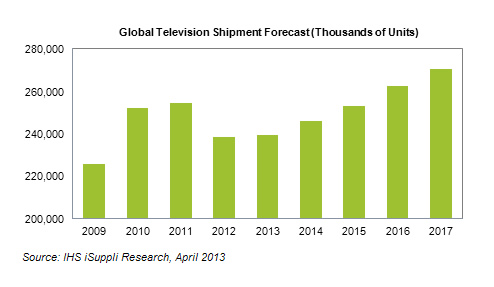

Worldwide TV market declines; recovery not seen till 2015, says IHS iSuppli

Global TV shipments in 2012 fell by 16 million units, marking a major inflection point that will have a lasting impact on the market, according to an IHS iSuppli report.

The finding, part of IHS iSuppli’s “Worldwide Television Market Tracker Report,” finds the drop-off was propelled by plunging sales in Japan and falling demand in North America and Western Europe.

Global shipment of all televisions in 2012 amounted to 238.5 million units, down 6.3 percent from 254.6 million in 2011. Shipments aren’t expected to reach the 2011 level until 2015, when they will total 253.1 million units, according to the findings from the IHS TV Systems Intelligence Service.

“Television shipments in 2012 declined for the first time for more than a decade, sounding the coda for the flat-panel replacement wave that deluged the business throughout the 2000s,” said Tom Morrod, TV systems analyst at IHS iSuppli.

“This event marked a fundamental change in the growth trajectory of the market, with flat or minimal increases in shipments expected in the coming years — a sharp contrast to the double-digit increases seen prior to 2010,” said Morrod.

According to Morrod, the drop-off in sales represents a “fundamental slowdown” in the TV market, which is underscored by the first-ever decline in shipments of liquid crystal display (LCD) televisions.

“Although television shipments will stabilize in 2013 and growth will return in 2014, developed markets have become saturated with flat-panel televisions,” he said.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

According to IHS iSuppli, the slowing sales first became apparent in 2011, which recorded an increase of just 1 percent compared to the 11.6 percent increase in unit shipments posted in 2010.

Several factors are contributing to the decline, including the fact that most consumers in developed regions had replaced their CRT sets with flat-panel models by the beginning of the decade. Economic factors and the conclusion of some transitions from analog to digital and their accompanying government subsidies were also important reasons for the decline.

By region, the biggest decline happened in Japan with shipments falling 13.5 million units in 2012. Japan end its “eco-points” subsidy program, which rewarded consumers for buying energy-efficient products with points that could be redeemed for other products. North America and Western Europe also saw declines in 2012, and unit shipments in Latin America, the Middle East, Africa and the Asia-Pacific region stalled, IHS iSuppli said.

China and Eastern Europe were the only regions to see an increase in shipments in 2012.