NEW YORK—While the popularity of streaming content among consumers is transforming the way people access their favorite shows, it is important for marketers, TV stations and advertisers to understand that there are differences in streaming activity, especially at the local level, according to a new article from ratings service Nielsen.

The article, “Streaming: Friend or Foe to Local Markets” published in the Sept. 16 edition of Nielsen Newswire, examines research from the organization’s latest “Local Watch Report” on the streaming activity of U.S. adults.

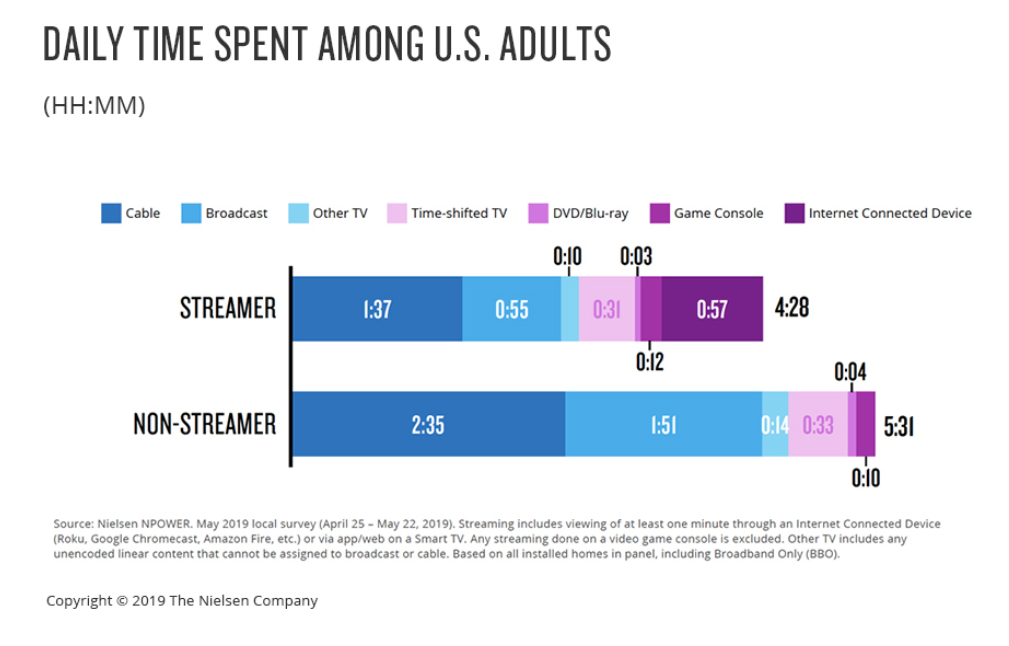

The piece puts streaming into perspective by comparing the time spent daily viewing non-linear content delivered over the top to that spent with linear TV, 57 minutes vs. two hours and 42 minutes.

Regardless of the difference, however, the article notes “there’s no denying the growing reach of streaming across the U.S.,” adding that the increase in streaming is uneven across regions and markets.

The article points to southern U.S. markets as an example. Over the past couple of years, device streaming device ownership in the south has outpaced all other regions.

Quoting Nielsen’s Q2 2019 “Streaming Meter Data Insights Report,” the article also notes that non-linear content from local stations accounts for 20% to 30% of all on-demand video streaming content.

The opportunity for local stations to leverage streaming is greater still, it notes. The linear content of local stations “is also increasingly being included in streams from vMVPDs (virtual multichannel video programming distributors)—and vMVPD adoption is rising.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The article points out that local stations in LPM (local people meter) markets have an opportunity to benefit from this adoption because households in these markets, which represent about half of all U.S. households, spend the greatest amount of time streaming non-linear content to their TVs—exceeding the national average.

The same is true for stations serving small and mid-sized markets measured by set meters, according to the piece.

While offering stations a reason to leverage this form of distribution for local content, the access to a streaming device doesn’t “always correlate with usage,” which the article points out is a “critical consideration” that local stations must weigh when deciding where to invest in digital.

The article concludes by pointing out that it’s easy to make assumptions and generalize about the fast-growing streaming market. But such assumptions, like the greater popularity of streaming among millennials versus older adults, aren’t necessarily true if looked at on a market-by-market basis.

Thus, if stations, advertisers and marketers are to capitalize on the opportunities presented by streaming, they need a better understanding of the market, particularly on local level, it concludes.

The article is available online.

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.