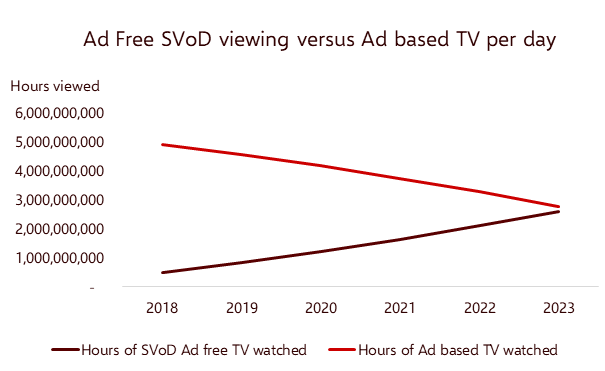

SVOD Viewing Hours to Equal Traditional TV by 2023

BRISTOL, England—Traditional broadcast’s days as king could be numbered. Projections in viewing hours per day by Rethink Technology Research’s Rethink TV service indicates that SVOD viewing is likely to match that of traditional broadcast across the globe by 2023.

In its report, “The Rise in SVOD Viewing to Swamp Traditional TV by 2023,” Rethink TV sees the 478 million subscribers of SVOD today to grow to 743 million over the next four years. It projects that China will have the most SVOD subscribers, but that North America will continue to drive the largest dollar volume. That group is expected to watch between 2-3 billion hours of ad free SVOD per day, while traditional ad-based TV will decline to similar numbers by that point.

The U.S. market, which combines paid SVOD and vMVPD services, is projected to grow from 146.5 million to 236.6 million during that time frame. Europe and Asia will be about even in SVOD revenue, but with prices in Europe much higher as Asia’s market features a large number of Advertising VOD streamers.

Chief among the subscribers in this projection is Netflix, which with an estimated 194 million SVOD subscribers globally by 2023 would make up 26 percent of total global subscribers. In the U.S., Netflix currently makes up 44 percent of subscriptions but is only expected to be 31 percent of increased U.S. subscription levels by 2023 as new streaming services like WarnerMedia and Disney+ are launched.

Netflix, Amazon and other U.S. services have a presence in Europe, but other local broadcasters and pure play SVOD players like Maxdome, Sky, Zatto and Rakuten TV will result in a more spread out distribution of users.

Elsewhere, China’s projected growth of 245 million subscribers will make up 72 percent of the Asia Pacific region, though average monthly spending for streaming will be just $2-$3. Latin America’s growth, meanwhile, is expected to be driven by one of either Netflix, America Movil’s Claro TV and Televisa’s Blim.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.