S&P: Consumer Holiday Spending Will Drop This Year

After the surge in 2021, only 7% say they are planning to spend more in 2022 according to an S&P survey

NEW YORK—Consumer holiday spending is likely to slow this year, after a huge surge in pent-up demand and revenge spending, combined with pandemic-era government assistance programs, lifted spending through the 2021 holiday season, new data from S&P Global Market Intelligence finds.

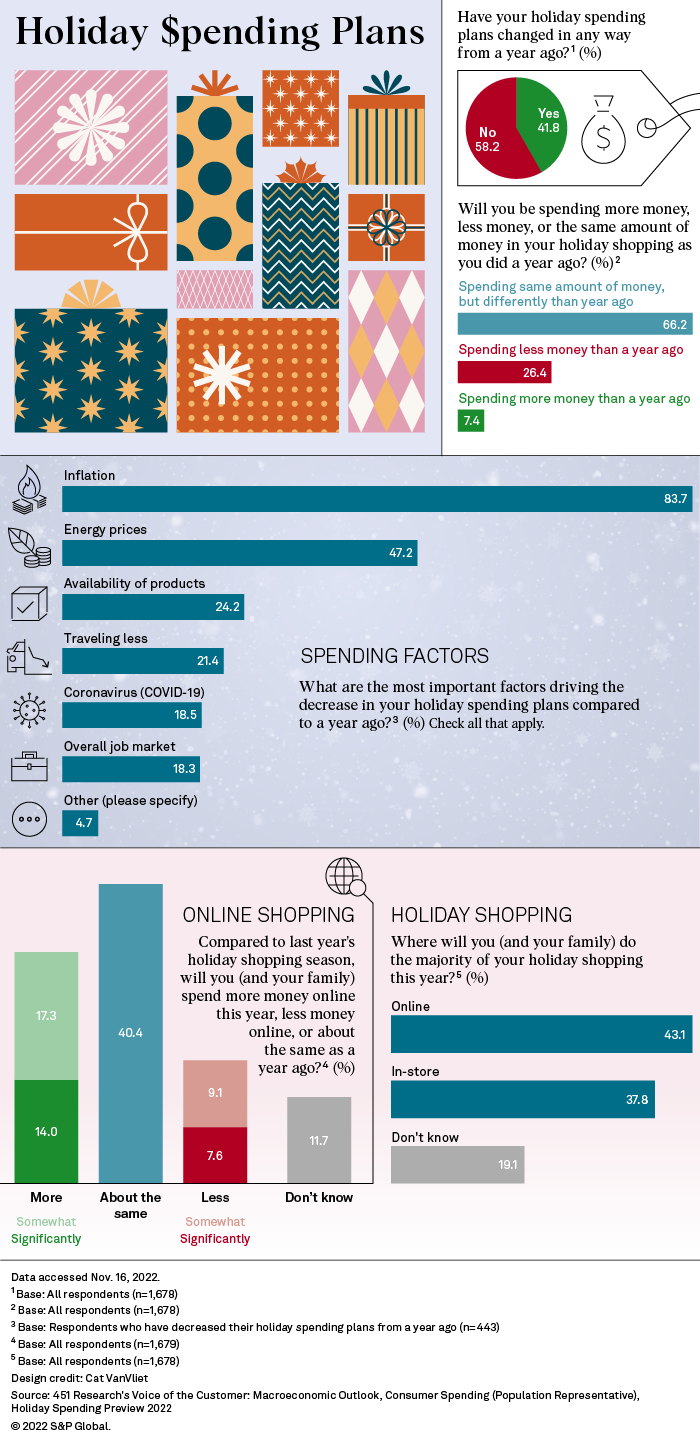

The S&P survey of 1,678 U.S. consumers found that 7% of respondents are planning to spend more for the holidays year over year, versus 26% saying they will spend less and 66% saying they will spend roughly the same amount.

S&P Global Market Intelligence's annual Macroeconomic Outlook: Consumer Spending, Holiday Spending Preview also shows a disparity between lower-income households (making less than $50K per year), and higher-income households that bring in more than $100K per year. Higher-income households (net +6) are showing a positive outlook while lower-income households (net -29) are showing a big pullback this holiday.

The survey reflects ongoing worries about the economy, which has in turn impacted TV and digital advertising.

The survey also highlights some bad news for broadcasters and media outlets dependent on retail advertising, with consumers saying they planning to shift more spending to online retailers like Amazon.

Key survey highlights include:

- Lower-income households hit hardest: An increased cost of living is affecting everyone, but it has a disproportionate impact on lower-income households.

- Respondents rank inflation and energy prices as the top economic threats to personal finances overall, with greater concern among lower-income households (57% said inflation, 33% energy prices) than higher-income ones (38% said inflation, 26% energy prices).

- To keep up with rising costs, lower-income households plan to increase spending on nondiscretionary items, with groceries, energy/utilities and housing taking the largest chunks of their budgets.

- To afford the rising cost of necessities, lower-income households plan to decrease spending on discretionary items, with travel/vacation, movie theaters and restaurants taking the biggest cuts.

- Higher-income households plan to increase spending on both non-discretionary and discretionary items.

- Importantly, nondiscretionary items take up less of their household budgets, allowing them to spend more on travel, restaurants, and consumer electronics, in addition to groceries and energy/utilities.

- Consumers plan more online shopping: The adoption of online shopping channels looks to continue this holiday season as 43% of respondents say it is their preferred way to shop.

- 31% of respondents indicate they plan to spend more online than in 2021, with Gen Z (52%) and Millennials (46%) leading the charge.

- 17% say they plan to spend more in-store. While Baby Boomers (22%) stand out as the most likely to return to in-store shopping, all other generational groups are hovering at 14%-15%, showing there is a consistent segment of consumers returning to in-store shopping that cuts across age groups.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.