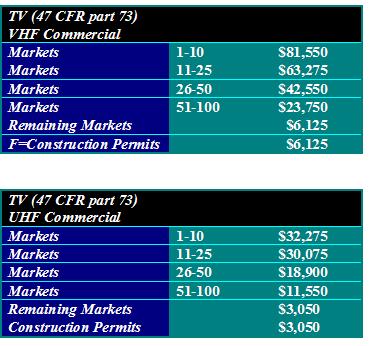

FCC Sets Broadcast Fees

WASHINGTON: TV stations that selected a very-high frequency channel assignment in the digital transition are about to experience bill shock. The commission announced its fiscal 2010 fee schedule Friday. VHF assessments are more than twice that for UHF stations. VHFs in the top 10 markets, for example, will be billed $81,550 by the commission. UHFs in those markets will see fee assessments of $32,275. The FCC said a migration away from VHF triggered the higher fees.

“Over the past several months, the number of entities changing channels from VHF to UHF has totaled over 38 percent,” the commission said. “This will impact the regulatory fees paid by those VHF television stations still operating on VHF channels. In many of the Nielsen Designated Market Areas, the number of VHF stations decreased almost 50 percent and this in turn will increase the regulatory fee for these categories twofold.”

The FCC acknowledged the VHF increase illustrated the necessity for reforming fee structure, but that “it is imperative that we take steps under our current fee structure to mitigate the impact of this shift on television stations still operating on VHF channels and, at the same time, take at least a partial step toward more fairly apportioning fees across all television markets.”

The FY2010 fees for TV stations are laid out in the tables at left.

This year’s fee cycle marks the first following last year’s full transition to digital television, thus the digital-only exemption no longer applies. Stations also operating on a Special Temporary Authority licenses as of Oct. 1, 2009, will be assessed as fully operational stations. Translators, low-power and Class A stations in all markets will be assessed $415 each for digital and analog operations that are not simulcasting. Satellite TV stations in all markets will be assessed $1,300. Broadcast auxiliary operations will be assessed $10 each.

A total of nearly $335.8 million is to be collected under the FCC’s Assessment and Collection of Regulatory Fees for Fiscal Year 2010, Docket No. 10-87.

-- Deborah D. McAdams

(Image by Steve Rhodes)

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.