Online Video Ad Spend Up 31% in Q1 2022

MediaRadar survey suggests that YouTube captured $482M of the $5.5B spent on online video ads in Q1 2022

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

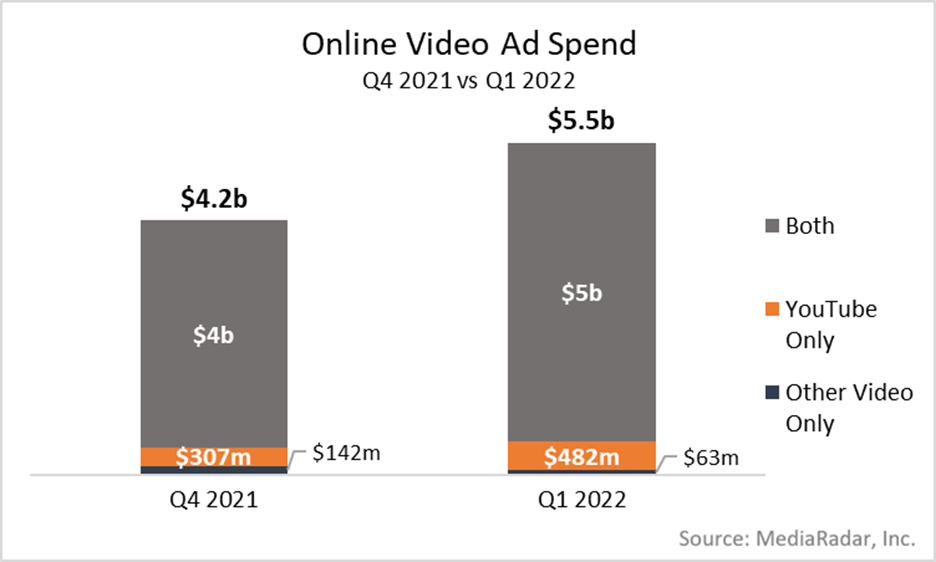

NEW YORK—The ad intelligence and sales platform MediaRadar has issued a new report that found YouTube captured nearly half a billion dollars ($482 million) of the $5.5 billion spent on online video ads in Q1 2022.

MediaRadar produced the analysis of where advertisers are spending their online video ad dollars based on a large sampling of online video advertising from traditional websites and YouTube.

Notably, this analysis doesn’t include streaming video platforms or social media, which are major contributors to the nearly $50 billion the IAB estimates will be spent on digital video advertising in 2022.

It found that $5.5 billion was invested in online video advertising in Q1 alone, with a 31% increase of advertisers spending across both YouTube and other video platforms compared to Q4 2021.

The online video ad spend for YouTube increased by an even larger amount by 57% from Q4 2021 to Q1 2022.

However, video Spend without YouTube spend was down 56% quarter to quarter.

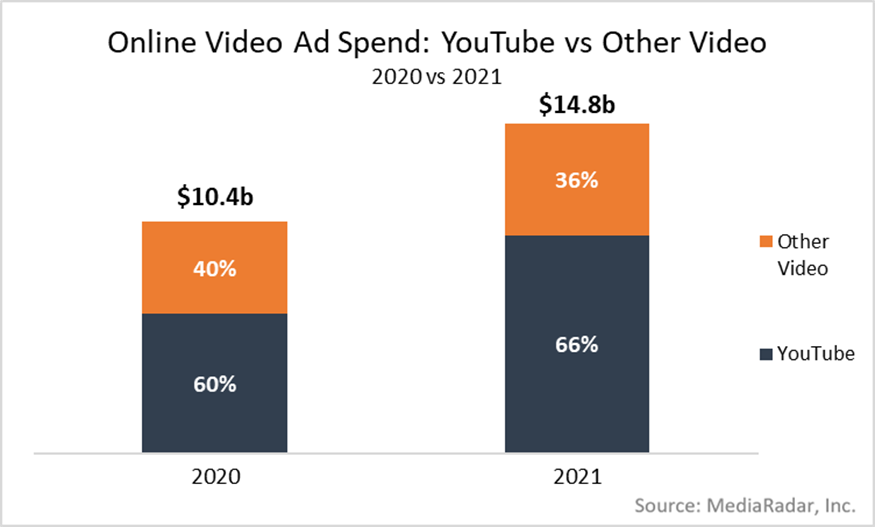

In 2021, according to the sample, online video ad investment grew 42% YoY from 2020 to over $14.8 billion.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Other key findings include:

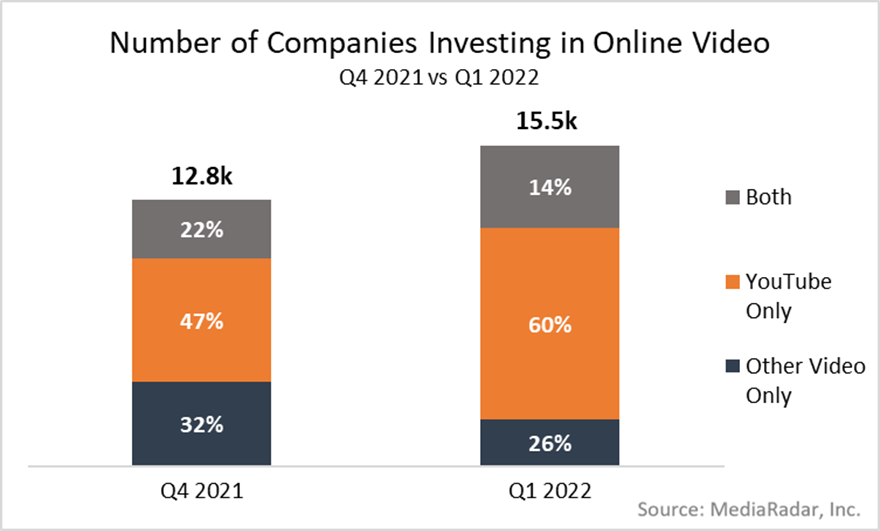

- The number of advertisers using online video increased in Q1 2022 by 21% QoQ.

- The number of advertisers only buying YouTube’s online video increased 55% QoQ Q1 2022 to over 9,000 companies.

- Companies advertising on both non-YouTube and YouTube increased as well 42% QoQ last quarter (nearly 4,000) from Q4 2021.

- However the number of advertisers that bought only non-YouTube video platforms decreased 45% QoQ in Q1 2022 compared to Q4 2021.

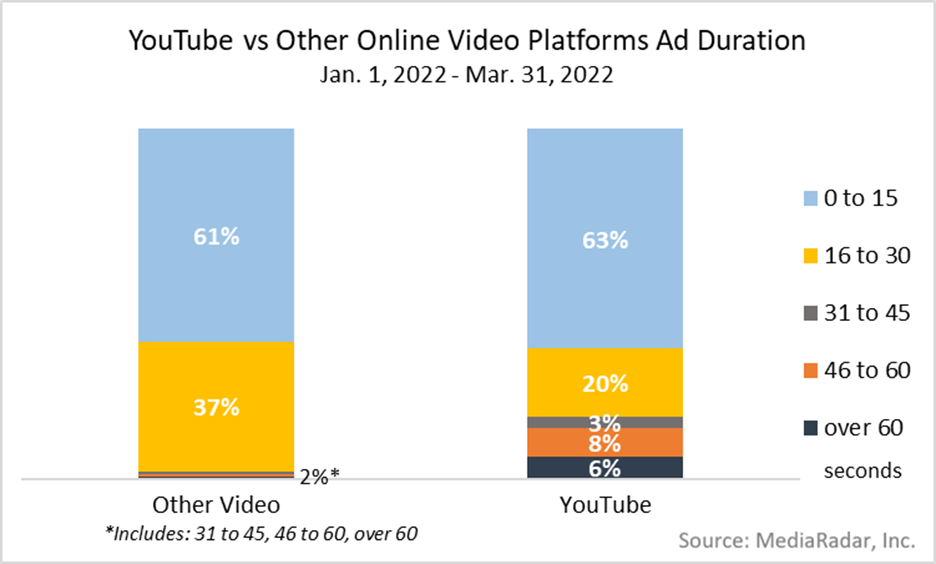

- In terms of the issues of ad duration, non-YouTube video platforms are leaning heavily into shorter ads that are 30 seconds and less. Those ads accounted for 98% of the ad load.

- YouTube also runs ads that are 30 seconds and less - 83%. However, the platform also had 11% of the ads from 31 to 60 seconds. There were 6% of ads longer than 60 seconds.

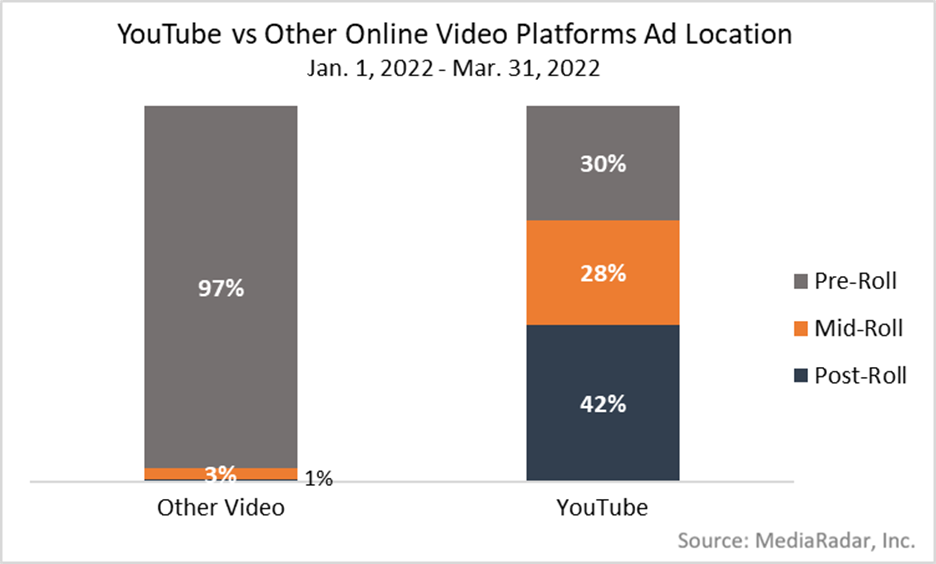

- Other video platforms rely heavily on pre-roll ad placement (97%) and that same strategy found in 2021. However, in Q1 2022 there’s a shift with adding a small amount of post-roll ads. (Full 2021: pre-roll (98%), mid-roll (2%)).

- YouTube saw post-roll receive the largest percentage of ads in Q1 2022 at 42%. Pre-roll followed at 30% and the remaining 28% were mid-roll ads.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.