S&P: Disney's Charter Dispute Could Cost It $2.2B+ in Lost Annual Revenue

The “dispute has the potential to alter future carriage negotiations across the industry,” S&P’s Scott Robson concluded

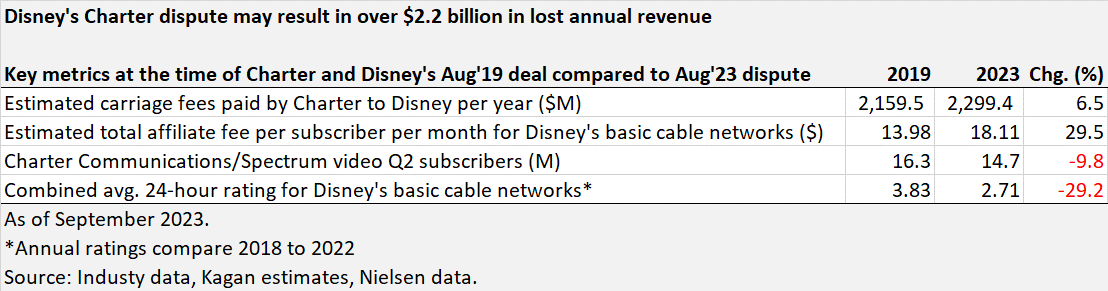

NEW YORK—A new analysis from S&P Global Market Intelligence suggests that the carriage dispute between Disney and Charter will be a costly one for Disney, which stands to lose more than $2.2 billion in annual revenue, and is likely to have a widespread impact across the industry.

Scott Robson, senior research analyst at S&P Global Market Intelligence noted that: "While we do believe that a deal will eventually be reached and Disney's channels will return to Charter's lineups, the impact of the dispute has the potential to alter future carriage negotiations across the industry."

"The carriage dispute between Charter and Disney highlights an industry undergoing a challenging transition from linear to streaming,” he wrote. “We estimate that Charter's carriage payment obligations to Disney are just under $2.3 billion in 2023. This has grown from an estimated $2.16 billion in 2019, when Charter and Disney last renewed their carriage agreement. Charter is paying a higher price for a product that is being used less by its subscribers. Combined ratings for the Disney-owned networks have fallen over 50% in the past decade from the peak in 2013 to 2022."

An analysis by S&P Global Market Intelligence's Ron Marcelo and Scott Robson, noted that “the rising popularity of streaming services has disrupted the traditional cable business and forced multichannel operators to evaluate the amount of money they are paying programmers for content. The dispute between industry titans Charter and Disney has the potential to change how the industry operates going forward. The rising cost of sports content has caused networks to pass off higher fees to operators, which have then passed them off to consumers. However, as cord-cutting continues to plague the industry, the cycle of rising fees is reaching a breaking point.”

Using S&P Global Intelligence’s 2023 basic cable network license fee estimates and first-quarter 2023 Media Census subscriber, the analysis estimates that “Charter's carriage payment obligations to Disney are just under $2.3 billion in 2023. This has grown from an estimated $2.16 billion in 2019, when Charter and Disney last renewed their carriage agreement.”

They also estimate that the price that Charter is paying for the 17 Disney-owned basic cable networks has grown at an average annual rate of 6.7% from 2019 to 2023, making the 2023 fees 29.6% higher than the 2019 fees.

“ESPN is the highest-priced network in our database at an estimated cost of $9.42 per subscriber per month,” they noted.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Meanwhile Disney has been shifting some content to its streaming services and ratings have declined at Disney’s 14 basic cable networks over the past decade by about 50%, forcing Charter to pay more for a product that its subscribers use less.

“The children's networks have seen the largest declines, with the flagship Disney Channel's average 24-hour rating of 0.15 in 2022 marking an 88.6% decline from 1.32 in 2013,” they wrote.

S&P Global Market Intelligence also estimates that “the US video market lost 6.4% of its subscribers in the second quarter of 2023 and that its video subs have fallen from 17.4 million in Q1 2015 to 14.7 million in Q2 2023.

“The carriage dispute between Charter and Disney highlights an industry undergoing a challenging transition from linear to streaming,” the S&P Global Market Intelligence analysis concluded. “While both companies are invested in making these relationships work, there are obvious pain points that might result in changes to the status quo. If Disney makes concessions on pricing, it has the potential for other programmers — such as Paramount Global and Warner Bros. Discovery Inc. — to lose negotiating leverage with operators moving forward and be forced to accept lower rates for the linear networks. On the flip side, if Charter agrees to Disney's demands, smaller operators might be put in a position to abandon video altogether as the margins no longer make sense. While we do believe that a deal will eventually be reached and Disney's channels will return to Charter's lineups, the impact of the dispute has the potential to alter future carriage negotiations across the industry.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.