Mobile video

The road to widespread consumer adoption of mobile video services has been winding, to say the least. However, faster networks, the proliferation of smart phones, explosive growth of tablet devices and the steadily increasing breadth of mobile video content are now driving rapid growth in the industry. This accelerating adoption of mobile video is creating a broader and more urgent need for mobile operators, TV service providers and movie studios to establish more cost-effective and scalable ways to manage, monetize and deliver content across multiple platforms.

According to IDC, 10.1 million media tablets were shipped worldwide in the fourth quarter of 2010. This is more than double the 4.5 million shipped worldwide in the previous quarter. The same report states that the U.S., Western Europe and Asia/Pacific (excluding Japan) regions accounted for 89 percent of all media tablet shipments in 4Q10. Tablets' larger screens coupled with improved services and increasing speed of mobile networks will play an important role in the expansion of mobile video adoption. In fact, a recent independent survey of mobile subscribers in the UK found that 61 percent of people are watching more video on their mobile devices than they did just one year ago.

While mobile operators and TV service providers are steadily expanding their offerings, as well as the promotion of these capabilities, the market for mobile video services is becoming more competitive. Nontraditional players are entering the market, and incumbent service providers are facing a number of technical and business challenges associated with delivering a differentiated high-quality mobile video service to consumers. These challenges include: achieving high-quality output; rapidly scaling content libraries and application features; efficiently and consistently encoding and delivering various types of high-quality content to numerous devices and platforms, with appropriate DRM; completing integrations across a variety of non-standards-based systems; and cost-effectively securing content license rights for the multitude of platforms.

Larger screen devices and consumer adoption

The introduction and massive adoption of tablet and larger-screened devices, combined with the availability of a greater variety of longer-form content and service features, have reset consumer expectations regarding the mobile video viewing experience. Previously, the limited availability of quality content and fewer multimedia-rich devices limited adoption of these services. Now, consumers expect a viewing experience similar to what they have at home on HDTV sets, with the added benefit of mobility. Yet according to an independent study conducted earlier this year, 57 percent of respondents said they were not using mobile video services due to cost concerns. This poses a challenge to both mobile and TV service providers: devise ways to offer high-quality premium video services to new platforms, while appropriately aligning costs with perceived value.

While TV service providers have done a great job providing quality HD content to their subscribers, they are now faced with trying to replicate that same experience across a variety of devices and platforms. With traditional broadcast formats, service providers have been able to work with an approved set of technical standards to assure the encryption and resolution meets approved OTA requirements. These don't exist in the mobile video world.

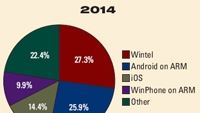

Mobile screen resolutions, operating systems (see Figure 1 on page 8) and feature sets are constantly in flux, making it nearly impossible to cost-effectively keep up with the transcoding, encryption and delivery of fresh, high-quality content. TV and mobile service providers must provide a secure environment for the delivery and consumption of content and ensure content provider license terms are met, after negotiating licenses for each platform and in some cases each device. TV service providers are learning that doing all of this in-house is extremely resource-intensive and costly due to the growing volume of content, the constant stream of new “hot” devices, formats and platforms. This will continue to challenge many mobile, cable and TV providers as they roll out and expand mobile video services. As these requirements grow more demanding, it will become more and more difficult to meet them with in-house solutions.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The acquisition, ingestion, encoding, digital rights management and administration of large content repositories are critical to the success of the delivery and management of content. Additionally, each piece of content that is delivered to a new device must be customized for quality and format specifications. For instance, video delivery for the iPad 2 will require an entirely new set of encoding and technical specifications from those for the iPhone. With so many new devices coming to market each week, it would be extremely costly and resource-intensive for content providers, mobile operators or TV/cable providers to handle this rapid evolution and scale their offerings.

IPTV booming

Many TV networks and cable providers are now offering IPTV services to customers, with options for subscribers to access content on a variety of devices (television sets, smart phones, tablets).

An IMS Research study released earlier this year indicated that the worldwide IPTV subscriber base will exceed 70 million by 2015, nearly double where it is today. Clearly, tablets are driving greater demand for flexible, “anywhere” video services. According to the report, a good percentage of this growth will occur in Western Europe and China. However, while these two markets will grow in terms of subscriber numbers, North American and Western European IPTV providers will still reap the most revenue, as the average revenue per user (ARPU) remains higher in these areas and the amount of content available to subscribers is greater. According to a recent report from IDC, the UK, France and Germany currently lead Western European markets in terms of total paid TV spending.

One major challenge for IPTV providers will be to capture new markets while protecting revenues within their own territories. For instance, services like Verizon FiOS in the United States and Orange in France have given consumers more choices when it comes to their IPTV services by expanding into geographic territories once owned exclusively by cable networks. In this new “boundary-free” world, providers will defend their territory by providing cost-effective, efficient, optimum-quality and highly scalable services. With competitors looming, a key differentiator for successful cable companies will be the mobile video services they can offer to their subscriber base bundled as an added value for their subscription. This model has the benefit of increasing subscriber loyalty and new subscriber take-up by providing consumers with more value for their money, in addition to offering opportunities for incremental advertising revenues as the audience grows.

Satellite operators with premium content have been early proponents of effectively offering content to consumers in the mobile arena. A good example of this is DirecTV in the United States, which has exclusive rights to all NFL games, or Sky Deutschland in the Netherlands, which offers a variety of original sports content. Both offer subscribers the option to watch games/matches and highlights on their mobile devices for free or for a marginal fee. This has provided them with an entry point by which to gain traction and credibility for these services with a subscriber base willing to pay for premium content. As subscribers increasingly consume video on connected portable devices over the next few years and move toward a mobile experience in the home, these content and TV/cable providers will have to embrace new models to support fledgling advertising and subscription revenues. Now is the time for them to prepare for this influx of mobile TV homes and scale their operations and services.

The challenges of expansion

The investment required for most service providers to offer these kinds of services is significant. In Western Europe, for instance, cable providers are focused on upgrading their customers to digital or broadband services — leaving little bandwidth to extend the upsell or deploy mobile video services. Additionally, these cable providers are heavily bound by distribution rights around content, which allows them to broadcast only over the STB. Sending this same content to mobile devices is not covered in their content license agreements.

China is one country fully ahead of the curve when it comes to the adoption of tablet devices and consumption of mobile video. According to a report from Morgan Stanley issued earlier this year, 41 percent of consumers surveyed in China expressed extreme interest in purchasing a tablet device this year, followed by the UK at 20 percent and 18 percent in Germany.

Many traditional TV service providers are also trying to navigate the change management associated with delivering mobile video. They are accustomed to having control over their own networks and determining when, where and how content is delivered. Now they have to put that trust into the hands of partners and mobile operators, creating a complete shift in thinking for proponents of a relatively stable and “safe” way of sharing content with subscribers. Content is now being pushed across multiple networks with varying amounts of bandwidth, requiring providers to figure out the best model to do this without compromising quality. Features like adaptive streaming from Apple have helped to resolve this issue on devices like the iPad, but solutions do not yet exist across all platforms and operating systems. As a result, it is necessary to work with outside companies that can offer these capabilities. Wi-Fi availability also helps to eliminate some of the bandwidth issues. TV providers will have to work more closely with mobile operators to understand delivery mechanisms and work to create a mutual agreement on best practices.

Technical challenges and costs

Another major challenge for all of these content and service providers is how to scale their mobile video services in an economic fashion. There are a number of costs associated with extending this business model, such as acquiring and ingesting large volumes of content, offering new services to new devices and securing digital rights — all of which will contribute to the additional monetization of existing content over the long term.

Mobilizing content enables service providers to reach their subscribers on their terms, driving “stickiness” and deepening relationships as television viewing evolves into a customer-driven experience. This does not require that all service components be managed “in house.” Networks and providers can choose to outsource the entire mobile entertainment service to a trusted vendor or to streamline and reduce costs by offloading resource-intensive processes such as content acquisition, ingestion and encoding — ensuring critical scale and quality assurance while maintaining control.

It is also critical that mobile operators and TV service providers are able to offer a fully integrated, branded entertainment experience for their customer base. By offering a bundled service with complete billing integration, they are able to utilize benefits that new entrants cannot easily duplicate. AT&T U-verse in the United States and Sky in the UK are two examples of providers that have done this successfully. This strategy helps to position a unique set of services to consumers while creating differentiation from competitors. It also enables these service providers to have a recognizable and sustainable business model over time.

Overall, while the challenges associated with ramping up mobile video services are plentiful, the potential upside with regard to increased customer loyalty, reduced churn and acquiring new customers from areas outside traditional network build-outs are significant for incumbent TV service providers. Through the intelligent use of technology solutions and services, it is possible for these providers to cost-effectively scale their offerings while ensuring a high-quality video experience and maintaining tight control over their customer relationships.

Mark Hyland, is vice president of sales and marketing at QuickPlay Media.