Google's New Platform May Upend iPhone

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The gritty, gloomy future in Ridley Scott's "Blade Runner" has to be one of the finest film depictions of dystopia. Two races, human and android, in all their morally ambiguous dementia, battle over an urbanized planet swathed in smog.

And sometimes over the past decade, the broadband environment has seemed similarly benighted.

Two providers, cable and DSL, have dominated the field, while multiple attempts at a viable third platform have all gone belly up. Meanwhile, broadband content, with the exception of YouTube, has seen very few revolutionary advances.

But the expected unveiling of a new generation of smartphones equipped with Google's Android software and linked to faster networks could herald a breathtaking sea change in our usage and definition of broadband.

DREAM ON

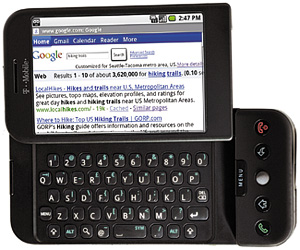

The first wave of Dream phones, manufactured by HTC Corp. and marketed by T-Mobile, have already received FCC approval, and launched late last month.

T-Mobile G1 powered by Google Android. Courtesy of T-Mobile USA Inc. These are the fruits of Google's mobile broadband strategy, which, under Google's Open Handset Alliance, has united cell manufacturers, chipmakers, and application developers in an effort to dethrone Apple's iPhone.

It hasn't all gone smoothly for Google.

Developers have complained about minimal support from the online search engine behemoth. And AT&T (which partners with competitor Apple), is lobbying the FCC to put the kibosh on the merger of Sprint and Clearwire assets to create the New Clearwire network (in which Google has invested a cool $500 million), expected to be a major carrier of Google's signals because of its newer WiMAX technology.

But the bottom line is that the phones are coming and are getting blog buzz to make Apple CEO Steve Jobs green with envy.

The global backdrop for mobile broadband growth also heralds rapid smartphone adoption.

Whereas the GSM Association, an industry group, counted only 11 million global HSPA (high speed packet access) subscribers over a year ago, research firm Wireless Intelligence says that figure is now more than 50 million and growing at the robust clip of four million a month.

With 3G networks deploying worldwide, the GSMA says end-user speeds are averaging 1 Mbps—on par with some fixed-line broadband services.

There are several other underlying dynamics that could well ignite mobile broadband in unpredictable ways over the coming months.

BIGGER AD PIE

First, fixed-line broadband is quickly maxing out. With DSL gamely hanging on to a smaller share, telcos will be spurred to accelerate their mobile sales—especially because of the potential for bountiful profits in data plans as subscribers increase their use of Web-friendly phones.

Indeed, such concerns were behind a recent brouhaha that erupted between Apple and its cell partners over Apple's share of data revenues, which Jobs quickly salved. Analysts say Google must also solve the revenue sharing equation, and recent reports of serious talks on the topic between Google and Verizon indicate their understanding of this conundrum.

Google executives say they have every incentive to partner, publicly declaring they can eventually generate more advertising revenues in mobile than in their fixed-line business.

While search advertising on U.S. cell phones generated a pittance of $35 million last year, according to research firm eMarketer, that is projected to rise to $1.5 billion by 2012.

That figure could easily escalate in the new mobile broadband environment. As In-Stat analyst Bill Hughes pointed out recently, the Android-equipped smartphones will be able to do location-aware searches, providing a major opportunity for Google to both influence user behavior and drive its advertising. It's not hard to image a plethora of ways users could tap into information tailored to their specific location.

COMPETITION—AT LAST

Second, the competition between mobile broadband platforms from Google, Apple, Research in Motion's BlackBerry, Nokia and others has been white-hot of late. Apple unveiled its faster iPhone in June, while BlackBerry has launched more Web-friendly devices. Nokia, meanwhile, in June acquired the 52 percent of mobile software platform Symbian it didn't own and announced the Symbian Foundation alliance including such cell powerhouses as Sony Ericsson, Samsung and LG.

Android's open platform allowing users to download applications to customize their phones will also catalyze application development and usage in unexpected ways. While it's difficult to say precisely what will be the next killer app—location-based search is only the most prominently predictable—a massive increase in apps overall surely boosts the chances for paradigm-shifting usage.

Finally, the evolution and proliferation of mobile broadband devices and platforms will accelerate in unforeseen ways. Mobile broadband-equipped cars, for example, could integrate far more than simple GPS-powered navigation systems.

All these factors, of course, ultimately boost the prospects of broadband video, which will surely permeate the new environments. Google's sizeable investment in YouTube, as well as its determined pursuit of digital advertising growth, ensures Android's future as a video platform.

Not to say this might all have a disturbingly dystopian ending, but for now the future of mobile broadband has never looked brighter.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.