Connected Media Big at CES

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

LAS VEGAS—From a Disney sensor that warns when kids are sitting too close to a TV set to a live UHDTV broadcast, to cloud TV, the 2014 International CES offered a larger-than-ever array of “television” viewing options.

Add curved big-screen monitors, including a Panasonic version that can undulate into convex or concave configuration, Dolby’s glasses-free 3D stereoscopic demonstration using lenticular overlays, a brewing battle among Intel, Qualcomm, Samsung, LG and others to control home networks, and cross-platform software, and you’ve still barely glimpsed the future of television, as envisioned by CES exhibitors.

Even new FCC Chairman Tom Wheeler expressed optimism for TV’s future with the vow that “there has never been [a] time of greater opportunity for broadcasters... to harness the new digital universe while performing the same public services they perform now.” Wheeler, in his first CES appearance as regulator-in-chief, called next year’s FCC incentive spectrum auction of broadcast airwaves an “unprecedented opportunity” and also said that the FCC will encourage new uses for additional unlicensed spectrum that will “probably” become available in coming years.

RESTRUCTURING THE VALUE CHAIN

For its 46th year in Las Vegas, last month’s CES again expanded its definition of “consumer electronics,” with a heavy focus on automotive technology (telematics, far beyond back-seat video screens, including driverless vehicles from BMW, Audi and others), 3D printing, robotics and endless health/wellness products. A major hurdle for many of these devices will be the availability of wireless spectrum—hence the significance of the policy discussions throughout the event about how to parse out airwaves.

At a show as vast as CES, attendees can find almost anything in hyper-abundance— including perspectives on “the future of television.” At the “How We Will Watch TV in Five Years” panel (which significantly did not include any broadcasting executive), the discussion focused on second-screen interactivity, the need for navigation, program guides and user interfaces. One of the speakers, John Penney, chief strategy officer at Starz, suggested that more emphasis should be put on collaborations with technology partners to enable content that viewers want to see.

“The business battle will be over the power of the network,” said Penney.

Beyond the predictable panoply of TV display formats (from palm-sized to humongous) was the underlying message that the video marketplace is in the midst of extensive restructuring throughout the value chain. Qualcomm—known for its mobile communications chips and its ill-fated FloTV venture—burst loudly onto the CES floor with microprocessors aimed at home entertainment. Qualcomm’s line-up included “smart gateway” products, “Gigabit Wi-Fi” and “StreamBoost” technology— all part of the company’s vision to enable product manufacturers to “further differentiate the products.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

At the adjacent booth, Intel—which abandoned its own proposed OTT service last year—touted its own roster of products, with such new categories as “Real Sense” perceptual computing. Among the products in Intel’s vision is a 3D camera about the size of an index finger but thinner than a cracker. The device could be used in services involving gesture or facial recognition and other “intuitive” and “natural” products, according to Mooly Eden, Intel’s senior vice president for perceptual computing.

SMARTER TV

The estimated 152,000 CES attendees (an audited census will be announced in April) saw more product integration, such as Roku Internet video receivers built into Hisense, Haier and TCL flat-panel TV receivers. The sets, in screen sizes from 32 to 55 inches, will be available at retail by autumn.

Several exhibitors rolled out the Industry’s first curved UHDTV displays at this year’s CES. Roku CEO Anthony Wood called the integrated devices “television(s) that we have designed from the ground up.”

Nowhere was the computerization of TV sets more apparent than in the massive exhibits of Samsung and LG Electronics. Both companies unveiled updates of their voice and gesture controlled-TV systems and more significantly, each unveiled operating systems that will be part of the digital ecosystem they expect will expand into homes, starting with TV sets.

LG Electronics, with its WebOS (operating system), and Samsung’s Smart Home both envision that their technology will be integrated not only into their own multimedia and communications devices, but also their major appliances, which were strategically placed nearby in their respective CES booths.

LG’s “HomeChat” system allows customers to control devices by sending SMS messages to them. The WebOS is intended to “make sense of the explosion of TV channels and Internet options,” according to Colin Zhao, director of product management at LG’s Silicon Valley Laboratory. The onscreen apps can be dynamically updated, presenting current popular programs or services for the home.

Samsung’s “grand vision” encompasses platforms for healthcare products, door locks and “eco-home” applications. The company’s initial round of services will include cameras built into TVs and other appliances to provide real-time video feeds to a user’s smartphone, allowing them to monitor their property at all times.

Sony focused on cloud-based TV and media, using its PlayStation platform as the centerpiece of its new service that combines traditional television viewing with on-demand content.

Andrew House, president and Group CEO of Sony Computer Entertainment, said that the company will combine live cable, on-demand and DVR content with an intuitive search capability to create “a more personal service for consumers.”

“For years, consumer electronics companies have tried in various forms to transform the living room and the home entertainment experience because it is fundamentally outdated and flawed,” House said. He stopped short of specifying a launch date or announcing any content deals for the video service. (Shortly after the CES, Sony announced that HBO GO will be an anchor of the PlayStation video bundle.)

Although Apple TV (not present at CES) and Roku control 64 percent of the Internet TV set-top box market according to Parks Associates, dozens of companies want a piece of that business. “Smart TV” products with built-in IP access would seem to obviate the STB category, but hopefuls see two significant opportunities: cable cord-cutters and viewers who do not have Internet-ready TV receivers.

While Google’s $35 Chromecast dongle for IPTV reception generated massive attention late last year, other companies are plunging ahead with similar plans.

FreeCast, an Alabama company which has been selling a thumb-drive sized “Rabbit TV” device for its video content discovery and management service, unveiled a $99 “ Rabbit TV Select” set-top box, which will go on sale in April. The STB connects via HDMI, “turning [the TV] into a complete quad-core PC,” according to FreeCast Founder and President Bill Mobley. The Rabbit TV device will offer “universal access to new release movie rentals, premium TV series and live 24/7 sports channels,” Mobley says, although he declined to identify the programming. The system incorporates a standard HDTV antenna to pick up local broadcast TV signals as well.

Nuvyyo, an Ottawa firm, unveiled its “Tablo” box, which includes a DVR that plugs into any HDTV antenna to capture free broadcast network programming including news and sports within the United States and Canada. Unlike traditional DVRs that are plugged into one TV, Tablo is a whole-home DVR that streams live and recorded HDTV content to any connected device with Internet access.

Nuvyyo CEO Grant Hall told TV Technology that in some test markets, Tablo could bring in nearly 100 channels, including multicast broadcast channels and LPTV signals. The Tablo DVR, outfitted with the Maxlinear ATSC tuner, is available this month, and retails for $219 for the two-tuner model with optional program guide data subscriptions for $4.99 per month ($49.99/year or $149.99/lifetime). A four-tuner model will be available in spring, priced at $249.99.

BATTLE OVER 4K

UHDTV monitors were omnipresent, including LCD models with screens nearly seven-feet diagonally. But questions about marketability continued. On the technical front, Dolby argued that “better pixels” with greater brightness satisfied the need for high-quality viewing.

Samsung Demos UHD Broadcast at CES

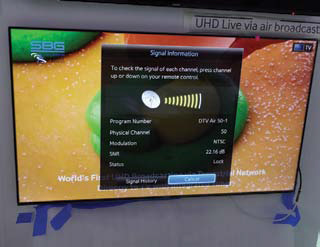

Samsung’s exhibit at the International CES included a live broadcast transmission of Ultra High Definition TV, presented in collaboration with Sinclair Broadcasting, which owns two Las Vegas TV channels. The UHD-TV signals were actually carried via Channel 50, KSLVLD, a low-power TV station owned by Biltmore Broadcasting.

Samsung hosted a live over-the-air broadcast of UHD content at its CES booth.

Channel 50, which usually transmits jewelry shopping shows, “was willing to lease the channel,” explained Mark Aitken, vice president of advanced technology at Sinclair Broadcast Group. “[We] added an OFDM modulator and gateway [non-standard DVBT2 configuration], and played out a UHD-TV [4K] program.” Aitken said the attention-getting live feed was intended to support Samsung’s message of “UHD everywhere.”

“The only way that advanced services, such as 4K, are going to happen commercially is with a new ‘next generation’ transmission platform,” Aitken said. “The demo Samsung wanted was not about nomadic opportunities.”

Using HEVC encoding, the team was able to transmit 4K content at about 27 Mbps, or roughly 30 percent more than the current U.S. broadcast infrastructure bit rate. Last spring, Sinclair—which has long endorsed the OFDM standard for DTV transmission in the U.S.—started up a similar transmission facility in Baltimore, transmitting 800-plus kW ERP of DVB-T2 (OFDM) power.

Gary Arlen

Technicolor showed applications for 4K content streaming and HD to 4K upscaling, standardized encoding and High Dynamic Range (HDR) tone mapping. The company says such facilities will “speed the deployment of UHD experiences.”

Technicolor demonstrated the 4K streaming service of M-GO (a pay-per-view streaming partnership of Technicolor and DreamWorks Animation), which will debut on Samsung UHD-TV sets this spring

Sharp upped its UHD agenda, showing its 8K monitor for the third consecutive year, still saying the product is at least five or six years away from market. Sharp’s added features this year were an 85-inch glasses-free 3D display for its 8K display.

Vizio, which in a little more than a decade, has grown to be one of the largest sellers of HDTVs in the U.S., won the display size wars at the show with its 120-inch UHDTV, which will be available in the autumn. Samsung came in second with a 110-inch behemoth. Samsung also hosted the first demo of over-the-air UHDTV in the U.S. (see sidebar).

The never-ending flow of “next big thing” products is a CES mainstay. Collectively, the 3,200 exhibitors—including about 200 start-up ventures in the “Eureka Park” area— demonstrated an array of possibilities, some of which may actually reach viewers.

There were inescapable promises of game-changing prospects, many of which may indeed affect TV viewing patterns. For example, aided and abetted by a prime corner position within Intel’s booth, the developers of the Oculus Rift virtual reality headset (“eyephones”) showed off 3D videogames developed by independent partners (and powered by Intel technology).

Promoters talked about the realistic visual presentations evolving to major platforms that could “tip the balance of the entire industry from traditional media to computer entertainment.”

Against such promises and technology wonders, it was refreshing to see people watching regular old-fashioned TV in the TiVo booth. The DVR pioneer set up three easy chairs and an endless supply of snacks and brought in three Las Vegas residents (all young males who appeared to be in their 20s), for a “binge viewing” marathon. The goal was to break the Guinness World Record for non-stop TV viewing. For four days and nights, constantly monitored by TV staffers, the trio watched and watched, often standing next to their chairs (and getting a five-minute-per-hour, which they could “bank” into longer time-off intervals).

All three survived the 87-hour marathon and shared a $5,000 prize plus TV sets, TiVo products, a Netflix subscription and other gifts—all for watching TV. TiVo said it ran the competition after its recent research showed that 80 percent of subscribers have binge-viewed at least once in recent months.

That was something worth watching.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.