TV Ad Spending Drops as Digital Surpasses Traditional in 2019

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

NEW YORK—For the first time, digital ad spending is expected to surpass traditional ad spending in the United States, according to the latest forecast from eMarketer.

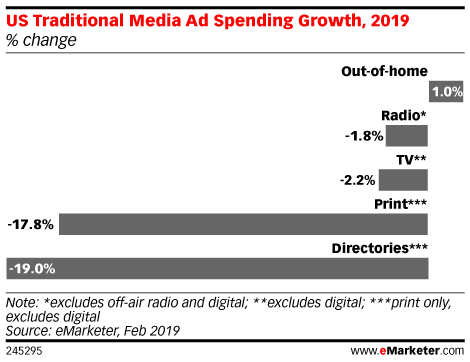

Nearly all forms of traditional ad spending will be in decline in 2019, including TV, which is expected to drop by 2.2 percent. That drop will bring TV’s ad spending revenue to $70.83 billion. One contributing factor is believed to be the lack of a major event like an election or the Olympics. The 2020 presidential election should propel TV ad spending back into the positive, but it is once again likely to again in following years.

Total digital ad spending in the U.S. for 2019 is projected to be $129.34 billion, which would represent a 19 percent growth and 54.2 percent of the estimated total U.S. ad spending. The most prominent form of digital ad spending will continue to be mobile, accounting for more than two-thirds of digital ad spending at $87.06 billion for 2019.

Also a first in eMarketer’s report, Google and Facebook’s combined share of revenue for digital ad spending will drop by less than a percentage total, but their revenue will still grow for the year. Amazon’s growth is the big contributor to that, as its U.S. ad business will grow more than 50 percent this year and its share of the U.S. digital ad market is estimated to grow to 8.8 percent.

As digital ads surge, practically all traditional forms of advertising are dropping (save for out-of-home). Overall, traditional ad spending will be down to a total of 45.8 percent from 51.4 percent in 2018, with the decline of directors (19 percent) and print sources (17.8 percent) the hardest hit. Down the road, eMarketer predicts that by 2023 digital will represent more than two-thirds of total media spending.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.