The New TV Gatekeepers

OEMs have increasing influence over not just which shows are watched, but also which are even on deck to be considered in the first place.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

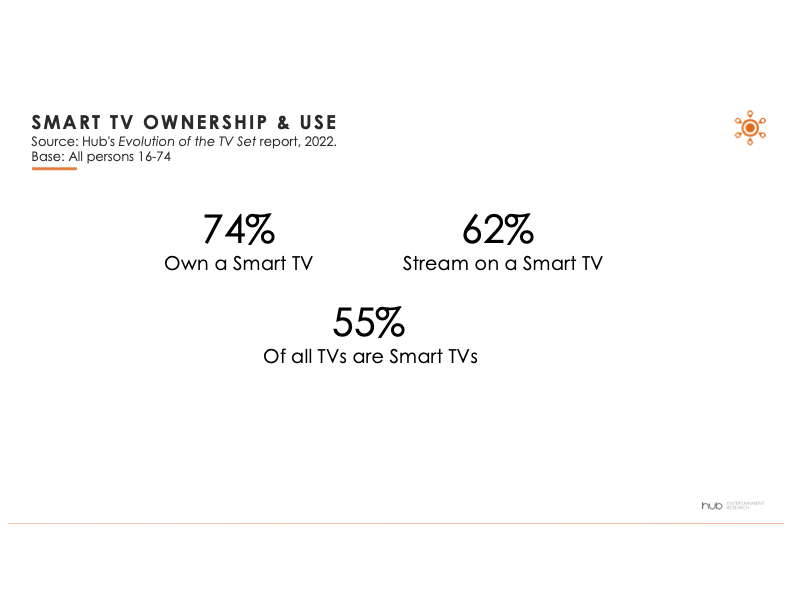

It should be no surprise to anyone interested in the M&E space that smart TVs are on an inexorable path to replacing analog and early digital TVs. In fact, today it’s hard to buy a TV of any size that doesn’t have smart capability. By count, smart TVs make up about 55% of all TV sets. Seventy-four percent of persons 16-74 say they have a smart TV in their home, while 62% say they regularly stream using an enabled (internet-connected) smart TV.

Emergence of the new gatekeepers

Just as important as the shift in viewing habits this represents is that homes viewing on enabled smart TVs, the OEM—through its platform/operating system (OS)—assumes the role of gatekeeper. The TV’s home screen will often be the first thing a viewer sees when turning on the TV set; the recommendations on that screen are powered by the OS, as is what is shown (and their order) for recently viewed titles.

Ads and promos for content are delivered by the OEM, presumably based on the viewing data taken from ACR measurements from the set, enhanced by marrying viewing information to matching household data from third parties based on the home’s email, router address, or other identifying features.

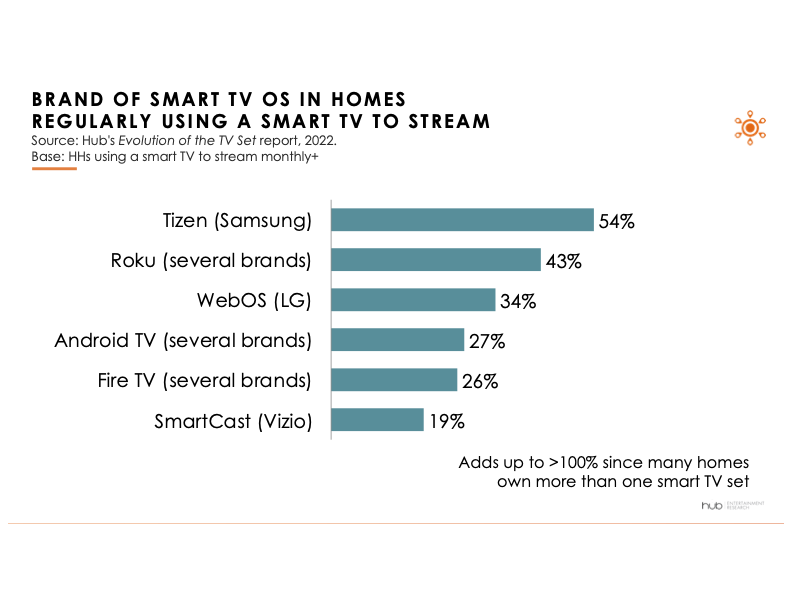

Let’s tune in a little more clearly to homes using a smart TV to regularly stream. In Hub’s recent “Evolution of the TV Set” survey, we asked these homes what operating systems their smart TVs have (or assigned the OS based on brand). While an imperfect measure, the estimate is still a good indicator of the relative size of each OS brand.

Homes that regularly stream with a smart TV report Samsung’s Tizen operating system is the most common smart TV OS, followed by Roku (used in several brands of TVs) and LG’s WebOS.

OEMs have a big and growing impact on which shows get watched

Today, the “stacking” of multiple video services, coupled with the sheer volume of shows being produced, means there’s even more clutter to cut through to find an audience. The smart TV platform/OS can have significant influence in how shows get found and watched.

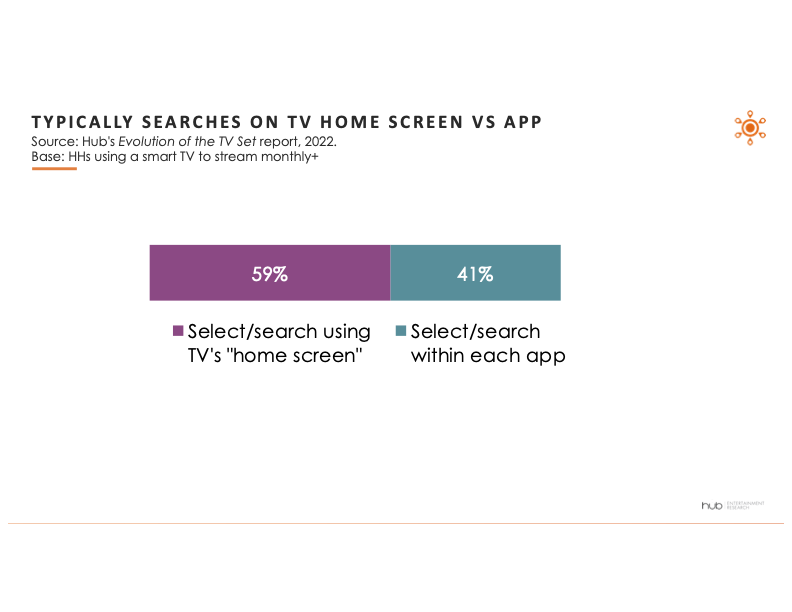

We asked smart TV streamers if, when deciding what to watch, do they typically search or take recommendations from the TV’s home screen, or do they search for content within individual apps?

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Six in ten (59%) of those who stream through a smart TV say they typically use the TV’s home screen to find shows. Only about 40% start searching with the app for an individual streaming service. This highlights the potential of the TV’s OS to influence what viewers discover and watch via recommendations, “last viewed” tiles, and promos for new shows (or simply whether a particular service is available on an OS or is “blacked out,” as in the bad old days of cable-network negotiations).

Not all OEMs have the same level of influence

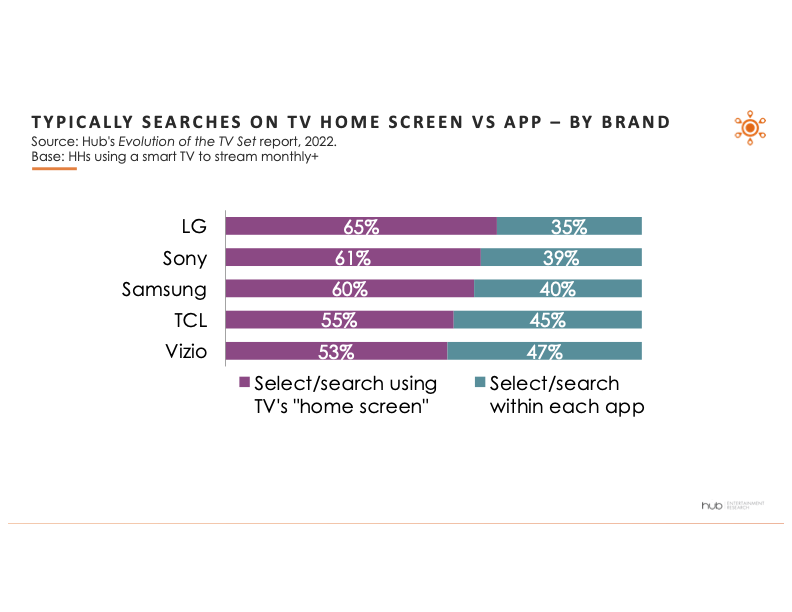

Even more interesting are how responses to this question differ depending on the brand of TV the person was watching. Again, keeping in mind the limits of survey research, it seems clear that there are some OEMs which are better at inserting themselves into the discovery process than others.

For instance, those using an LG set were almost a quarter more likely to say they used the TV’s home screen to make viewing decisions than people using a Vizio set (65% vs 53%).

Discovery, Decision, Delivery, and Data

Smart TV OEMs have quite an opportunity to leverage (as do those making streaming media players—devices we’re exploring in our next survey). OEMs have increasing influence over not just which shows are watched, but also which are even on deck to be considered in the first place. They also play an increasingly important role in the sale and delivery of digital advertising as well as the collection of viewing data via ACR.

The leading smart TV OEMs are already a critical part of CTV’s front-end viewing experience and back-end advertising and data business. Those trailing the leaders may need to make decisions whether to ditch their home-brewed platforms in favor of licensing an OS with considerably more mass.

Will we end up with a situation analogous to smartphones, where there are only two dominant players, iOS and Android? It seems unlikely, but it will probably take at least several more years for the market to play out.

David C. Tice is a senior consultant to Hub Entertainment Research and Principal of TiceVision LLC, a media research consultancy. For over 25 years, he has overseen syndicated and custom research projects for many media companies, media industry associations, and pro sports leagues.