Ampere: Global Pay-TV Subscribers Grow 3M in Q2 2020

Emerging markets help to offset the loss in the U.S.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

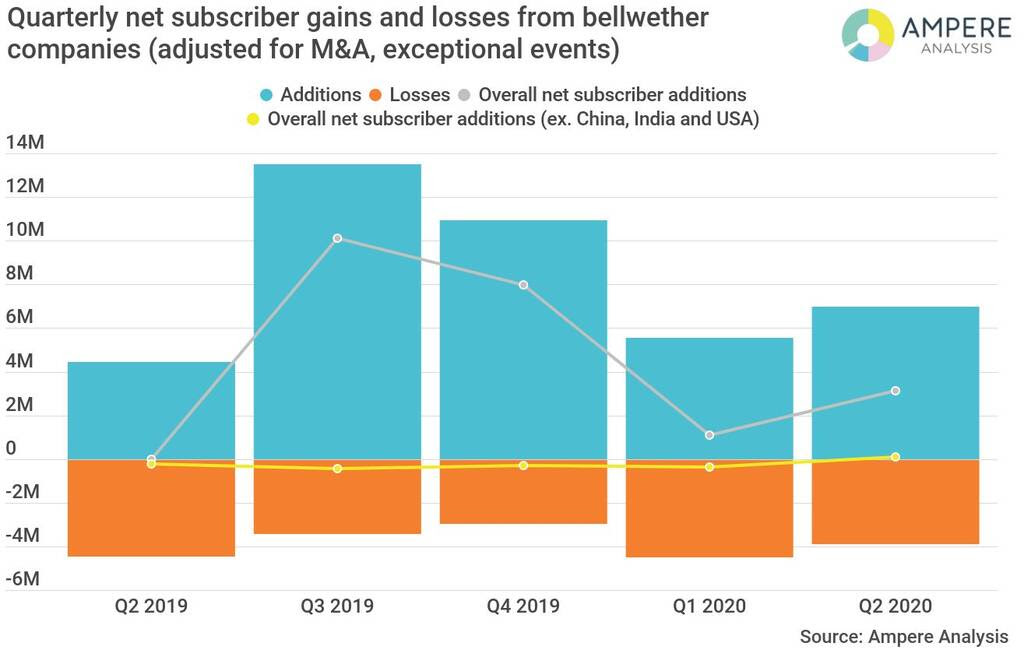

LONDON—While pay-TV has been experiencing historic lows in the U.S., the global pay-TV market shows that it’s not all doom and gloom. According to a new report from Ampere Analysis on the second quarter of 2020, bellwether pay-TV companies throughout the world added more than 3.1 million subscribers.

Ampere reported on more than 70 companies for the study. This bellwether group of companies accounts for more than half of the world’s 1.1 billion pay-TV subscribers.

Of the bellwether companies that reported to Ampere, 44% saw growth in Q2 2020, adding nearly 7 million subscribers. The remaining 56% saw a loss of 3.9 million subscribers, which brought the quarter to a net growth of 3.1 million subscribers.

The U.S. market led losses, with 1.4 million dropping their subscriptions across the bellwether companies, despite slight growths from Charter and Dish. China, on the other hand, saw the most net additions among its bellwether companies with a net gain of 3.1 million. The rest of the world’s bellwether pay-TV operators lost around 1.1 million net subscribers.

In comparison to the first quarter of 2020, Q2 total pay-TV subscriber totals were 0.5% higher, this despite the loss of premium content like live sports and other increased economic pressures due to the COVID-19 pandemic. However, if you were to remove the three most populous nations from Ampere’s report—China, India and the U.S.—that growth would only be 0.1%.

The losses in the U.S. have been an ongoing trend, with Ampere reporting that U.S. bellwether companies have lost 6.3 million net subscribers in the last four quarters.

Some other country notes shared by Ampere show that Canada experienced its second largest combined quarterly pay-TV subscriber loss in Q2 2020. This was offset by growths in France and Spain, which had their largest bellwether net additions in more than a year.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Proportionally, Ampere says that Australia was hit the hardest in Q2 2020, followed by Denmark, the U.S., Canada, Brazil and New Zealand all having posted losses. Spain had the largest percentage growth in Q2 2020, followed by Russia, Romania, India, China and France.

“While some countries are seeing pay-TV subscriptions suffer due to the COVID pandemic, particularly caused by the transient loss of sport, there is still growth in the market, driven partly by bundling of services and by emerging markets,” said Toby Holleran, senior analyst at Ampere. “Cord-cutters in a number of developed territories like Canada—whose pay-TV market continues to mirror its North American neighbor—are being replaced by newer TV customers in emerging markets, leaving the markets as a whole stable. But there is a little growth left even in some developed nations such as France and Spain, which are bucking the trend of stagnation in Western territories.”

For more information, visit www.ampereanalysis.com.