Amazon, Peacock Lead in New U.S. Streaming Signups

Peacock accounted for 10% of new streaming signups in Q4, 2021 while Netflix’s penetration dropped below the two thirds mark, according to Kantar

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

LONDON—Newly released data for Q4 2021 from Kantar helps answer the question of who is winning the streaming wars as competition heats up in 2022.

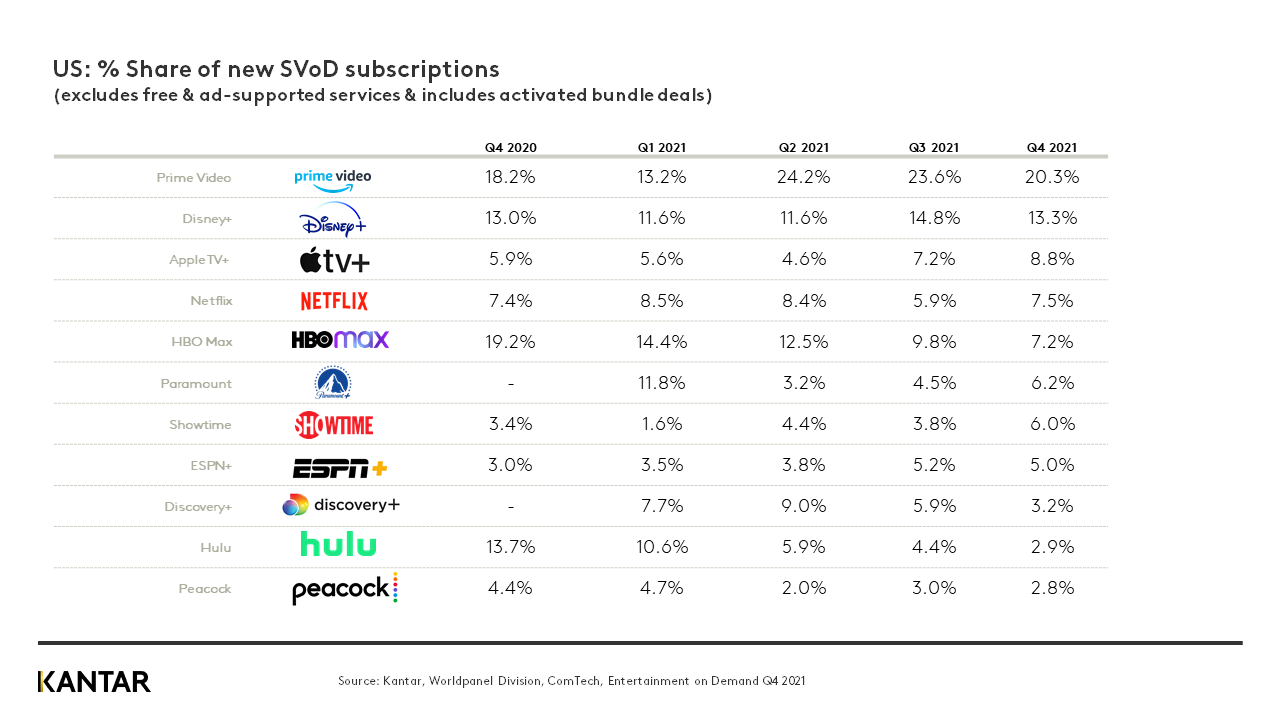

Its data showed that Amazon Prime Video and Peacock garnered the highest proportion of new streaming users in Q4 2021, with Amazon holding that the #1 position for the third quarter in a row and Peacock moving into the #2 position.

Overall Peacock had 10% of all new sign ups in Q4 2021, boosting its household penetration to 12% in Q4 2021, up from 9% in Q3 2021.

Peacock is still heavily reliant on its ad-based tiers to bring in new users, with 56% of new users coming in through FAST, 26% through AVOD, and 15% through SVOD, Kantar said. However, paid tiers are making up a higher proportion of overall streamers, with the free ad supported TV (FAST) share declining 6% points year over year. This indicates Peacock is finding success in its strategy of bringing in new users through FAST and trading them up to ad-supported on demand (AVOD) or SVOD tiers, Kantar reported.

The new data was less promising for Netflix, which has seen its stock hammered for slightly missing Q4 subscriber count targets. The Kantar data shows that Netflix’s subscriber base is now below two thirds of US subscribers, as its penetration declined compared to Q3 by 0.5 percentage points, despite the success of “Squid Games.” It has also seen a decline of 5 percentage points in penetration year over year, Kantar reported.

Overall, Kantar reported that the proportion of U.S. households who have a video subscription has risen to 85% (up two percentage points compared to Q3 and up two percentage points from Q4 2020). The growth came after two consecutive quarters of decline, boosting the number of U.S. homes with a SVOD service to 109.4 million in December 2021.

Kantar reported particularly fast growth in video streaming from free advertising supported TV (FAST) and advertising-based video on demand (AVOD) services, with the FAST services up 4.9 percentage points in penetration compared to Q3 2021, AVOD up 3.6 percentage points and SVOD up 1.8 percentage points compared to Q3.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

In Q4 2021, 18% of US households used a FAST service, doubling year over year when household penetration was 8% in Q4 ‘20, Kantar reported. FAST penetration is now nearly the size of AVOD, which has a household penetration of 24%.

Within FAST, Peacock, IMDB TV, Tubi, and Roku Channel account for the greatest share of new users in Q4 2021, collectively making up 79% of all new FAST users this quarter, Kantar reported.

Live streaming services also grew by 0.7% points and are now present in 10% of US households, Kantar said.

Amazon Prime Video is the #1 destination for new SVOD subscribers for the third consecutive quarter, but its share is down 4 percentage points from Q3 2021.

Stacking also continues to grow among current streamers, with the average household now using 4.7 services on average.

The issue of churn, however, remains a big one going into 2022.

The Kantar report noted that Q1 2022 “can expect to see more fluctuation of subscribers as stacking continues to grow and planned cancellation is up across the board.”

Average planned cancellation was up in Q4 2021 compared to Q3 2021, Kantar reported, adding that most significantly it was up for platforms that were reliant on a single title to bring in new users.

For example, after the success of “Ted Lasso” during both Q3 and Q4 2021, 19% of Apple TV+ users say they plan to cancel their subscription in Q1 2022.

Similarly, HBO Max, whose top content driving sign up in Q4 ’21 was Dune, has a planned cancellation rate of 7%, up 2% points from Q3.

While Peacock is doing well in overall sign-ups, the following data focusing on SVOD services and excluding ad-supported offerings paints a different picture.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.