IPTV Update: AT&T Launches U-verse

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Telco conquers technical hurdles, but faces battle for franchises

SAN ANTONIO

In late June, when AT&T began offering its IPTV service to a few hundred customers in San Antonio, it marked the technology's move from a "controlled market entry" phase to a more general service rollout.

In making its U-verse TV service commercially available, AT&T also detailed its pricing for the first time. The cable-type service is available at monthly rates of from $69 to $124 for broadband and a standard array of TV and cable channels, with the higher prices charged for faster Internet speeds and premium-channel packages. These prices include three set-top boxes, and $5 a month for each additional set-top box.

Customers who signed up during the first month received the service free for three months, with a one-time installation/training fee of $20 (regularly $95). The company also is offering a 30-day money back guarantee.

In announcing the expansion, initially to 5,000 new homes, AT&T plugged some of the advantages of its IPTV service, including faster channel switching than digital cable, picture-in-picture functionality, the ability to search for programs using the title or actors' names, and the ability to continue watching a program while searching through an interactive program guide.

AT&T said HD programming and DVR service will be available in October.

Because an IPTV system brings only the viewed channels into the home, with actual switching done in servers centrally located in AT&T's infrastructure, the U-verse system has the capacity to eventually offer a virtually unlimited library of VOD movies and programming.

The company also announced it would offer IPTV service in 15 to 20 additional markets by year-end, though the actual markets were not included in the announcement.

However, an earlier press release detailed the company's intention to build a fiber-to-the-premises network to deliver the U-verse service to a 20,000-home community near Houston. And a vote by the San Jose City Council recently denying AT&T permission to do a trial program in the city without signing a franchise agreement indicates the company's intent to roll out U-verse there.

FRANCHISE FRACAS

The San Jose franchise battle illustrates that though AT&T and other communication giants may be technically and financially capable of building new systems to compete with established cable and satellite services, there are upwards of 40,000 local franchising authorities standing in their way.

Each of these LFAs have cut their own deal with local cable operators, which can include a percentage of revenue, public education and government channels, and reportedly such services as upkeep of flower beds. Those telecom giants now entering the market have protested they cannot make the multibillion dollar investments in infrastructure if they must negotiate more than 40,000 separate agreements.

INITIAL INSIGHT

Toward that end, the telecom companies have lobbied to have a national franchise provision included in the U.S. House of Representatives version of the new telecommunications bill.

If such national franchising legislation fails to become law, there may be state-by-state relief. Just such a bill is winging its way through the California legislature.

(Verizon, building out its own hybrid-IPTV system in other markets, filed suit last month against one Maryland county for retarding its entry there.)

While AT&T declined to detail lessons learned during the San Antonio controlled market entry, the company said the initial test was valuable.

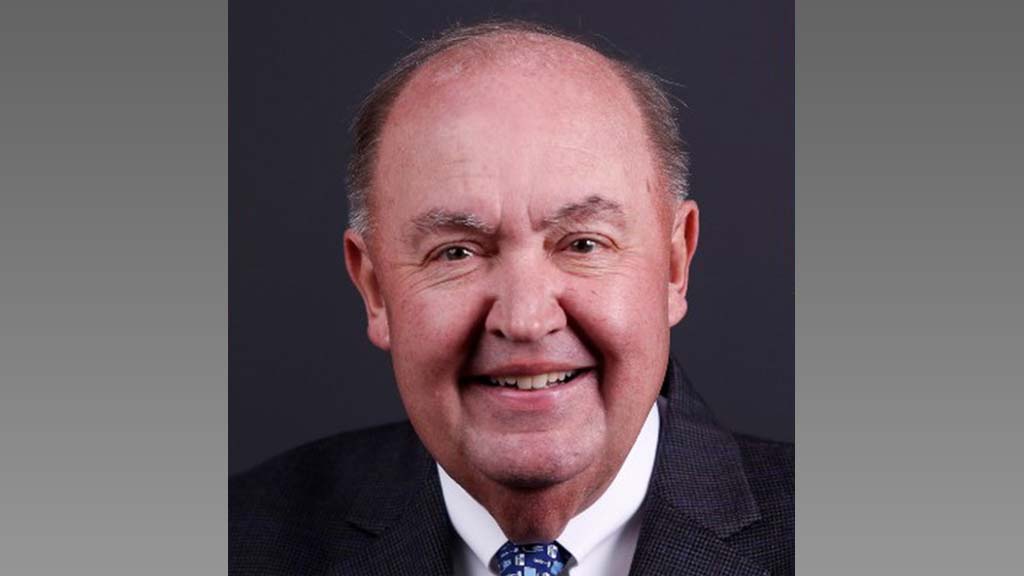

"The insight that we gain from the controlled market entry will be applied to the broader rollout, " said Brad Mays, AT&T spokesman. "There is learning that goes on in [that process] that will help us refine the service based on what the customers want."

Microsoft, which supplies the software for AT&T's IPTV build-out, echoed Mays' comment on the controlled market entry.

"You plan for some kind of learning in the early trials," said Ed Graczyk, director of marketing and communication for Microsoft TV. "That's why you do the trials: to make sure you get all the processes down and get everything worked out."

Though this AT&T initiative is Microsoft's only pure IPTV undertaking currently in the United States, the company also is supplying IPTV software for such projects in Germany, Switzerland, France, Italy, Spain, Hungary and Canada. All are still in the nascent stage.

The surge of such IPTV endeavors has been tied to the availability of a new generation of set-top boxes with the system on a chip. "That's what the market's been eagerly awaiting," said Graczyk. "It's what will enable lower cost set-tops and other functionality like high definition and low-cost hardware, like a full-blown DVR."

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.