The Lines Blur Between Online and Broadcast

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

When Comcast unveiled plans to integrate YouTube videos into its X1 cable platform, the cable behemoth solidified a trend that will bring insurgent content into mainstream video delivery. Comcast had already brought long-disdained Netflix onto X1, but even more significant, the YouTube deal coincided with the birth of YouTube TV, which offers 40 channels of live television—a potential competitor to Comcast’s core video package.

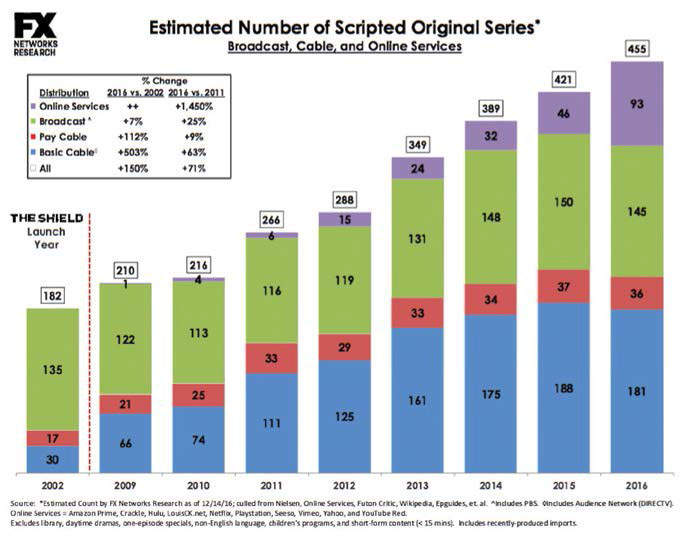

According to FX Networks Research, of the 455 scripted shows on all platforms in 2016 (up 8 percent over the previous year), 93 of them were made-for-online channels, compared to 145 for broadcast channels, 36 for pay TV and 181 for basic cable. At about the same time last month, Vimeo confirmed plans to expand its original content production and bolster its transactional video-on-demand (TVOD) relationship with BBC Worldwide.

These deals accelerate the momentum toward conflating broadcast/cable and online programming. Although it’s unlikely that the ventures are intended to stave off future offerings that could be available on ATSC 3.0 services, the new developments create potential hurdles for broadcast initiatives on that emerging platform.

Moreover, the evolving connections come at a time when original online content is exploding. In the past three years, the number of original scripted online series has tripled (much of it on Netflix and Hulu) while the number of original series on broadcast, cable and pay TV channels has remained relatively stable, according to a December analysis by FX Networks Research, a unit of the Fox-owned cable programming channel. Of the 455 scripted shows on all platforms in 2016 (up 8 percent over the previous year), 93 of them were made-for-online channels, compared to 145 for broadcast channels, 36 for pay TV and 181 for basic cable.

ORIGINAL CONTENT SELLS

Analysts have noted that the move toward original scripted programming reflects each platform’s effort to charge more for commercials and to attract critical attention.

A separate study by 451 Research found that one in five U.S. streaming subscribers now pay for three or more services, with investment in original content most often cited as a key reason to sign up. The report found that consumers are creating their own bundles of video services, starting with Netflix (bought by 95 percent of multiple streaming consumers) and Amazon Video (82 percent). Depending on preferences, viewers then add à-la-carte platforms including Hulu, HBO Now and iTunes, according to the report.

This entire process also continues to blur the differentiation between program sources. As technology makes it more efficient (and cheaper) to produce content with high visual quality, and as on-demand viewing rearranges viewers’ consumption patterns, it is becoming harder to identify the source of content.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

As if that matters.

When “Fox Now,” a revised streaming app from Fox Networks Group, debuted last month, it blended content from the Fox broadcast network, FX and the National Geographic Channel; shows from Fox Sports are expected to be added this Spring. Lachlan Murdoch, executive chairman of 21st Century Fox, pointed out that the video app with multiple network programs makes it a more effective advertising vehicle.

Networks and stations struggle to establish and maintain brand identity. But the unification of content on screens—both fixed in-home displays and portable devices—is erasing such status.

“We’ve now completely pivoted to a couple key principles, one of which is [that] we’re going to give the customer the best interface, and we’re going to do it with the content they want,” Comcast CEO Brian Roberts said at a Morgan Stanley Technology, Media & Telecom conference last month. By making online content available through the X1 set-top box, Roberts intends to become “an aggregator of aggregators,” carrying content that “at times is competitive.”

“Our strategy is to get most of our customers in a bundle,” he said. “Every time people take one more product, they churn less.”

To promote the integration, Comcast ran in introductory sampling in early April. Xfinity X1 customers had unlimited access to Netflix’s entire U.S. catalog for a week, including original series such as “House of Cards,” “Stranger Things” and “Orange Is the New Black.”

GOING GLOBAL

The melding of online and broadcast content also has a foreign flavor. For example, BritBox—a $6.99 per month online, ad-free subscription VOD package of BBC and ITV programs—debuted in the U.S. last month. The online service streams selected British soap operas and other shows within 24 hours of their U.K. broadcast premiere airings.

BritBox also includes libraries of classic content (much of already seen via PBS and other U.S. channels), such as “Prime Suspect,” “Absolutely Fabulous,” “Sherlock Holmes,” “Brideshead Revisited,” “Agatha Christies’ Poirot: The Early Cases,” and “Miss Marple.” There is also “Very British Beginnings,” a smörgåsbord of shows featuring young performers who went on to become stars, such as Emily Blunt, Daniel Craig and James Corden.

BritBox executives acknowledged that its direct-to-consumer launch is the first step toward integration with other distribution channels, such as Amazon Channels and ventures such as Comcast’s X1 aggregation of OTT and SVOD services.

Amazon Channels, which debuted barely 18 months ago, exemplifies the blur between streaming and conventional video content. An option for Amazon Prime customers, Amazon Channels now carries about 100 SVOD services, including HBO and Cinemax. Although Amazon has not released usage data for Channels, the company claims it has “millions” of Prime video subscribers.

Michael Paull, vice president of digital video at Amazon, called Channels “a validation of this platform idea,” adding that it gives consumers “one simple integrated experience” that doesn’t require subscribers to jump among apps, according to a published report. He called it an “evolution of the TV space.”

ADDING MOBILITY

Perhaps the most challenging aspect of the integrated broadcast/online programming juggernaut is the role of mobile. Access via portable handsets is a linchpin of the ATSC 3.0 initiative, recognizing the growing role of mobile video.

Several recent reports underscore that viewers—especially millennials—rely on mobile access. The latest Ooyala Global Video Index report found that mobile viewing accounts for 54 percent of global video plays, up from 46 percent a year earlier. (In North America, mobile viewing is barely 50 percent, far less than in Europe and the Middle East.)

“Where online content once was seen as supplemental to traditional TV, it’s now replacing it,” according to Ooyala, a Silicon Valley-based provider of media analytics technology. It also observes that advertising is shifting. Ooyala expects that marketers will spend $114 billion on mobile advertising in 2018—well behind, but catching up with the $215 billion spent on TV advertising.

“Mobile video—in one form or another—will continue to grow as younger users who have been tethered to their mobile devices since birth continue to play a larger role in the ecosystem,” the report says. The report singles out the success of smartphone viewing, which accounts for 47 percent of time spent watching videos in the youth demographic—mostly “long-form” content rather than “snackable” short-form videos.

Again, that finding suggests both a challenge and an opportunity for broadcasters, who intend to transmit content via their forthcoming ATSC 3.0 capabilities.

Gary Arlen is president of Arlen Communications LLC, a research and consulting firm. He can be reached atinfo@arlencommunications.com.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.