+ are poised for more substantial budget expansions, projecting year-on-year increases exceeding 10%.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.