Apple Boosts Its Smartphone Share to Highest Level in 12 Years

Total smartphone shipments fell in Q3 but Apple increased its global share to 16% according to Strategy Analytics

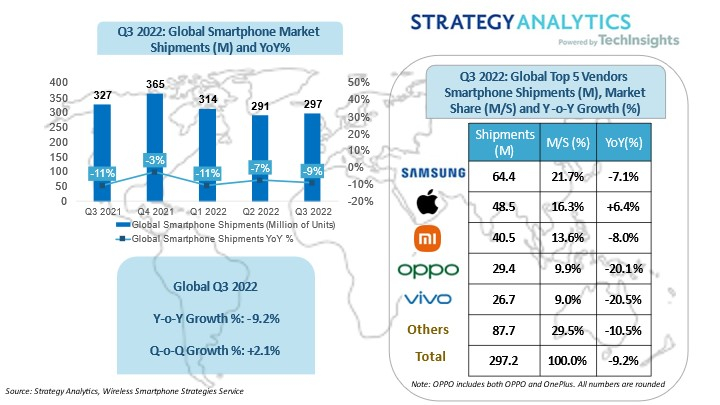

BOSTON—Global smartphone shipments fell 9% in Q3, 2022 compared to a year earlier but Apple had a strong quarter, boosting its share of the global business to 16%, the highest level in 12 years, Strategy Analytics reports.

Strategy Analytics is also predicting global smartphone shipments to decline by 9% to 10% for all of 2022.

As global smartphone shipments fell 297 million units in Q3 2022, Samsung topped the global smartphone market with a healthy 22% share in Q3 2022 and Apple landed in second place, with Xiaomi, OPPO (including OnePlus) and vivo rounding out the top five smartphone providers.

“Global smartphone shipments fell -9% YoY to 297 million units in Q3 2022,” said Linda Sui, senior director at Strategy Analytics. “This is the fifth consecutive quarter of annual decline by smartphone volumes. Inventory adjustments and geopolitical issues adversely impacted smartphone market in the third quarter of this year. Meanwhile, unfavorable economic conditions continued to weaken consumers’ demand on smartphones and other non-essential products.”

“We estimate Samsung shipped 64 million smartphones and topped the global smartphone market with a healthy 22% share in Q3 2022,” added Woody Oh, director at Strategy Analytics. “It slightly outperformed the total market and declined -7% YoY by shipment volumes. Demand tilted towards low- cost A and M series, while the newly launched Z Fold 4 and Z Flip 4 help the company strengthen the leadership in foldable segment. Apple shipped 49 million iPhones worldwide, up +6% YoY, for 16% global market share in Q3 2022. This is the highest third quarter market share for Apple over the past twelve years, at the expense of leading Chinese brands who are hampered by the sluggish performance in both home and overseas market. Apple had a good quarter, led by newly launched iPhone 14 Pro and Pro Max, while the demand for iPhone 14 remained mixed.”

“Xiaomi shipped 40.5 million smartphones and took third place with nearly 14% global market share in Q3 2022, slightly up from one year ago,” reported Yiwen Wu, senior analyst at Strategy Analytics. “Xiaomi outperformed other major Chinese brands and registered -8% annual decline rate, thanks to the well diversified regional footprint. However, Xiaomi continued suffering from the geopolitical uncertainties in Europe. China and India market also delivered a mixed bag for the Chinese brand. OPPO (OnePlus) held fourth spot and captured 10% global smartphone market share during Q3 2022. Vivo stayed fifth with 9% global smartphone market share in Q3 2022. OPPO (OnePlus) and Vivo both posted a double digit annual decline rate and lost ground in most markets, as 4G and 5G competition intensified sharply in China and other markets.”

Looking forward, Sui said, “we forecast global smartphone shipments to decline -9% to -10% YoY in full-year 2022. Geopolitical issues, economy downturn, energy shortage and price hike, exchange rate volatility, and Covid disruption will continue to weaken consumer demand during the last quarter of 2022. All these headwinds would continue through the first half of next year, before the situation eases in the second half of 2023. Samsung and Apple would continue to outperform and remain top two places. Chinese brands need to stabilize the performance in China market and explore new growth engine to terminate the falling track.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.