The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Every pundit worth his or her salt is making predictions about the impact of 5G on the world economy. Intel just released a report that attempts to measure that impact on the media and entertainment market.

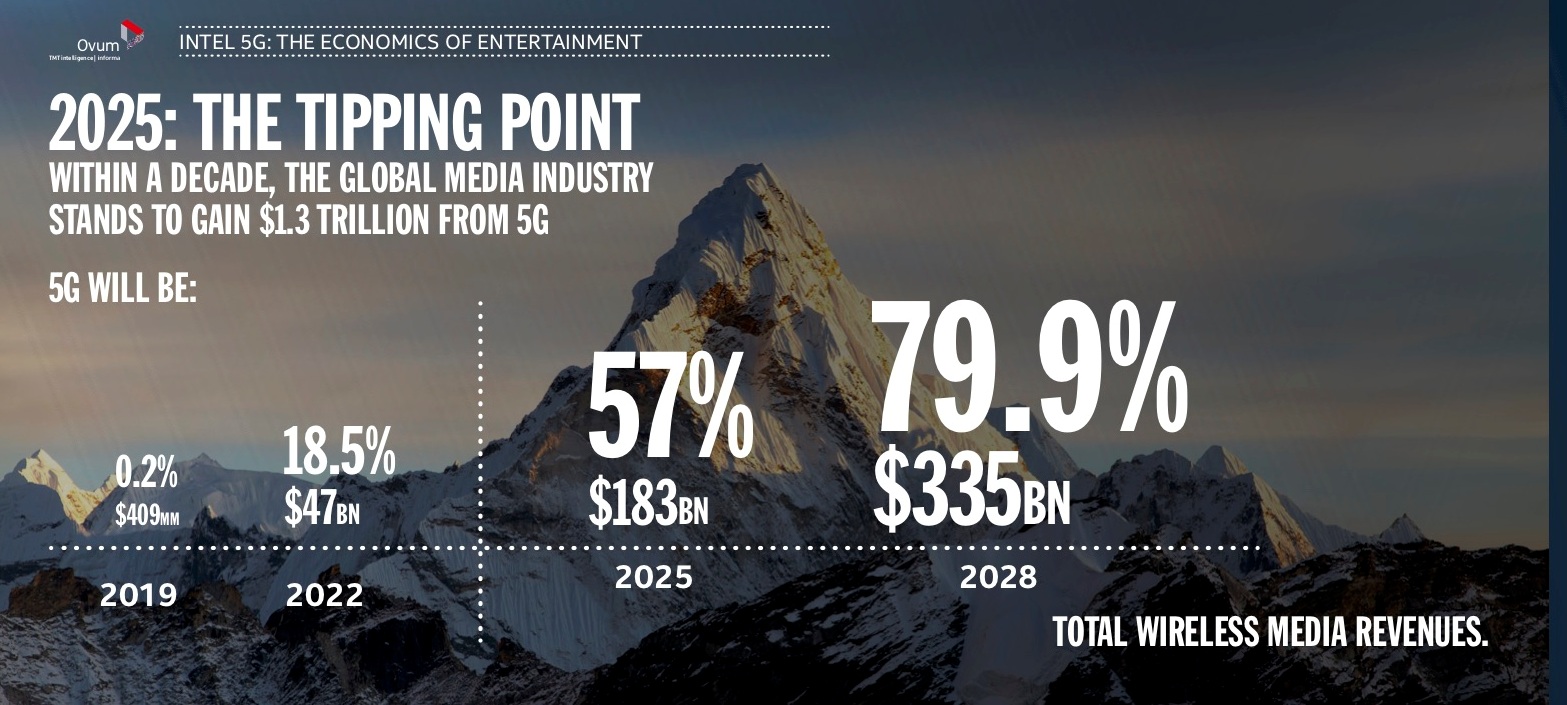

According to a new “5G Economics of Entertainment Report,” commissioned by Intel and conducted by Ovum, nearly $3 trillion in cumulative revenue opportunities will be spurred by wireless technology from 2019-2028 and experiences enabled by 5G networks will account for nearly half of it (close to $1.3 trillion).

The report cites 2025 as the “tipping point” for 5G, predicting that by then, 57 percent of global wireless media revenues will be generated by the next-gen cellular standard, which promises bandwidth up to 100 Gbps. With speeds potentially up to 1,000x faster than the current 4G protocol, the buffering issues that come with livestreaming and large downloads will be a thing of the past.

5G’s speed will also enable the growth of immersive services such as virtual reality (VR) and augmented reality (AR), which will generate more than $140 billion in cumulative revenues between 2021 and 2028. Ovum predicts that gaming will be at the forefront of 5G-led innovations, with AR gaming comprising annual revenues of nearly $36 billion globally, or more than 90 percent of 5G AR revenues.

By 2028, new “immersive,” currently non-existent applications will provide an annual revenue bucket of $67 billion, which is the value of the entire current global mobile media market--video, music and games–in 2017, Ovum predicts.

For the current media market, 5G is characterized by Ovum as a “major competitive asset” which will allow telecom companies to better compete with cable, satellite and IPTV. The term “cord-cutting” will seem like an anachronism a decade from now as telcos offering 5G will be able to offer most, if not more than the same services as current wired cable service providers.

5G will also have a major impact on mobile display advertising, as higher speeds will enable social and media immersive experiences, leading to an expected market of $178 billion worldwide by 2028.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The average monthly traffic per 5G subscriber will grow from 11.7GB in 2019 to 84.4GB per month in 2028, at which point video will account for 90 percent of all 5G traffic, according to the report. Ovum also warns that the demand for applications for 5G will mean that evolved 3G and 4G networks will suffer as their capacity will be insufficient to handle the increased video viewing time, content evolution to higher resolutions, more embedded media and immersive experiences.

“5G will inevitably shake up the media and entertainment landscape. It will be a major competitive asset if companies adapt, said Jonathan Wood, general manager of Business Development & Partnerships, 5G Next Generation and Standards at Intel. “If not, they risk failure or even extinction.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.