Digital Glut or Gush: What’s Important?

Gary Arlen In this season of annual budget planning plus fourth quarter product releases, it’s easy to get lost in the endless flow of predictive pronouncements and ebullient announcements. They vie for attention and generate increasing confusion about what to do with “new media.”

The glut of upbeat outlooks and the gush of promotional promises thundered with particular intensity on a couple of overwhelming days recently. Studies and forecasts surfaced, offering divergent views about viewing migration to multiplatform systems. Simultaneously, a gushing torrent of product introductions offered updated digital devices and software intended to pave the path for the delivery and reception of such multiplatform services.

Since our job around here is to interpret these promises, the deluge made for a hectic week. And it required some rumination about how business planners will handle this range of information.

Do you design your tactics based on broad forecasts and spot-check studies? Or should you absorb product information and start building digital platform options based on new product availability?

Not to be overly skeptical, but the field studies and predictions are inevitably optimistic, often created to reassure investors and technology providers. Similarly, product announcements are opportunistic and don’t necessarily assure market acceptance.

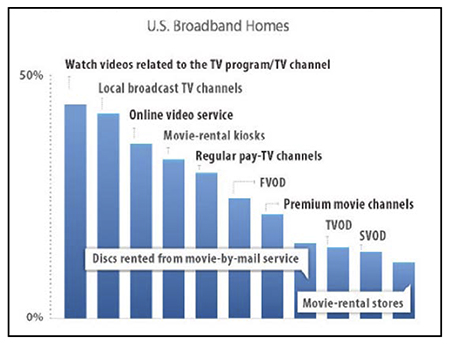

Fig. 1: Sources used to watch movies at home

Source: Parks Associates: “Video-on-Demand: The Road to Revenue,” September 2013 Yet plan you must. Inevitably, it’s a combination of broad market outlooks mixed with specific tools and processes that suit your role in the emerging digital marketplace.

VIDEO-VIEWING NUMBERS

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Nonetheless, the glut of forecasts and the gush of product promises tend to daze as well as dazzle. For example, in its new “Video-on- Demand: The Road to Revenues” report, research firm Parks Associates found that in the first quarter of this year, 44 percent of U.S. broadband homes subscribed to some kind of online “over-the-top” (OTT) service such as Netflix, Hulu Plus or Amazon Prime, (Fig. 1). That level of paid online VOD was just slightly lower than simultaneous viewing of TV and second-screen content.

Parks’ Senior Analyst Heather Way points out that, “Online video is now a common source of video viewing in U.S. households, while Transactional VOD [“TVOD”: TV-set-based VOD viewing] is near the bottom.”

Not surprisingly, the Parks study found that young viewers (ages 18–24 years old) are the most likely to subscribe to OTT video services.

Viewers are far more likely to watch such programs on a mobile device or tablet, Way told TV Technology when we sought amplification of her report. “More and more, consumers are using a smartphone or tablet to view video content when the primary screen [the TV set] is not available.”

Separately and simultaneously, FreeWheel Advisory Services’ “Video Monetization Report, 2Q2013” provided another upbeat outlook on Americans’ broadband video viewing patterns. It, too, focuses on the dramatically fast uptake of mobile viewing and especially the increased acceptance of online advertising by both viewers and marketers.

Online video usage increased 38 percent from the second quarter 2012 to the same period this year, says FreeWheel, a San Mateo, Calif.-based marketing research and support agency. It emphasizes that online video advertising “increasingly [resembles] the linear TV experience.”

Again, the impact of tablet viewing is clear: tablets accounted for 13.27 percent of video viewing in the second quarter of 2013 compared to 7 percent during the same period last year and 7.5 percent in the fourth quarter of 2012. Watching video on smartphones or other mobile devices also doubled during the year: 2.2 percent in 2Q2012 and 4.3 percent in 2Q2013.

While the FreeWheel analysis confirms other researchers’ upbeat predictions for “non-traditional” viewing, its core message stresses the migration of advertising to these addressable platforms. But the migration will not be simple, the company observes.

Yet another report came up with similar trend data about the movement of digital video advertising. An eMarketer study, sponsored by Adap.TV, concluded that “more digital viewers means more marketers jumping on the video advertising bandwagon, trying to take advantage of the branding opportunities afforded by video.”

This study’s data deck includes the high hopes that marketers bring to digital platforms: 47 percent of marketing professionals expect higher product awareness, 58 percent anticipate greater engagement. It also lists reasons why advertisers will move toward broadband video platforms: 73 percent cite “better targeting;” 67 percent mention “measurement;” 54 percent cite “scale and reach” as rationales to increase their digital video spending.

And, according to another report, young viewers are not the only ones embracing online video. Ericsson’s Consumer Lab found that 41 percent of people in the 65– 69 age bracket watch more than one piece of streaming content per week; Hulu and Netflix topped their choices. Analysts took this factoid to mean that even traditional TV’s “most adamant supporters” are being tempted by the new digital alternatives.

Finally, VEVO issued its viewership report for the first half of 2013, revealing that 50 percent of its U.S. video views now come from mobile and connected TV devices. That’s even higher than the Parks and FreeWheel reports, although as is usually the case with such studies, the data sources—the audience universes for each study—are not identical. VEVO CEO Rio Caraeff said that non-desktop viewing is the fastest growing part of VEVO’s business.

VEVO’s experience, of course, is skewed by its core content: mostly short music videos that are a mainstay of mobile viewing. The connected TV factor is noteworthy, though, especially when Caraeff told CNET that 80 percent of his company product development now focuses on such at-home devices. VEVO has deals with Roku, Xbox and Apple TV, and analysts expect that Google Chromecast and Samsung smart TV deals are in the works.

DEAL-MAKING AND PRODUCT EXTENSION

Indeed, that’s where this collection of bullish forecasts tips into the world of product evaluation.

In September, Roku unveiled plans to expand its video streaming service by adding an Android App. Barely a month after updating its mobile iOS app, Roku introduced v2.3, which lets users of Roku set-top boxes stream videos between their Android smartphones, tablets or other devices via the STB to their big-screen TV monitors.

Aside from sharing family videos, such technology opens the door to more “user-generated content” if and when that opportunity resurfaces for commercial media operators.

In a speech at the Edinburgh Television Festival in September, actor Kevin Spacey warned that traditional television program producers and broadcasters could be left behind if they fear the risk-taking and “warp speed” technological changes that are part of the new video era. Roku also revised its interface (an augmented grid system) for cross-platform remote control of online viewing.

And Facebook, which has quietly been upgrading its video offerings, acknowledged that it is testing a system that allows videos to play automatically on mobile versions of its service.

Reuters described this capability as “setting the stage to turn the 1.15 billion-member social network into an attractive venue for lucrative, television-like video ads.”

According to reports, only videos posted to Facebook by individual users, especially “celebrities or musicians,” will have the auto-play function. The inclusion of professional performers suggests that Facebook will increasingly rely on video as a revenue-generator, with some analysts expecting that the social network will charge brand marketers $1 million to $2.4 million for a 15-second auto-play video ad.

Meanwhile, Samsung is accelerating its TV apps agenda. At the Internationale Funkausstellung (IFA) consumer electronics trade show in Berlin, Samsung introduced two new applications for its SmartTVs, expanding the pool of upscale content available to its customers. The “Opera” app features about 100 performances from Austria’s Wien National Opera House; the “Gallery” app allows users to see high-definition photos taken by popular photographers. Both free apps can be downloaded from Samsung’s proprietary TV app platform.

The concentrated flurry of new media forecasts and product upgrades came barely a fortnight after the celebrated Kevin Spacey speech at the Edinburgh Television Festival. The iconic actor/director espoused the “third golden age” of television, citing the high-quality content of made-for-video programs, including the Netflix “House of Cards” series in which he stars. In his MacTaggart Lecture, Spacey warned that traditional program producers and broadcasters could be left behind if they fear the risk-taking and “warp speed” technological changes that are part of this new video era.

Dazed by the options and choices? Of course, everyone is. Does the data and product deluge prompt inertia or statis? It better not.

Nonetheless, the forecasts are generally not issued with a warning that past performance does not guarantee future successes, at least not at the same growth rate. And the products, which provide just a glimpse of tools coming into the market, are similarly not guaranteed to succeed in a competitive market.

No wonder these multiplatform decisions are so complicated.

Gary Arlen is president of Arlen Communications LLC, a media/telcom research firm. He can be reached atGaryArlen@columnist.com.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.