Ad Slump Demolishes Broadband Also-Rans

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

It's yet another line that's been trending downward in recent months. Only this one has a direct bearing on the prospects of numerous broadband video ventures, and will directly dictate the shape of broadband video content in the short- and mid-term.

Internet ad revenues in the first quarter of 2009 dropped a hefty 5 percent from the same period last year, from $6.1 billion to $5.5

billion, according to an Interactive Advertising Bureau/PricewaterhouseCoopers report. Though nowhere near the double-digit slump of its print-based counterpart (which has wreaked its own havoc on traditional media), and despite Internet advertising's continued growth in share of overall ad spending, the decline in online ad dollars has throttled Web video business models.

RUNNING OUT OF JOOST

Not coincidentally, several such ventures have tanked—a shakeout predicted by pundits (including me) as the current recession loomed.

Two of the most prominent are Joost and Microsoft's Soapbox, and in their woeful tales can be perceived newer, harsher paradigms at work.

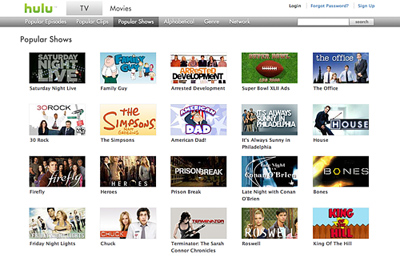

Joost, which launched in 2007, couldn't make a dent in a tightly competitive field. Its latest user numbers were abysmal, just over 600,000 visitors in May, compared to 76.5 million for Google's YouTube service and 8.2 million for runner-up Hulu, according to research firm Compete.

Joost announced last month it would shift to offering white label online video platforms to cable operators and other video providers, effectively ending it as a consumer brand.

Despite backing from the brains behind Web 1.0 darlings Skype and Kazaa, Joost was unable to secure high-quality content deals, à la Hulu, the Web child of NBC and Fox, or gain critical mass through cheap, addictive user-generated content (UGC) à la YouTube.

Joost's strategy flaws also included requiring a downloaded video player for its high-tech, peer-to-peer video-sharing technology, while the less-sophisticated Web-based players of rivals could be integrated into popular sites such as Facebook.

Ironic, because Joost was initially seen as a "YouTube killer" by the content companies that took stakes in a site they hoped would counter YouTube's piratical tendencies.

But what may have crippled Joost's business model most severely was the bottom line on its own ad revenues: it had to pass on a reported 70 percent to media conglomerate content suppliers, such as the major TV networks.

Microsoft, meanwhile, in yet another sign of its increasing irrelevance in broadband video, effectively shuttered its Web video platform, Soapbox. Launched in 2006, the same year Google purchased YouTube, Soapbox never effectively integrated its site with those of larger Microsoft communities (e.g. Xbox, MSN) to ramp up its user base, and was quickly eclipsed by YouTube.

AppleTV, another once-promising Web video star, has also faded—its consumer marketing has been nonexistent—and its repositioning appears imminent.

WE ALL STREAM FOR…

Other newer ventures, as well as older content suppliers still transitioning to the Web 2.0 environment, have had to make dramatic broadband video strategy shifts.

Case in point: a recent CBS News deal to simulcast its news content on uStream, an emerging YouTube rival that encourages user chat and other interactivity alongside its videos.

The deal reflects the breaking down of traditional walls, once erected by established powerhouses to protect their valuable content (or, more accurately, to protect the advertising that pays for such content).

Will Hulu survive the online ad slump? The trick for CBS and others will be to adjust the ad revenue matrix to keep uStream and other alternative online platforms afloat, while still garnering enough ad dollars to pay for expensive video production of news and other genres once destined solely for television.

This struggle reflects a deeper, widening schism, which is also reflected in the collision course of the two dominant providers: YouTube and Hulu. One relies predominantly on cheap UGC, and pushes the boundaries on privacy (eliciting periodic flare-ups with NBC Universal and other conglomerates), while the other draws viewers with high-end video formerly found only on television.

A Web 2.0 version of high- vs. low-culture wars? Hardly.

The more significant aspect of this struggle, for determining long-term business model health, is whether the major conglomerates behind Hulu can continue paying for high-quality shows as traditional TV ad revenues and Web revenues both slump, and highly coveted younger demographics continue their migration to other types of content, particularly mobile broadband.

How fast all broadband video sites and providers learn to collaborate with each other, and how effective their efforts are at developing addictive applications for social networking (such as live streaming on Facebook) or mobile broadband (such as uStream's popular iPhone app) will also play a major role in determining outcomes in this vastly complex, fast-moving environment.

Facebook's new Live Stream Box, for example, allows its users to log onto any third-party video site, such as one streaming a concert or other event, and sync back their comments to their own Facebook page in Twitter-like fashion. Even more recently, the social-networking site began integrating apps that allow users to stream video through their own page.

As Facebook attempts to morph its social-networking muscle into a full-fledged, on-demand video hub, even more futuristic apps are emerging on mobile broadband platforms, adding such technologies as GPS to the video mix. Imagine real-time tornado tracking, or ghost hunting, or the latest travel videos from your friends in Tierra del Fuego.

Now that could be something worth watching.

Will Workman is a former editor of telco industry publications Cable World and MediaView. He is now working on his Ph.D. in mass communications. He can be reached care of TV Technology.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.