Scaled-Back CES Returns to Vegas After Pandemic Hiatus

Connected TV, XR variants, streaming outshine video gear as ‘hybrid’ show expands tech turf

LAS VEGAS—TVs and related video devices—once a mainstay of the annual CES trade show—will still play a smaller but still highly visible role in the show, which returns to a live (vaccinated) in-person event, Jan. 5 –8, 2022.

As the tech industry returns to Las Vegas after the 2021 show was cancelled, visitors will find that the electronics extravaganza (formerly known as the Consumer Electronics Show) has continued its metamorphosis into a broader realm of personal technology, evidenced by a bigger-than-ever presence of (including more speakers and conference sessions about) automotive, health/wellness and smart homes/smart cities among nearly 50 product categories.

Not to mention the inevitable buzz about virtual reality.

THE WORLD OF XR

ATSC 3.0 (aka “NextGen TV”), 8K Ultra High Definition equipment from almost every major supplier, plus upgrades of OLED (Organic Light Emitting Diode), MicroLED and HDR (High Dynamic Range) will be on the convention show floor, and there are a couple of conference sessions exploring their capabilities. But the larger focus of CES’s video agenda involves Connected TV (CTV) services, XR—the umbrella acronym for the new Realities of Virtual Reality (VR), Augmented Reality (AR) and Mixed Reality (MR)—and other new content, especially the role of streaming media.

“The dynamics have changed,” explains Karen Chupka, CTA’s executive vice president-CES, observing that small retailers no longer come prowling for new products. “Buyers come with specific needs,” she said. The name change in 2015 from Consumer Electronics Association to Consumer Technology Association presaged the shift to a broader array of products.

CTA expects about 1,600 exhibitors and as of mid-November the vague prediction was for 70,000 to 100,000 in-person attendees, with about 25% coming from outside of the U.S., based on early registrations and the lifting of travel restrictions to the U.S. Visitors from 134 countries had registered as of mid-November. (For comparison, the January 2020 CES attracted about 180,000 visitors and had 4,500 booths.)

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Chupka expects that public officials—from federal, state and local jurisdictions—will be at the show, but as of mid-November, the Innovation Policy Summit was in the early planning phase. In past years, appearances by members and staff of the Federal Communications Commission, Federal Trade Commission, Congress and other top public officials have often been announced just a few weeks before show time.

Only one of the keynote speakers as of mid-November comes from a company identified for its video products: Jong-Hee Han, president of Visual Display Business at Samsung Electronics, will deliver the pre-show keynote address on Tuesday night. Other keynoters are from automotive, telecom, pharmaceutical and technology companies.

Beyond the obvious changes in 2022—especially the COVID-induced hybrid format, with many “attendees” expected to tune into the virtual show via streamed conference sessions and digital booth visits—the upcoming event comes as the TV business is attracting pervasive new players.

Comcast’s XClass receivers (already on sale at selected Walmart stores) and Amazon’s FireTV sets are the early versions of both companies’ initiatives to sell home TV receivers, mainly for the ad and data opportunities to leverage their vast footprints in the digital world. Chupka does not expect either of those firms to exhibit on the show floor, although there is substantial buzz that they—and their Chinese-made display devices—will be in Las Vegas. Amazon has a showfloor booth, as it has had for several years, but declined to reveal what it will exhibit.

On the technology front, Brian Markwalter, CTA’s senior vice president for research & standards, expects MicroLED will attract a lot of attention, especially as manufacturers seek to downsize the technology into the consumer video arena.

“MicroLED is very high end for commercial displays right now,” Markwalter said, adding that he expects to see some set-makers bring it to market, although he could not identify any of the potential suppliers or a timetable.

He also cited the growing market for OLED, which “has a steady portion of the market.”

Steve Koenig, CTA’s vice president of market research, expects “8K everywhere” at CES.

Koenig also believes attendees will relish the opportunity to “see what NextGen TV is all about.” Beyond that, he cites the “incremental improvements” in smart TVs plus new kinds of partnerships between manufacturers and streaming content producers to be a major factor in the video activity at CES. And he expects that Amazon and Comcast will use the show as a way to advance their plans for working with retailers to sell their branded TV sets.

TRACKING NEXTGEN TV SALES IN A FALTERING MARKET

In response to a question about tracking sales of NextGen TV-enabled sets, Koenig pointed out CTA stopped aggregating factory sales data a few years ago and is now working with manufacturers “to validate forward-looking predictions.” He pointed out that CTA began forecasting NextGen TV sales early this year and now expects 2.1 million NextGen sets will be sold this year. An updated forecast will be released just before CES starts.

“2023 will be the inflection point,” he told TV Tech, forecasting about 11 million units to be sold in the U.S. the year after next. “We’re getting perspective; I expect the shape of the trend will change a little but not dramatically.”

The U.S. market for TV sets is in flux as the industry prepares for CES. Although 2020 was “a banner year with the highest shipment levels in more than 20 years,” largely fueled by pandemic-induced sales, according to Koenig, the current level of TV set sales is drifting downward again. CTA expects a 2% decline in 2022.

As for CES highlights, both Markwalter and Koenig observed that there will be “more command and control” features, including voice and gesture recognition. They cited recent improvements in relevant technologies, including “taking advantage of artificial intelligence, facial recognition and voice technologies” for search tasks. They also cited leaps in audio features, such as soundbars for Dolby Atmos to enhance the immersive viewing experience.

Citing increasing consumer distress about finding digital content among the growing array of streaming providers, Markwalter said he expects new products with improved user interfaces and content search features. Pointing out that about 90% of new TV sales are Smart TVs, Markwalter said that the “broad mix of how people watch TV and where they watch” requires advanced abilities to discover programs and summon them up onto a screen.

SIZE MATTERS

“There will be lots of new TV models in 70-inch and larger sizes,” Koenig said, adding that such big screens “plays right into 8K” and reflects “consumers’ zeal for the biggest screen possible.” He contends that the size is “not just about movies” but also for telepresence and gaming. “You’ll see a lot of pairings of audio with video for a robust immersive experience,” he added.

Stephen Baker, vice president and industry analyst specializing in technology at The NPD Group market research firm, agrees that TV set sales will decline but popular sets will get bigger in the coming year. “The industry is still in the process of absorbing 18 months of elevated hardware sales and streaming.” The “biggest opportunity” now is for sales of sets that are 75+ inches and at prices of $1,500.

Baker contends that, “Video remains a critical part of CES and everything that goes on in CE business.”

“The tough thing about TVs is that it is a very commoditized category,” he said. “The screen is such a big percentage of the price.

“We’re at the point where a TV is not just a TV. It’s a window with an operating system; it’s a way to leverage that space in people’s houses.”

Those factors are driving the entry of companies such as Comcast and Amazon into the physical TV set sector, Baker adds. They see the opportunity “for streaming, advertising and interactions with consumers through the biggest and best screen in their homes.“

Looking ahead, Baker expects the next wave of “amazing technology” such as MicroLED and transparent screens is “still a few years off,” but there may be private demonstrations during CES.

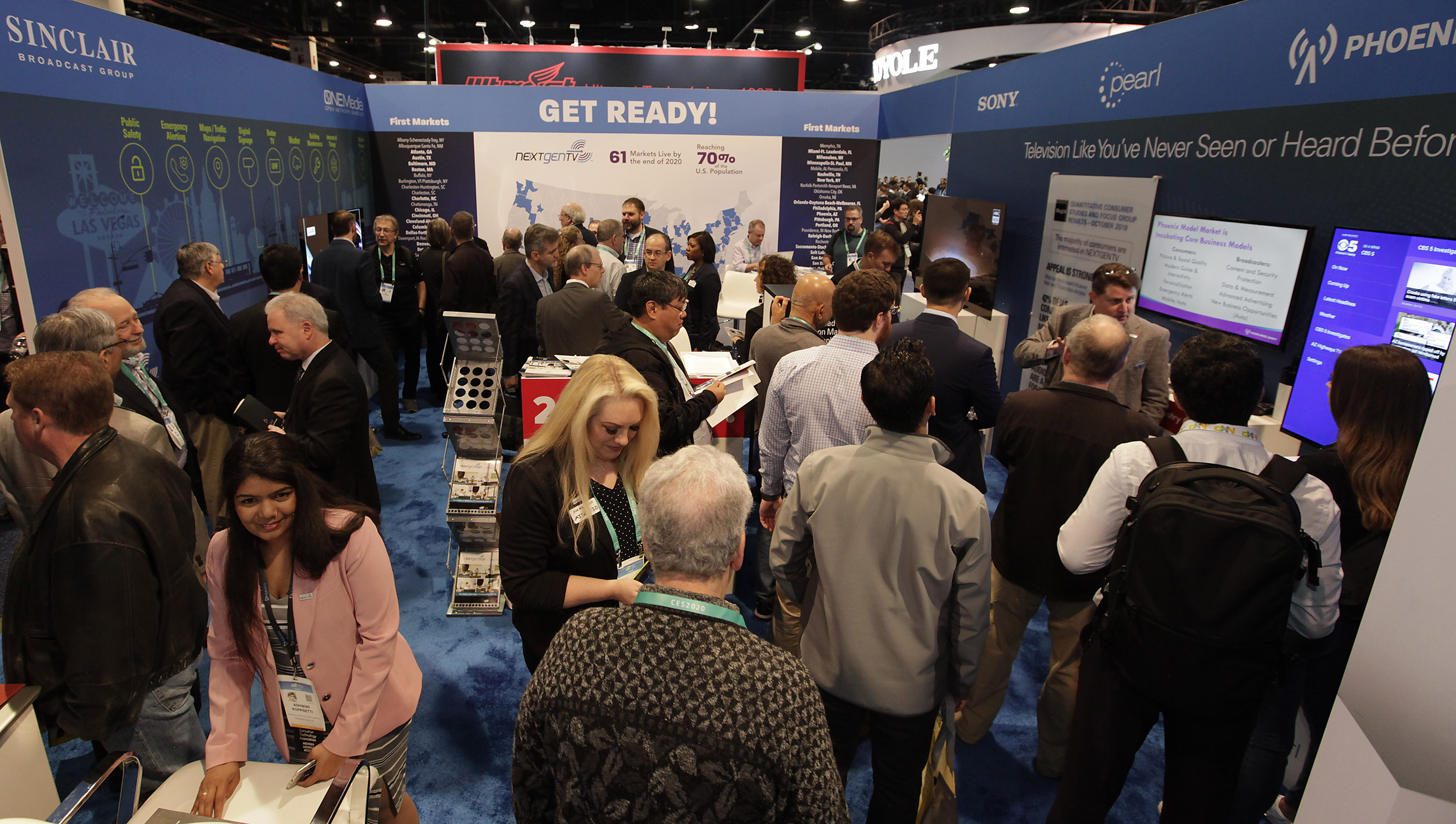

ATSC’s AGGRESSIVE APPEARANCE

The Advanced Television Systems Committee, which developed the ATSC 3.0 standard, will again showcase its technology and member companies’ hardware at a booth in the Las Vegas Convention Center’s Grand Lobby. ATSC President Madeleine Noland says the exhibit will “underscore the value of having the NextGen TV mark as an indication that a consumer device will be ready for television’s next generation.”

Noland stressed that ATSC will remain involved in “technical developments that will impact broadcasters around the world.” She points out that groups such as ATSC’s Planning Team 4 are working on “Future Broadcast Ecosystem Technologies,” which the organization terms as an initiative “to ensure that the ATSC 3.0 standard remains at the vanguard of new developments.”

She also cited CTA forecasts for NextGenTV unit sales. CTA’s January and July 2021 outlooks showed a three-fold increase in sales expectations, and Noland foresees “those numbers growing in 2022.”

Pearl TV, the consortium of major broadcasting groups, will showcase its national marketing campaign, launched in November as a “hardcore push to raise awareness of the NextGen brand, according to Anne Schelle, managing director. The goal is to educate retailers as well as consumers, she said, adding that Pearl will initiate a “broadcaster/retailer award” to recognize local partnerships that promote NextGen TV within a community.

In addition to a display within the ATSC exhibit in the Convention Center’s Grand Lobby, Pearl will have a hotel suite where it will demonstrate “the extraction layer” (called “RUN3 TV”), which allows broadcasters to develop applications that work across multiple receivers, combining live linear TV with over-the-top HTML5 applications.

Pearl also plans to announce additional NextGen TV set manufacturers and to step up its relationships with SOC (system-on-a-chip) suppliers as well as participate in a conference panel organized by NAB’s Sam Metheny. It will offer a “digital playbook” for virtual attendees. As for the continuing nationwide rollout, Schelle said that ATSC 3.0 service will launch in Houston by Spring (closer to the NAB Show). Pearl TV’s exhibit will include Dolby AT4, a voice tech audio platform that offers consistent loudness and is integral to NextGen TV, Schelle said.

FOCUS ON CONTENT

“C Space,” the CES program focused on media, advertising and branding, will include many of the TV content programs in addition to the other CTA sessions on media and video-tech topics. With more than 150 conference sessions during the show’s four days, only a handful deal with video; most of them will be run by CTA partners and focus on non-broadcast issues.

For example, the Digital Hollywood program features sessions on internet TV, FAST (free ad-supported streaming TV) and OTT (over-the-top) programming, plus the relationships of streaming to 5G and the Internet of Things (IoT). Digital Hollywood speakers come from Disney, Paramount, Fox and WarnerMedia as well as from Hewlett-Packard, Qualcomm, Samsung, LG, IBM, Microsoft and Verizon.

SCHEDULE SHIFT AND NEW VENUES

Among the changes are a schedule shift with the show starting on Wednesday, Jan. 5 and ending Saturday, Jan. 8; a slight shift from the Tuesday through Friday timetable of recent years.

Most video-related exhibits (Sony, Samsung, LG, Hisense and others) will remain in or near familiar locations in the Central Hall of the Las Vegas Convention Center. The new West Hall will largely be dedicated to the growing array of automotive technology.

TUNE IN REMOTELY

The streaming and on-demand production and distribution will be handled by Web Summit, which is using its event operating system, Summit Engine, a cloud-based platform built to support events with both in-person and digital audiences. (Microsoft ran this part of the digital program in 2021.) Digital audiences will have the opportunity to share the excitement of the in-person event by accessing live keynotes, viewing select conference sessions and connecting with exhibitors and other attendees.

Jean Foster, senior vice president of marketing and communications for CTA, said the Web Summit platform lets CTA “reimagine how we convene and collaborate as an industry.”

To register for the show, visit www.ces.tech.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.