More Ad Spending Heads To Second Screens

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Gary Arlen

While dozens of recent studies and forecasts tout the growing significance of second-screen viewing, a new white paper from Nielsen and the Association of National Advertisers gets quickly to the lifeblood of the television business: Advertising revenue.

The report’s message is that a transfusion is underway, siphoning—or redirecting— money from traditional broadcast budgets to multiscreen campaigns. It’ll be a quick process: barely three years for a more-than-doubling of multiscreen ad spending from today’s 20 percent to nearly 50 percent by 2016.

THE DECLINE OF THE TRADITIONAL TV SCREEN

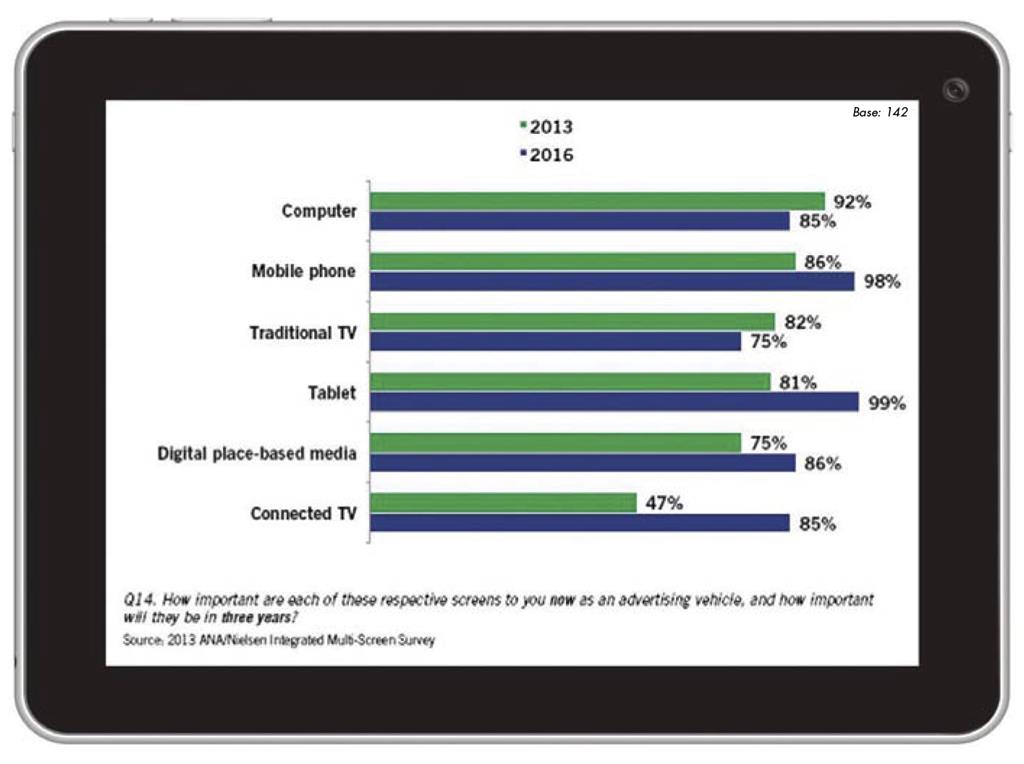

The report on “Optimizing Integrated Multi-Screen Campaigns” also delivers a strong message about “the importance of screens,” showing a continuing decline in the role of the “traditional TV” screen (see Fig. 1).

Whereas 82 percent of respondents (media sellers, marketers and ad agencies) rank TV sets as “very” or “somewhat important” today, that level drops to 75 percent by 2016 (see chart), putting it at the lowest level among the six types of “screens” ranked (computers, mobile phones, traditional TV, tablets, digital place-based media and connected TVs).

The ANA/Nielsen analysts point out the inconsistency of the expectations versus real-world performance. Specifically, the study notes that the mobile phone is today rated as the second most important screen (at 86 percent) as an advertising vehicle, “yet that rating is consistent with actual spending [on] mobile advertising.”

Fig. 1: The importance of screens today and in three years Such analyses may raise questions about respondents’ expectations that mobile phones and tablets will be “somewhat/ very important” in 2016—respectively 98 percent and 99 percent—as ad platforms.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

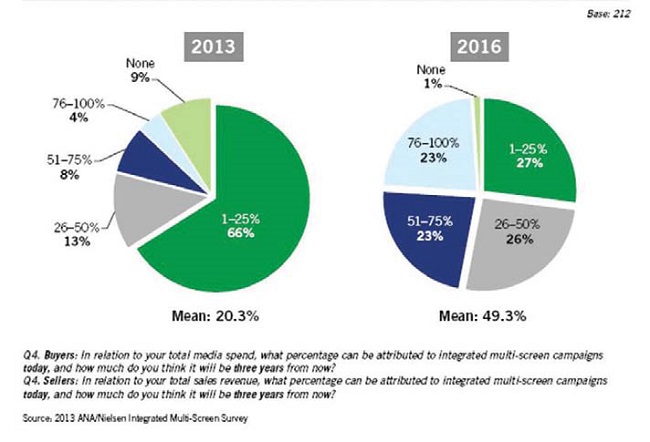

Nonetheless, the study’s fundamental finding indicates that the people who buy advertising will put their money where their mouths are (see Fig. 2). Nearly half of the respondents believe that multiplatform campaigns are “very important in delivery of marketing messages today,” according to Nielsen. And 88 percent predict that multiscreen campaigns will be very important in 2016.

Today about 12 percent of advertisers spend more than half their budgets on “integrated multiscreen campaigns.” By 2016, 46 percent of advertisers will devote that level of spending to multiscreen campaigns, according to the ANA/Nielsen study. (The spending ratio can be interpreted in several ways, such as the overall average spending devoted to multiplatform options: the mean level is 20.3 percent now, 49.3 percent in 2016).

SECOND-SCREEN ENGAGEMENT

Not surprisingly, Nielsen emphasized the importance of metrics on development of multiscreen advertising. Given its new relationship matching Twitter usage and TV viewing, the ratings firm pointed out that 73 percent of survey respondents would “prefer to use just one set of metrics across all screens.”

In particular, all categories of respondents consistently cited the need to determine if the advertising was delivered to the desired audience and whether such advertising produced the desired effect.

ANA President/CEO Bob Liodice used that finding to call for more cross-industry collaboration.

“An industry-wide initiative including trade associations and senior leaders from across the advertising ecosystem must be established to help foster standards and best practices for multiscreen campaign measurement and management,” Liodice said. “This would build on Making Measurement Make Sense (3MS), an industry-wide initiative to advance cross-platform comparability through improved digital advertising metrics and standards.”

Meanwhile, the enthusiasm about multiscreen marketing raised familiar questions about the distraction factor. A couple weeks after the ANA/Nielsen report surfaced, Eric Ferguson, Nielsen’s vice president of media client services, appeared in an online video interview, acknowledging that second-screen usage is both an enhancement and a distraction. But he emphasized that since 75 percent of TV viewers multitask at least once a month—using a tablet or smartphone while watching TV programming—that the human acceptance process is already in place.

Ferguson called the two-screen experience “engaging” and “highly complementary” for both program content and advertising. He cited a recent Nielsen study for Viggle, another second-screen developer, which found increased ad effectiveness during two-screen viewing.

“Results were very positive in favor of additional ad effectiveness among the dual exposed,” for both Viggle add-ons as well as basic video content, Ferguson explained. He also noted that “ad memorability” trickles down into other viewing measurements.

Ferguson also addressed the question of whether a double hit of advertising on two screens could turn off viewers.

“Additional frequency across platforms tends to benefit overall [ad] performance,” he said. “There’s a misperception that hitting people over the head with the same ad, the same brand, the same message [makes] people get sick of it and tune out.”

“That’s really not the case,” he continued. “More times than not, it enhances performance. We’ve found [on] both single platform and now across platforms… additional frequency tends to benefit performance, and hitting them over the head is not going to be a bad thing.”

EXPLOITING REAL TIME

Among the significant findings of the ANA/Nielsen research was the value of “real-time measures for optimization.” The study cautioned that the “decline in the perceived importance of traditional TV” is part of an online evolution. ANA/Nielsen’s evaluation points out the “almost universal interest” in having the TV industry adopt such online practices as “targeted/addressable advertising, behavior-based planning and real-time measurement.”

Fig. 2: Percentage of total media spend/sales attributed to integrated multiscreen campaigns

Although it was not mentioned in the study, some of these factors are part of the ATSC 3.0 agenda.

The study identified the ad formats “considered to be best-suited for integrated multiscreen advertising.”

“There is a strong interest in video as a platform, across multiple screens, and the opportunity for the use of video [will] grow,” the report concluded. “There are increased opportunities for branded entertainment and native advertising, as interest in content marketing is on the rise.”

ANA/Nielsen’s report cautioned that barely half of marketers believe that “standard TV commercials are best-suited for integrated multiscreen advertising opportunities” although media sellers and ad agencies overwhelmingly adhere to the value of standard commercial formats.

That finding alone may testify to the disparity in the multiscreen world ahead. Legacy providers like their traditional way of doing business—even as product manufacturers and audiences are quickly revising the ways in which they use television.

Gary Arlen is president of Arlen Communications LLC, a media/telcom research firm. He can be reached atGaryArlen@columnist.com.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.