TV Viewers Declining Could Help Mobile TV to Rise

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

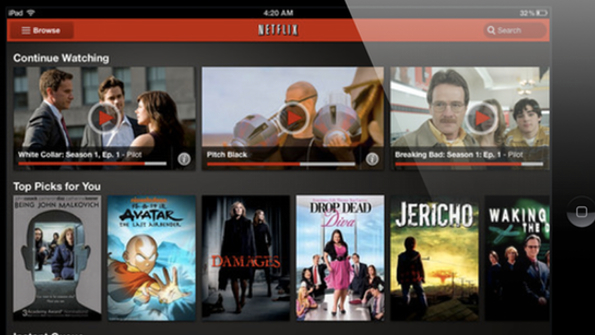

Nielsen has release some new data on TV viewing, and its results are not too surprising. A new study looked at viewing on services such as Netflix, and found there were some interesting changes from last year.

Netflix subscribers watched on average 11 percent fewer minutes of TV than non-subscribers of the services, and the Internet video usage continued to rise. In the second quarter of 2012, Netflix subscribers watched an average of 246 minutes of television per day, as well as12 minutes on other streaming platforms. Nielsen’s Cross-Platform Report for Q2 2012 also compared this with 276 minutes of TV for non-Netflix subscribers. Although not completely dramatic, the study showed that TV viewing has dropped almost 2 percent from the same period a year ago.

Another item not surprising is the rise of people using their tablets and smartphones while at the same time watching TV. Around 40 percent of these viewers are using their device at the same time as watching television and 85 percent of them do this on a monthly basis. The total number of U.S. TV households declined by 1.37 million compared to last year in the second quarter of 2012, to around 114.3 million, according to the Nielsen report. Cable TV operators lost 2.7 million customers, with 59.3 million total in the second quarter of 2012, while satellite operators gained 173,000 (to 34.65 million) and telcos ended up gaining 1.2 million (to 9.27 million).

Part of these trends have no doubt been triggered by the rise of mobile TV, both via smartphones and tablets. Because more people have access to a portable entertainment device, more are getting comfortable with cutting the cord and replacing existing cable services with a diet of mobile entertainment. Content producers and advertisers can still target the “second screen” aspect, and it seems like the fact that people are using their mobile devices more and more while they are watching television could be a golden opportunity, one that has yet to be fully exploited.

One trend that seems pretty clear no matter how you look at it is that consumers want more freedom and choices. Although services such as cable TV certainly offer a large chuck of content via hundreds of channels, many consumers end up paying for tiers that they don’t even watch (or worse don’t even know they have). Because cable rates keep inching up to pay for land expansion, some customers are examining their bills and searching for alternatives. Streaming and live content to mobile devices can be appealing, especially some services which are less than $10 a month, compared to a triple-digit cable bill. The increase in satellite also shows consumers are ready for a change. With lower general prices for satellite as opposed to digital cable (although often with one-or two-year contracts), many are moving to these options to save money and grab more flexibility. Satellite can be much more competitive because it is not the monopoly that most cable systems have on most neighborhoods.

Driving a lot of the change is the TV that you carry around with you now. Most of the flexibility comes from mobile and its one of the final frontiers (or first frontier) where you often pay only for what you want, without a large all-inclusive monthly bill. The fact that devices now, such as Airplay on Apple devices, can move your HD content from the mobile device back to the TV, makes the prospects even more appealing.

The Nielsen study is telling but not surprising; regular TV viewing will most likely continue to decline as other options, especially mobile, continue to rise.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.