AUSTIN, Texas—Samsung continues to dominate the Advanced TV market, according to the new DSCC Quarterly Advanced TV Shipment and Forecast Report, which also forecasts Advanced TV revenues to see a 9% growth rate from 2019 to 2025 to $26 billion.

The report covers the worldwide premium TV market, including most Advanced TV technologies: WOLED, QD Display, QDEF, Dual Cell LCD and MiniLED with 4K and 8K resolution.

This report looks at current and future TV shipments and revenues by technology, region, brand, resolution and size, and forecasts the growth of all of these technologies. The report includes the preliminary shipment result for Q1 2020, a forecast by quarter for 2020 and an annual forecast to 2025.

Advanced TV is defined as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The historical data in the report allows analysis by feature for advanced LCD TVs, including:

- QDEF TV: TV using a Quantum Dot Enhancement Film; these TVs are sold as “QLED” by Samsung, TCL and others.

- MiniLED: LCD TVs with a MiniLED backlight, as sold by TCL starting in 2019.

- Dual Cell: LCD TVs employing dual-cell technology, as introduced by Hisense in 2019.

- LCD Others: this category includes LCD TVs with 8K resolution that do not fall in any other category.

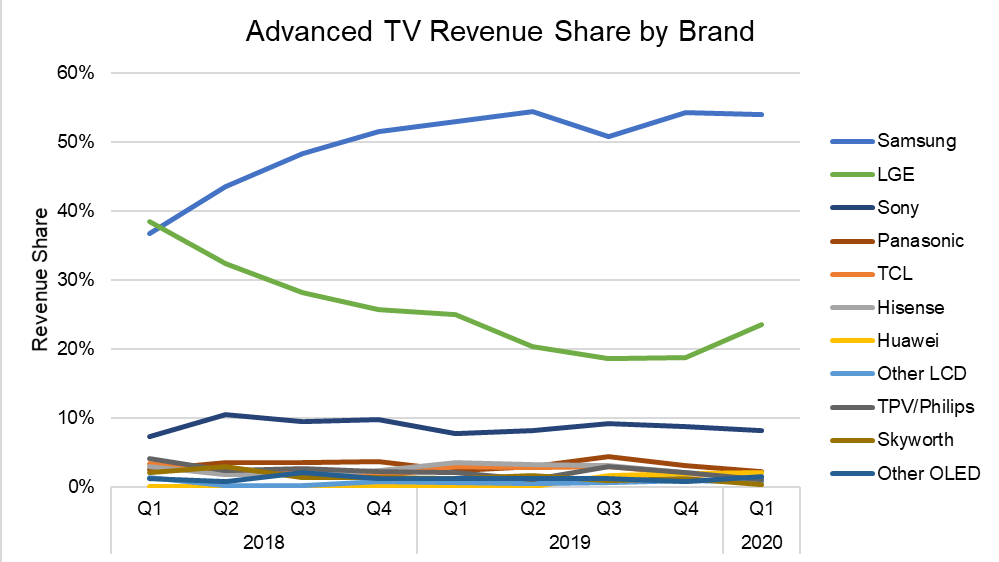

In Q1 2020, among all Advanced TV products, Samsung increased its revenue share to 54% from 53% in Q1 2019 by expanding its QDEF product line into more affordable models. LG held the no. 2 brand position in Q1 2020 with 24% revenue share, while Sony took the third spot with 8%.

The share battle in China has gotten increasingly intense, with four companies with double-digit percent market share. Samsung’s share of Advanced TV in China increased to an all-time high in Q1 with 42% unit and revenue share, whileHuawei has emerged as a major player in Advanced LCD TVs, capturing an 18% share in Q1. Hisense introduced OLED TV in 2019, but this did not prevent the company’s share from eroding to 14% in Q1. LGE fares poorly in China with less than a 5% share. Skyworth, once a major player with 24% share in Q2 2018, has seen its position diminish to only 3% share in Q1 2020.

While the COVID-19 impact will slow growth in Q2 2020 to 11% year-over-year (Y/Y), growth will resume in the second half of 2020 and Q4 unit growth will reach 27% Y/Y. Forty-eight-inch OLEDs will start in limited volumes, adding to the product mix for OLED, and LGD’s increasing OLED capacity will allow OLED to hold its unit share of Advanced TV and increase OLED’s revenue share. Across all technologies and sizes, DSCC expects Advanced TV unit shipments to increase by 30% in 2020 compared to 2019.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Long-term Advanced TV shipments are expected to grow from less than 10 million in 2019 to nearly 35 million in 2025, a 24% CAGR for that time period. OLED TV units are expected to grow at a 31% CAGR from 2019-2025 to 14.7 million units, while advanced LCD TV units are expected to grow at a 21% CAGR to 20.8 million units. The largest sizes will see the biggest growth, with growth in 75-inch-plus expected to be 36%, and growth in 75-inch-plus OLED even higher at 87% CAGR.

From a revenue standpoint, while the overall category will see revenue growth, OLED TV is expected to capture all the revenue growth in Advanced TV, as advanced LCD revenues are expected to be the same in 2025 compared to 2019. OLED TV revenues are expected to grow at a 19% CAGR from 2019-2025 to $16.2 billion. Advanced LCD TV revenues were $10.0 billion in 2019, are expected to peak at $11.1 billion in 2022-2023, then decline to $10.0 billion by 2025. Even larger size LCD TVs are not expected to have revenue growth as Samsung shifts its emphasis from its QLED LCD products to QD OLED.