Consumers Seek More Personalized Experience With Pay TV, OTT

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

ADDISON, Texas—The old Burger King slogan “Have it your way” could soon apply just as easily to the TV market as it once did for the fast food chain. Looking at the trends that will impact the pay-TV and OTT markets in 2020, Parks Associates revealed that consumers want more and more control of how, when and what they’re watching.

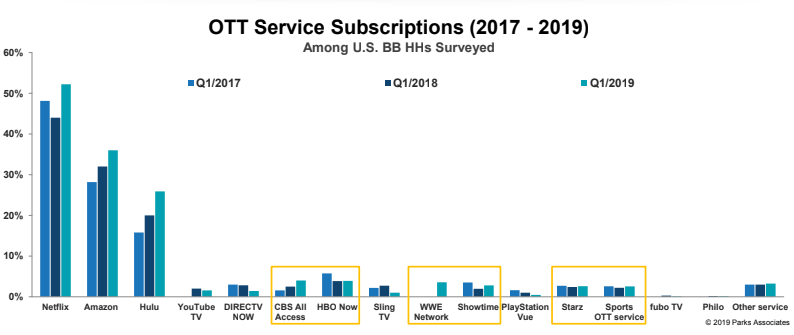

The rise of OTT streamers has been well documented as Netflix, Hulu and Amazon Prime have become three of the largest content producers in the TV industry. And soon they’ll be joined by new streaming services from Disney (Disney+), Apple (Apple TV+), NBCUniversal (Peacock) and WarnerMedia (HBO Max), offering massive resources for popular syndicated content and new original programming. However, there has also been a growth of what Parks Associates in the webinar called “the OTT middle class.”

This middle class of services includes more specific options like CBS All Access, Showtime, Starz, Acorn and sports OTT services. While their numbers are not anywhere near the big three, the rise in streaming options for more specific content allows users to personalize what they have access to and complementing other services.

Helping out with all these new options are aggregation platforms that allow users to find their subscriptions through a single device, like Roku or Amazon Fire.

Still, even between the big three and middle class options available, and the number of cord-cutters seeing a rise from 2018 to 2019, the number of OTT subscriptions has plateaued some. This could change as the new services like Disney+ and Apple TV+ hit the market, but it could also be a sign of over saturation, and rather than people continuing to add to their streaming subscriptions, they chose to drop one service or more in favor of another.

Pay-TV, meanwhile, is in part going with the mentality that if you can’t beat them, join them. While traditional pay-TV subscriptions continue to decline, many pay-TV providers are launching/developing their own OTT or alternative services. Comcast, for instance, has three services that offer different packages for consumers—XFinity TV is the traditional TV and internet bundle, XFinity Instant TV consists of the internet and a streaming TV skinny bundle and then there’s XFinity Flex, an equipment rental service for broadband customers only.

The search options, for both Pay-TV and OTT, are also striving for greater personalization. Using AI technology and saved search and recommendation features, these services are improving what content is most readily available based on past preferences. Things like voice control are also being incorporated to allow for easier and more detailed searches.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“The Pay-TV companies, having some struggles around the subscription issues, are really looking at maximizing their revenue and maximizing their engagement with their existing subscribers,” said Craig Leslie, senior analyst with Parks Associates. “One of the best ways to do that they found is really through creating better user experiences through personalization. This really drives created content consumption, translates longer viewing times, higher customer retention and increased revenues through more advertising and premium content sales.”

Other trends that Parks Associates highlighted focused on the technology that will be available to watch all this content. With many of these new functionalities and services that are available via Smart TVs, the idea seems to be trending making the TV not just the center of the entertainment world for families, but the center of their smart homes. Size and quality are also becoming more important, with Samsung launching its 292-inch “The Wall” TV monitor that is capable of 8K quality visuals and consumers beginning to demand that 4K and HDR as essentials.

To find out more about Parks Associates findings, listen to the full webinar on-demand.