DURHAM, N.H.—Broadband internet subscription growth was fairly flat for Q3 2022 as churn kept numbers down, however new fixed wireless services now on the market are helping to stem the bleeding, according to a new report from Leichtman Research Group.

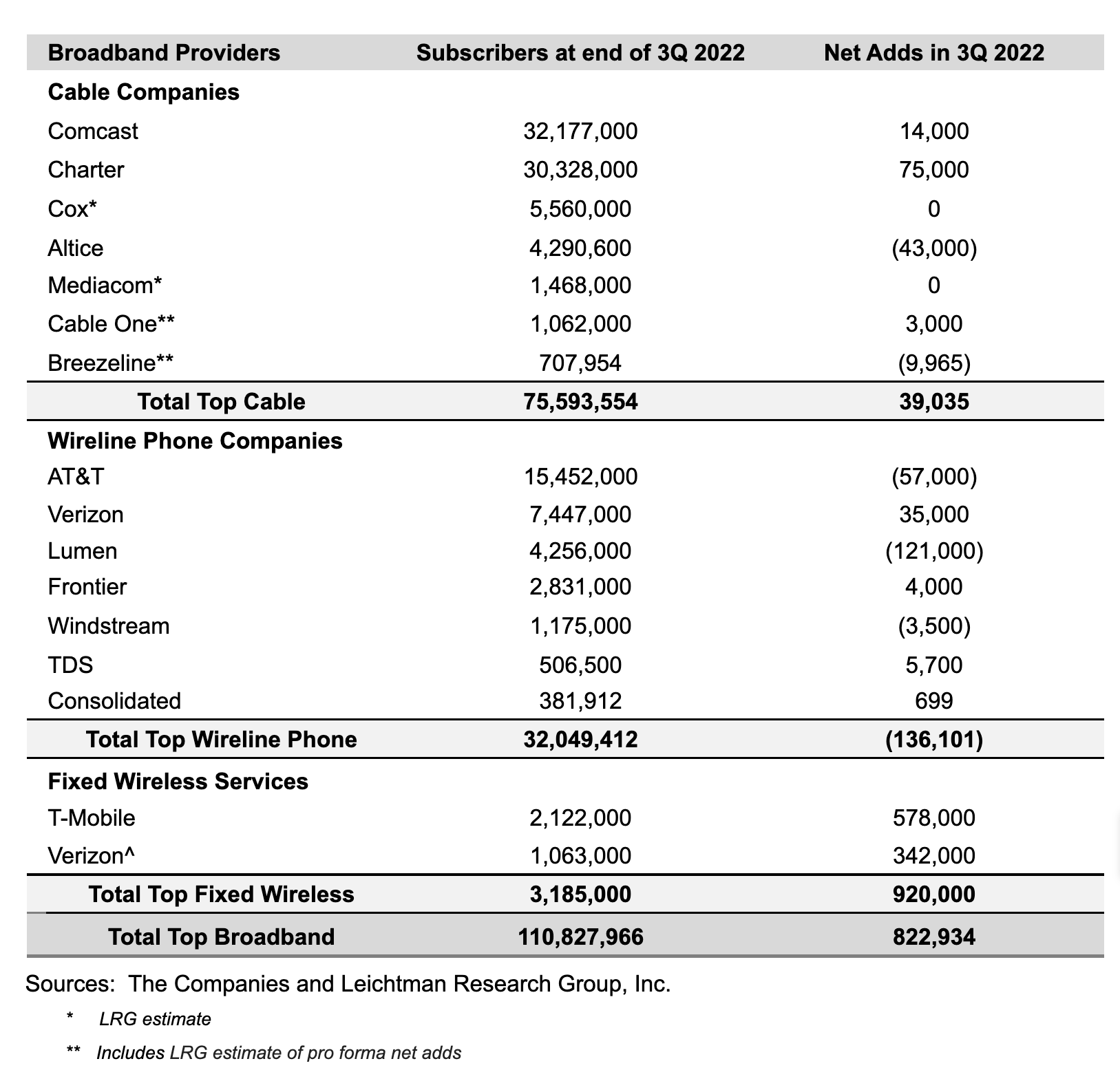

LRG found that the largest cable and wireline phone providers and fixed wireless services in the U.S.—representing about 96% of the market—acquired about 825,000 net additional broadband Internet subscribers in 3Q 2022, similar to a pro forma gain of about 820,000 subscribers in 3Q 2021. These top broadband providers account for about 110.8 million subscribers, with top cable companies having about 75.6 million broadband subscribers, top wireline phone companies having over 32 million subscribers, and top fixed wireless services having about 3.2 million subscribers.

Overall, LRG reports that broadband additions doubled in 3Q 2022, compared to 3Q 2021, with top cable companies adding about 40,000 subscribers in 3Q 2022—compared to about 590,000 net adds in 3Q 2021. The top wireline phone companies lost about 135,000 total broadband subscribers in 3Q 2022—compared to about 40,000 net adds in 3Q 2021 and wireline telcos had about 550,000 net adds via fiber in 3Q 2022, and about 685,000 non-fiber net losses.

As expected, the growth of fixed wireless/5G home internet services from T-Mobile and Verizon helped keep numbers up, as both companies more than tripled their subscriber count, adding about 920,000 subscribers in 3Q 2022, compared to about 190,000 net adds in 3Q 2021, LRG said.

“Top broadband providers added about 825,000 subscribers in 3Q 2022, including 920,000 net adds for fixed wireless services, along with a minor gain for cable, and net losses for wireline phone providers,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Over the past year, fixed wireless services have accounted for nearly 80% of the approximately 3,260,000 net broadband additions.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.