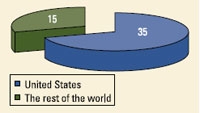

Automation is surprisingly alive and well considering how many companies exist. Latest estimates show 50 broadcast automation companies worldwide. (See Figure 1.)

Veteran broadcast automation companies have been successful in keeping their system technology current to stay competitive and desirable. Also, several companies have expanded their portfolio of products and now sell into other areas of the broadcast facility.

A 2007 study done by the European organization International Association of Broadcasting Manufacturers (IABM) shows the automation segment of the broadcast market is valued at $430.9 million (see Figure 2), which is about 4 percent of the total broadcast industry. The library management segment is valued at $106.5 million, which is about 1 percent of the total broadcast industry. The storage segment is valued at $1.57 trillion, or about 14 percent of the industry.

Worldwide, the broadcast industry is reportedly worth $11 billion. It continues to grow at a solid pace of 11 percent annually, especially in the Americas and Europe. Asia is growing as well, but its gross numbers are much lower. The library management segment shows the fastest growth.

Automation companies span a wide area of the broadcast market. Some companies overlap, providing solutions across various market segments.

Types of automation

Technology foundations for broadcast automation companies vary. The standard trend, however, is clear. Certain technologies are more popular than others, primarily broadcast automation types. The three main types of automation are:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

- Standard device control

- Video server and broadcast automation combo

- Hybrid device control and video server combo.

The trend is moving toward a hybrid system in which a video server and broadcast automation combo controls more third-party devices in software plug-in form, rather than controlling external hardware boxes.

Research shows that Microsoft Windows is the operating system used most by broadcast automation companies. Figure 3 shows the types of operating systems used by broadcast automation companies. The trend is moving toward Linux-based systems because companies are finding it to be a cost-effective alternative to Windows-based systems.

Pairing video servers with automation systems

Today, most major automation players now offer video server and broadcast automation combo systems. They are basically broadcast automation software running on video servers with advanced interfaces and device control for third-party equipment. These systems are usually made up of off-the-shelf broadcast-quality video cards and off-the-shelf disk drives for storage. High-end systems use industry video cards, transcoders and RAID sets. It's a trend that's here to stay.

What's the biggest factor? Cost. The smallest TV station markets are required to switch to DTV within the next two years. Broadcast automation companies can expect good sales in the entry-level of broadcast automation.

Some industry experts question the reliability of these systems. There are many risks with having so much master control on one system.

Industry watchers advise there should be more built-in redundancy within a single system and that external redundancy should be standard in all systems. Like any product, the broadcasters ultimately decide the level of redundancy they can afford and are comfortable with.

Branding automation

Branding automation companies are coming out with their own versions of master control automation. These systems integrate a graphics playout server, animations, live video, video clips, audio, real-time external data feeds and master control automation functionality. Normally, these systems are controlled by master control automation systems as a third-party device. Today, they are being used as standalone automation systems for controlling DTV channels.

Not all broadcast automation companies are BXF-compliant, but many vowed at NAB2007 that they would be compatible this year. Some advertising agencies have also become involved in the new standard. The jury is still out on whether or not they all accept the new standard. By involving the advertising agencies, interstitials can have unique identification codes that stay with the metadata from creation to playout to reconciliation and finally affidavit and billing.

The BXF standard

The new SMPTE (S22-10) standard is quickly being accepted by the broadcast automation community for the proper transfer of schedules and as-run logs between traffic and broadcast automation. For years, broadcast automation and traffic companies had to create a conversion application or traffic features to convert schedules and as-run logs to and from whatever traffic system they were working with. This created additional and unwanted costs to the broadcaster.

Asset management

Asset management systems have become the center of every media enterprise. To be successful, a solid asset management system should come complete with built-in transcoding features. Transcoding needs to be as transparent and cost-effective as possible. The system should also include a built-in source to a destination-intelligent management system to automatically transcode various video formats with ease.

There's money to be made by redistributing rich media assets, whether it be via new DTV channels, the Internet, IPTV or cell phone video. For the broadcast automation industry, the key is to cater to each department individually. From there, other departments can be added to the asset management system, and then wrapped together into one central enterprise-wide system. Resources, networks and storage do not need to be revamped. The infrastructure already exists. You're simply adding more capabilities to an existing system.

Fewer RU boxes, more software

A few automation companies are selling systems with broadcast hardware equipment capabilities. In previous years, manufacturers of broadcast hardware embedded their software code on chips. Now the tables have turned. Automation companies are including hardware functionality in their software systems.

Virtual master control

Hybrid and combo broadcast automation companies spur a new business model. New global broadband service providers manage the broadcasting aspects of distribution and delivery of all forms of digital content. These companies enable content creators and distributors to extend their digital media presence through physical and virtual production, broadcast and infrastructure facilities

Hybrid and combo broadcast automation companies provide virtual master control systems without the usual requirement of hardware found in today’s uplink facilities. These new service providers are targeting media and entertainment organizations worldwide.

Expanding systems

Some automation companies are expanding their software to integrate both the business side and automation side of a broadcast facility. Broadcast automation companies are now providing programming, sales, traffic, master control, asset management and billing applications. Most traffic/automation companies in the United States have separate software systems and databases. A closed loop, traffic interfaces or BXF is used for bidirectional communication between these applications.

Some automation companies are expanding their products to integrate the engineering side or the news and production side of the broadcast facility. This trend will continue as companies expand their product offerings. Automation companies look to expand because doing so supports and strengthens their business. Broadcasters like it because they get integrated products with centralized databases and automated streamlined workflows.

IPTV sales opportunities

Industry players think there are growth opportunities in the IPTV world as telcos roll out their DTV broadcasting services over telephone lines. IPTV may already have solutions for VOD services and pass-through channels, but many are developing their own network channels. Some of the issues IPTV is trying to solve are problems that have already been solved in the broadcast world. Even if IPTV is being driven by the IT/computer world, broadcast automation companies have opportunities in IPTV.

Third-party vendors

New third-party vendors are developing software plug-ins and add-ons for new business model automation systems. New plug-ins are being developed for services such as content verification, error tracking, fail-over tracking, compliance recording and also legacy third-party hardware products, such as routers, switchers and branding. Since these are software plug-ins, no additional hardware is required, keeping the cost low.

This change is a paradigm shift in how third-party vendors interact with broadcast automation systems. In the past, third-party vendors sold hardware systems that the automation company would control via Serial RS422 or RS232. Now, a third-party device is just a software plug-in. Many of the hybrid and combo broadcast automation companies sell their own third-party device plug-ins, but there is still plenty of room for third-party vendors to develop and sell plug-in options. Other areas could include branding features, switchers, routers and audio servers.

Automated workflow management

There are various types of automation systems within a broadcast facility. Traffic, master control, productions and news are good examples of areas that use automation systems. Each of these products have advanced to a point that a clear set of business rules can be implemented and configured to create a logical workflow for the successful completion of a goal.

Automated workflow management is either the successful completion of a goal across various departments or within an automation system. It includes three important levels:

- Day-to-day staff operations

- Operations monitoring, control and performance reporting

- Global reporting and statistics for upper management.

Adhering to and being compatible with SMPTE and industry standards will help tear down the walls between the various automation system silos. Standards implementation is key. Continuance of control level software development will also help bridge the gap between various automation systems. With IT infrastructures the norm in broadcast facilities, automation companies will be more open to interfacing with other broadcast facility automation systems at a horizontal or vertical level, depending on the workflow requirements.

Automation tomorrow

In the future, there will be an automated asset management system in which the ingesting and archiving of digital media will be fully automated. Master control will no longer be staffed. It will be monitored by traffic, engineering and production, depending on the situation. Spots and programming will come in from media delivery services in digital form and autopopulate the playout video servers or ingest video server. Metadata with spot and program lengths, segments lengths, titles and identification numbers will be automatically imported into the traffic system.

Hybrid automation systems will be the virtual master control of the future. Instead of various hardware components, there will be software plug-ins. Third-party vendors will already have the software for their hardware systems. It just a matter of redesigning it without the hardware. Instead of a router or switcher, they'll provide a software plug-in for the automation system.

Soon we will not be able to make a move unless the computer system says it's OK. Someday built-in intelligence added to monitoring and messaging systems will decide the best form of action for every request. In the broadcast industry, there is already built-in intelligence in traffic systems for plotting the highest paid commercials in the log schedule. Broadcasters use these systems to maximize the profit potential of any given time slot. The difference will be who or what is in control. Instead of applications controlling processes, these applications will soon control people.

Controlling the enterprise

Metadata is the key to everything broadcast. It's required at every level and in every aspect of the broadcast facility. The metadata has to be present, available, accurate and transportable from system to system, department to department, and vendor to vendor. That's our future.

Traffic departments will be in control of the master control room because year after year, the goal is to reduce manpower and to automate processes more. Someday the traffic department will be in full control of everything master control. Since traffic controls the metadata, who better to control the final product? Granted, there will be times when a live person will be needed in master control. This will probably be a dual role with either an engineer or a production person.

The bottom line

It's never easy to predict the future, but there are clear technology trends. Hardware is miniaturizing, and eventually, it will go away completely. Expect more company mergers and acquisitions. Companies with low-cost solutions will do well in the next few years as the final small market level of TV stations switch to DTV.

Smart broadcast automation companies are staying ahead of the curve and developing the next generation of automation products for new business models, such as virtual master control, IPTV, mobile phone, the Internet and DTV business. Expect to hear more about SOA methodology and monitoring and control systems.

Companies are riding the last of the automation business and should soon move toward alternative business models. Expanding your product line into new areas and working in new business model sectors is critical for increasing market share and staying in business after the big switch is over.

Sid Guel is a broadcast automation consultant.