Deloitte: TV Antenna Comeback Continuing in 2020

NEW YORK—There are a multitude of elements that will contribute to the overall TV industry landscape in 2020, but in a recent study Deloitte took a close examination of three in specific: antennas, content delivery networks and ad-supported video services (AVODs).

Deloitte’s full report, “Technology, Media and Telecommunications Predictions 2020,” covers a range of technology topics, but the sections on antennas, CDNs and AVODs delve into the economic impact of these technologies across the globe.

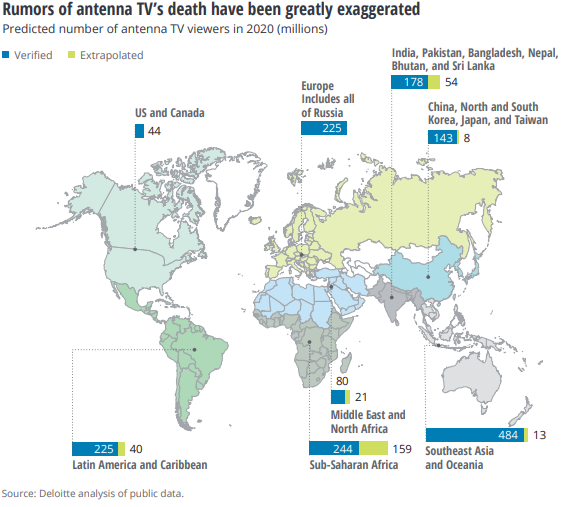

In its in-depth look at antennas, Deloitte examines how the death of antenna services have been greatly exaggerated. Across the world, Deloitte forecasts that 1.6 billion people, representing 450 million households, worldwide will watch some of their TV from an antenna in 2020—and it calls that the low estimate. Deloitte acknowledges that data on antenna use is incomplete, with some countries not providing information, but even so, the number of people watching TV through an antenna around the world will be 50% more than those watching TV over cable, IPTV and direct broadcast satellite combined in 2020, per Deloitte.

“Antenna TV is helping the global TV industry keep on growing even in the face of falling TV viewing minutes and, in some markets, increasing numbers of consumers cutting the pay-TV cord,” the report reads. For example, Deloitte predicts that U.S. pay-TV subscribers will decline by 5 million in 2020, in part mitigated because of the 2020 Summer Olympics and U.S. presidential election.

While other countries are seeing similar results, global TV viewership growth is expected to continue to grow in the next few years. Overall, TV subscriptions are projected to grow 8% between 2018 and 2024, while two-thirds of global pay-TV operators are expected to increase over the same period. Specifically regarding ad revenue in 2020, Deloitte estimates that it will grow by $4 billion, boosted in parts by the use of antennas as well as things like targeted ads.

Antennas are impacting another area of the industry. As the issue of spectrum and the desire to develop 5G and other wireless services continues, the industry must be aware that the spectrum used by antenna is not as available as may have been previously thought.

Content Delivery Networks are another element that is expected to significantly impact the bottom line of the TV industry in 2020. With the popularity of streaming video over the internet, CDNs’ global market is projected to reach $14 billion in 2020, a 25% increase than the estimated $11 billion in 2019. By 2025 that number is expected to more than double to $30 billion.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

With the demand for CDNs to ensure high-quality delivery of content, media and telecom companies are developing their own CDNs to have greater control over their content and revenue. Despite this, Deloitte says that CDNs and OTT kicking pay-TV to the curb anytime soon.

“Most media companies will likely run their OTT efforts in parallel with their broadcast and pay-TV services, allowing the market to determine which will draw the most subscribers,” Deloitte wrote.

Another area poised to have a noticeable impact in 2020 and moving forward, according to Deloitte, is ad-supported video platforms, or AVODs. These types of services are currently most popular in Asia, with the region estimated to contribute $15.5 billion of a total $32 billion in revenue across the globe.

Something that may boost that in other regions around the world is the overall rise in streaming services available to consumers, says Deloitte. While new ones continue to launch, consumers are expected to limit the number they subscribe to, with some projections putting the cap at three subscription services. In this case, Deloitte believes that streaming platforms that do not make the cut may develop AVODs so as to generate revenue from their services.

Find out more by reading the full “Technology, Media and Telecommunications Predictions 2020” report.