The Times They Are ‘A-Changin’

Bob Dylan made the phrase famous, but the Emmys in 2017 were a testament to the evolving palate of a new generation of viewers tapping streamed content and not tuning into traditional broadcast TV. The transition in programming to streaming content providers is rocking the TV world.

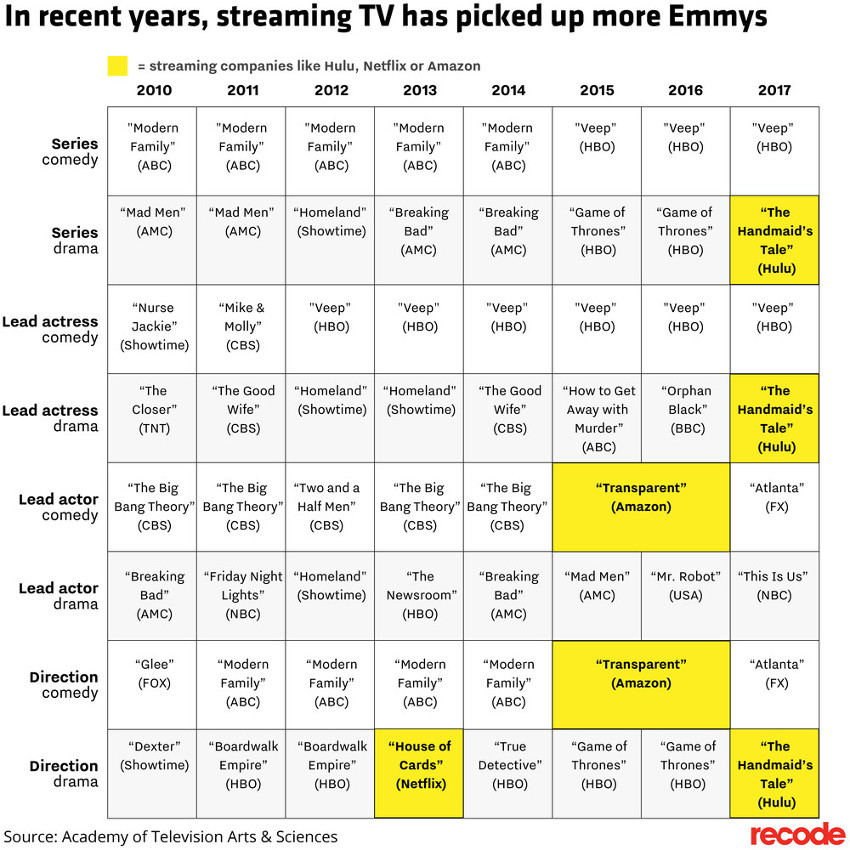

The four major networks were conspicuously snubbed by the awards this year: CBS with zero awards—ditto for Fox and ABC. NBC was the sole survivor from the Big Four, and won six (four of which went to “Saturday Night Live”, which by the way you can get streamed on multiple channels). HBO was the Emmy-winning leader with 10 awards, Hulu had five, Netflix had four, and FX had two. The night’s big headline-making winner was Hulu, which won an Emmy for the coveted Best Drama.

As a result, the Emmys appeared to amount to a prime-time promotional platform for subscriber-based content services.

Click on the Image to Enlarge

In total, streaming companies walked away with 32 Emmys this year. The frightening aspect here for television networks and traditional advertisers is the demographic and physiographic of Millennials, Gen Y and Gen Z viewers who are shifting to OTT and steamed content. The Emmys, to some degree, validate the shift and speaks to the broad viewing audience migration simply based on the quality of programming. And others can say this shift is a result of the poor quality of advertising. Marc Pritchard, chief brand officer at Procter & Gamble, recently said, “Bottom line, it is time for marketers and tech companies to solve the problem of annoying ads and make the ad experience better for consumers.”

Regardless, the trend started with viewers moving away from consuming broadcast TV at pre-scheduled times, in favor of on-demand viewing on digital platforms; so time-shifting isn't new, but it is now being refined and with a bonus of high-quality content. Programs that would have been dismissed because of limited audience appeal in some cases are now market leading content and “cord-cutting” technical alternatives—now easily available—compound the dynamic, and together these all result in an industry-wide tectonic shift.

What is going to happen to the $70 billion television advertising market, which is now sprouting cracks and threatening a breech, potentially washing away significant parts of a business model 70 years in the making? The shift could be disastrous for a multiplicity of jobs, and an industry built upon the brand supported media buy.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

EMMY NOMINATIONS A PROGNOSTICATOR?

Netflix, today an entertainment powerhouse, is close on the heels of HBO in delivering high-quality and consumer-validated content. The company nabbed a record 93 nominations for its original streaming content this year, nearly double the number of nods earned in 2016, and just 17 shy of HBO’s eye-popping 110. Noteworthy is that HBO is actually a subscription based, non-ad supported, streaming channel also distributed as part of a number of cable company packages.

In 2016, Netflix was third in overall nominations behind FX—a company which earned recognition largely on the strength of “Fargo” this year. Netflix hung out at the bottom of the nominee list in 2015, behind Fox, FX, NBC, CBS, and ABC, and has now blown by the competition as it pivots from a disk distributor.

Television network executives must also be concerned about more than the ad revenue eroding, as their brands are becoming diluted. Speaking when Emmy nominations were announced, Warren Littlefield, executive producer of “The Handmaid’s Tale,” said its recognition was “an acknowledgment of where streaming content is in the world.”

“We no longer say ‘networks,’ we talk about ‘platforms,’” he told Vanity Fair magazine. “Hulu gets to stand tall with not only offering classic television, but they’ve stood up to say: ‘We’re power players in original content.’” The ad buyers are most definitely having to rethink their decision paradigm and as they control the confidences of the brands.

ADVERTISING SHIFT GETTING CLEARER

Viewers have shifted to streaming services with a corresponding impact on television advertising. Media research firm eMarketer has cut its estimate for ad spending in the U.S., and is forecasting growth in 2017 of just 0.5 percent to $71.65 billion, $1 billion less than the forecast in January 2017. The firm estimates TV’s share of total media ad spending in the U.S. to plummet to 34.9 percent in 2017 from 36.6 percent in 2016, and is forecast to slip below 30 percent by 2021.

Netflix, climbing the Emmy ladder and strategically playing the odds, is betting big against the big four networks, and its OTT streaming competition. The company has been practically doubling nomination count every year, while producing a mind-boggling 600 hours of original content and spending $6 billion a year to try and dominate revenue supporting the media wars.

More and more players are entering the market, as technology makes it easy to spin up a channel and the financial community has opened their wallets to take advantage of new streaming programming and the consumer demand. Earlier this year, Apple tapped two well-regarded television studio heads to lead its programming efforts. Apple has more than $1 billion budgeted for original programming content; Facebook wants its own version of “Scandal;” and Google is ready to spend up to $3 million per episode on a drama. The nouveau riche channel arrivals will make an already hypercompetitive industry even more ferocious. This year, there are expected to be more than 500 scripted TV shows, more than double the number six years ago.

TALENT FOLLOWS AWARDS

SVOD (streaming video on demand) talent has been shifting from traditional TV to streaming and exiting at an alarming rate. High-profile examples include Netflix poaching an ultra-successful producer from ABC, and Amazon luring away the creator of the blockbuster “The Walking Dead” series on AMC.

Netflix and Amazon—which have had longer records in original programming—with their wins on television’s biggest night, will enhance their standing in Hollywood’s creative community, where top talent tends to gravitate towards the channels and platforms that can offer the most potential for awards recognition.

ENTRY LEVEL COSTS NOT A FACTOR

There are some trends that could rescue the TV bundle, as the outsized pay-TV channel packages become increasingly endangered. Re-aggregation of content and the birth of virtual MVPDs is a trend spawned partially after “TV Everywhere” sacrificed the consumer experience and scattered content across hundreds of platforms and apps. Disaggregation caused by “TV Everywhere” apps had the unintended consequence of waking an anaesthetized consumer. Virtual MVPDs are now serving as the recreation of the cable bundle and at the same time creating a more accessible user experience for streaming media viewers. Welcome to the new world.

Rich Greenfield, analyst with BTIG Research, said Hulu’s Emmys success signaled an increasing pressure on the traditional “bundle” of channels sold by cable and satellite providers. “It illustrates how great content has never been cheaper and easier to access,” he said, pointing to new standalone streaming services such as HBO Now and the bundling of streaming services with telco packages. “You do not need the bundle to watch ‘The Handmaid’s Tale,’ ‘Big Little Lies,’ ‘The Crown,’ ‘Veep’ [or] ‘The Night Of.’ Hulu is only $7.99 a month, HBO is now a free giveaway via AT&T and Netflix is free via T-Mobile.”

IMBALANCE VERTIGO

The amount of money the major television networks spend on programming versus the streaming services providers is ridiculously disproportionate. The networks spend much larger sums in comparison, but are now collecting less and less of the recognition, i.e. Emmys. The streaming content creators are spending in comparison considerably less, yet racking up more and more of the awards.

The major television networks are not currently able to create addressable advertising through their traditional distribution. Technology advances are coming, but the adoption by these behemoth corporations and their vested engineering infrastructure slow the pace. The streaming service content creators and distributors will most certainly leverage addressable advertising, and in turn, ultimately demand higher CPMs for their viewers. The double dip is, they will do this while spending much less money on their programming too.

CALL TO ACTION

Major television networks will get their OTT counterpart offerings out there as quickly as possible, and with the brute force only they can deliver. The 2017 Emmy results merely clarified the other growing trends to motivate the level of change undoubtedly on the horizon. The big four will ultimately not be stripped of their dominance in ad spending dollars by the OTT and streaming upstarts.

Creating proprietary OTT and streaming content offerings create opportunities for television networks to re-assert their brands, and as the migration of television network’s profits move to their OTT services via addressable advertising.

NextGen TV (aka ATSC 3.0) will play a role for the TV networks to distribute IP streaming broadcast television and assert pristine quality broadcasts to second screens. By maintaining their high standards in the OTT streaming distribution world the television networks will assert their brand dominance and in doing so, will stand apart from the current numerous streaming offerings. Consumers still place far higher trust in the traditional TV broadcasters for quality programming and the time is now as this opportunity won’t last forever as viewers continue to immerse themselves in streaming programming choices from multiple sources.

Lastly a priority will certainly be preserving programming’s digital rights and to make the most out of addressable advertising. The competition is gaining on the big four, however, there are tools available to open the OTT streaming levies and put the pressure back on the usurpers dipping into the waters behind the $70 billion dam built by these industry leading titans. The trick will be to migrate a portion of the network’s current market share to streaming distribution without losing control, and pushing the ad revenue CPM, because only they can.

Mark M. Myslinski of OpenVideo Consulting is a 15-year veteran of the digital cable television industry combined with over 7 years recent experience in the streaming media industry. Mr. Myslinski can be reached atmmmyslinski@gmail.com.