Will C-Band Survive the Latest Spectrum Grab?

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

ALEXANDRIA, VA.—As if the last “spectrum reallocation” and subsequent repack hasn’t provided enough drama, there’s another move afoot to further trim broadcasters’ operational resources. This one hasn’t received the notice that the big “reverse auction” commanded, but it has the potential to send TV, radio, and cable system operators scrambling, should the FCC (and wireless providers) have their way.

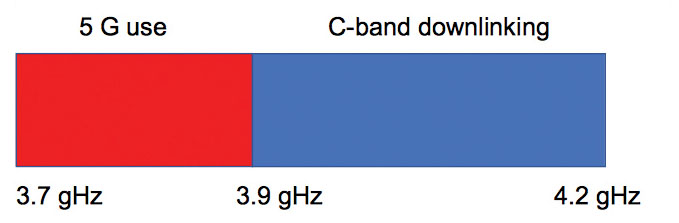

This time, the government has its sights on the 3.7 to 4.2 gHz block of C-band spectrum used by one-to-many satellite distribution of content, contending that it’s needed to build out 5G wireless networks.

A 2017 FCC “Notice of Inquiry” hinted at repurposing this spectrum chunk that’s seen heavy use during the past three decades or so, and the Washington wheels are grinding even faster and more noisily following a Notice of Proposed Rulemaking issued last year.

In that NPRM, the commission contended that this “mid-band spectrum is well-suited for next-gen wireless,” and suggested that some or all of the 3.7-4.2 gHz real estate be turned over to 5G developers. And if they get the whole enchilada, current C-band deliveries could migrate to Ku-band birds, fiber or even the internet.

PLENTY OF FEEDBACK

The FCC also urged C-band users to register their sites and to speak their minds about accommodating 5G. Response was good in both areas. Some 10,788 earth stations were added to the 3,800 that the FCC already knew about. And many players chimed in, including TV station groups and networks, wireless providers and even Google.

Some offered suggestions for easing the pain brought on by placing 5G ops in the band, while others called for restraint and moderation in any plans that might rock the C-band boat:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“The commission should proceed cautiously where it looks to make intensively utilized spectrum—as is the case in the C-band—available for new uses.” (Comcast/NBC Universal)

“…Commission action that repurposes spectrum in the C-band cannot undermine the existing, essential pipeline that relies upon the C-band to bring video content to American viewers. That pipeline must remain undisturbed, reliable, smooth and efficient.” ( Joint filing by the ABC Television Affiliates Association, CBS Television Network Affiliates Association, FBC Television Affiliates Association and NBC Television Affiliates)

“The record affirms that proposed changes to the C-band downlink spectrum… could significantly disrupt the television content distribution ecosystem to the detriment of more than 100 million U.S. television households, particularly if the Commission does not engage in a sufficiently transparent and robust review and oversight of any reallocation process.” (NCTA - The Internet & Television Association)

“Significant questions remain unanswered regarding how this distribution architecture can be protected while reallocating a portion of the C-band for mobile use, and the Commission should move forward in this proceeding only after those questions are fully and publicly addressed. Airy and unspecific commitments regarding the accommodation of current C-band users will not mollify American viewers and listeners when their favorite programming is interrupted.” (NAB)

The Church of Jesus Christ of Latter-day Saints—the single largest stakeholder in the fray, with nearly 3,500 registered C-band receive sites—was quite insistent about protecting its interests:

“Given the past investment in, and importance of, the C-Band to consumers and existing users, the Commission must reject proposals to intensify terrestrial use of the C-Band absent a robust record demonstrating that existing services will be protected from new, potentially-interfering services. Since the Commission first proposed altering and expanding the use of the C-Band, Comcast and others have posed numerous questions about how existing services will be protected. Yet, the administrative record remains largely devoid of detailed answers to those questions.”

The organization also voiced concern about expenses arising from changes.

“If a permanent solution to this issue requires the Church to limit its use of the C-band, the Church is open to discussing that solution. But fair is fair. If the Church is required to reconfigure its distribution network to ensure the availability of spectrum for other services, it should be reimbursed for the cost of that transition.”

C-BAND WORKAROUNDS

Among those entities promoting moderation in any C-band makeover, the CBand Alliance, a group of four satellite operating companies—Eutelsat, Intelsat, SES and Telesat—propose to allow 5G occupancy of the lower 200 MHz of the band, and accommodate current C-band services within the remaining 3.9 to 4.2 gHz chunk. (A 20 MHz guard band at the top of the 5G berth, along with the special installation filters on all TVROs would ensure interference-free operation.)

Based on comments received in putting this article together, there seems to be something of a consensus as to the workability of the CBA proposal, if indeed 5G has to become a bedfellow. One of those favoring band sharing is Sherrod Munday, a TV and radio consulting engineer who has been closely following the matter.

“I would say that the CBA has the largest amount of industry support,” said Munday. “A large number of players are behind it. The FCC’s proposition and public notices seem to give this a fair chance of success. If the CBA’s proposal to reallocate 200 MHz can happen without loss of service, this would go a long way to satisfy the [5G] requirement.”

Munday doesn’t really believe that the other suggested alternatives are realistic, given the need for the rock-solid delivery in all types of weather, and the difficulties and vulnerabilities that come with a fiber or internet solution.

“A Ku-band downlink is not always comparable to C-band,” said Munday. “Yes, it can be done, but reliability might suffer. And I’m not sure that I would be comfortable with internet program distribution either. You need an active backup. The internet is effectively non-controllable—not all outages can be routed around or fixed. If there’s a major attack on the internet, all bets are off. I would be much more comfortable with satellite for large-scale distribution.”

Munday added that while point-to-point fiber is highly reliable, the approach does not scale economically.

“Many telcos and organizations like the Broadband Access Coalition [an alliance of tech companies advocating the use of “white spaces” to provide broadband in rural areas] have said that there is not an economical model that makes sense for providing fiber to rural customers,” Munday added. “[For example], in the middle of Kansas, there’s no way to run fiber cost-effectively to a site. You’re looking at perhaps $20,000 per mile to run fiber to a rural location.”

Munday said that while fiber can replace satellite in major cities, it probably can’t be done economically. Google, for example, announced in 2016 that while they would continue to support existing fiber service, no further expansion was planned.

“If Google has backed out of their fiber distribution plan, what does that tell you about replacing C-band with fiber?” Munday asked.

John Joslin is director of sales and marketing for satellite company Dawnco, and has been involved in communications satellite endeavors for more than three decades. He noted that CBA says they’ve tested their concept and that it works.

“However, all C-band downlink users will have to obtain an LNB filter [a waveguide-type device that mounts just behind a dish’s LNB or low-noise block downconverter] and get it installed,” he said. “Right now, the FCC is authorizing the use of 3.65 gHz for WiMAX purposes, and this is very close to the satellite spectrum, which starts at 3.7 gHz. Use of LNB filters makes this possible.”

Joslin said such filters employed for this are based on new technologies and can provide some 45 dB of rejection.

“They allow you to have an interfering signal very close to your C-band satellite frequency and still have things work,” he said. “These newer designs should work to reject 5G interference.”

WILL THERE BE A HAPPY ENDING?

Even though Joslin praised the CBA’s approach, he admitted that there could be a small number of sites that may have issues. Others too, although trying to remain optimistic about a C-band/5G skirmish, also noted that the outcome might not be entirely favorable for satellite users. As expressed by one consultant, who asked not to be identified, but whose firm handles FCC matters for several very large broadcast and media groups:

“Syndicated programming has to get to the stations somehow, and they don’t truck videotapes around anymore. C-band is very reliable and remains the best option. However, you can register all of your downlink sites twice if you want to, but if they decide to take that spectrum, they will.

James E. O’Neal has more than 50 years of experience in the broadcast arena, serving for nearly 37 years as a television broadcast engineer and, following his retirement from that field in 2005, moving into journalism as technology editor for TV Technology for almost the next decade. He continues to provide content for this publication, as well as sister publication Radio World, and others. He authored the chapter on HF shortwave radio for the 11th Edition of the NAB Engineering Handbook, and serves as contributing editor of the IEEE’s Broadcast Technology publication, and as associate editor of the SMPTE Motion Imaging Journal. He is a SMPTE Life Fellow, and a member of the SBE and Life Senior Member of the IEEE.